Black American workers have become more confident in their household financial situations over the past two years, according to new research findings revealed by Limra.

Drawn from its 2024 Financial Wellness Index study, Limra's findings suggest a growing sense of financial security among Black American emplopyees and an increased recognition of the role professional financial advice can play in long-term stability.

Limra’s research found that Black Americans were more likely in 2024 than in 2022 to agree that financial knowledge, professional guidance, and employer-provided benefits contribute to their overall financial wellness.

Citing a separate consumer sentiment study conducted in January, Limra said Black Americans are also more likely than the general population to believe their personal financial situation will improve in 2025 (61 percent vs. 51 percent).

Highlighting the role of workplace benefits in financial confidence, 77 percent of Black American workers said their employers should offer services to help reduce financial stress, up from 69 percent in 2022. Meanwhile, 74 percent viewed their workplace benefits as a critical part of their financial wellness strategy.

Limra’s findings align with previous research showing elevated concerns among Black Americans on a range of personal finance areas including saving for retirement, covering expenses if they can no longer work, or building emergency savings.

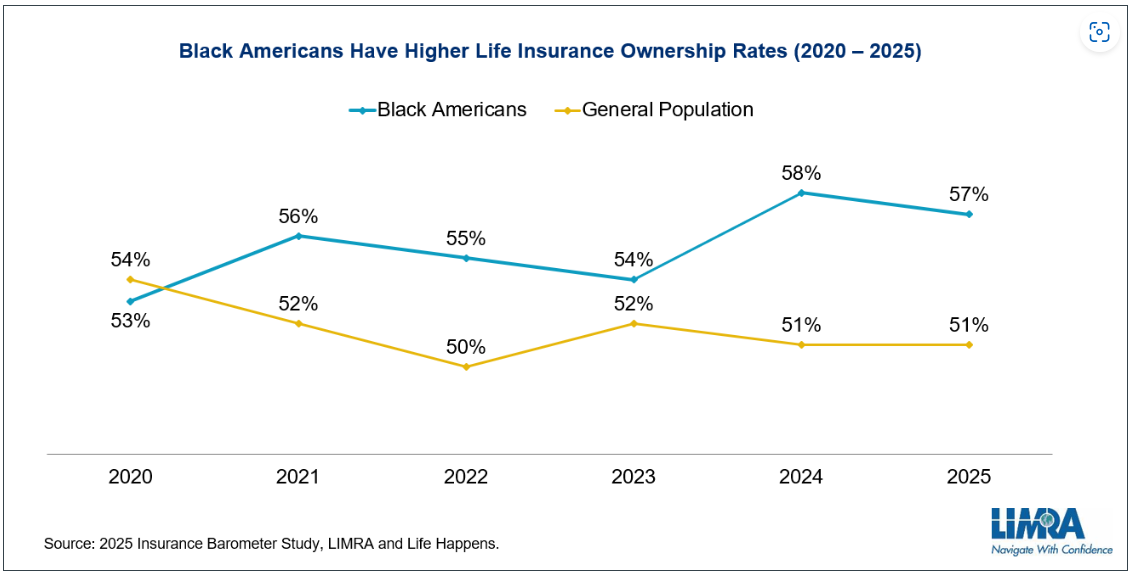

One bright spot amidst the findings, Limra said, is the consistently higher reported rates of life insurance ownership among the Black community than the general population. At last count, it found 57 percent of Black Americans owned life insurance, compared to 51 percent for the American population as a whole.

The 2024 Insurance Barometer Study by Life Happens and Limra found roughly half of US adults currently own life insurance policies, while a record 42 percent admitted their need for additional life insurance.

Limra's latest research showed that Black Americans were slightly less likely than the general population to cite expense or other financial priorities as barriers to owning life insurance, suggesting a distinct perspective on how life insurance fits into their broader financial planning.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.