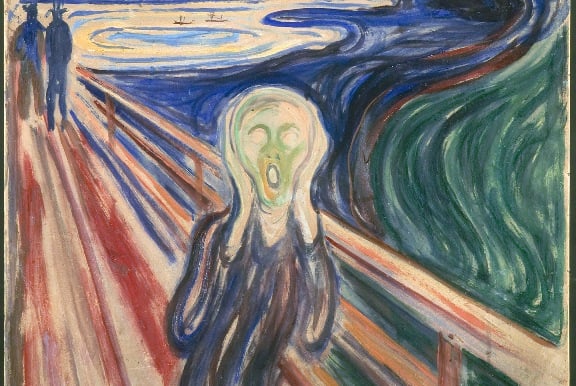

One of the best-known images in the history of art, Edvard Munch's “The Scream,” is being sold at a New York auction in May.

The 1895 work by the Norwegian artist, one of four versions of the screaming figure, will be included in Sotheby's May 2 sale of Impressionist and modern works. It carries a value of at least $80 million, the auction house said in an e-mailed release today.

Masterpieces by big-name Impressionist and modern artists have been fetching exceptional prices in recent years. Sotheby's “Scream” is the only one left in private hands. It is being offered by the Norwegian businessman Petter Olsen, whose father Thomas was a friend and patron of the artist. The pastel-on- board composition has been in the Olsen family for more than 70 years. The primary version of the work, in tempera and crayon on board and dating from 1893, is in the National Gallery of Norway.

“I have lived with this work all my life, and its power and energy have only increased with time,” Olsen said in an e-mailed statement. “Now however, I feel the moment has come to offer the rest of the world a chance to own and appreciate this remarkable work.”

Munch Museum

Proceeds from the sale will go toward the establishment of a new museum, art center and hotel on Olsen's farm, Ramme Gaard at Hvitsten, Norway. It will open next year in connection with the Munch 150th anniversary, and will be dedicated to the artist's work and time there.

The primary version of “The Scream” was stolen from the National Gallery in 1994 and recovered several months later. Another was taken from the Munch Museum in Norway in 2004 and recovered after two years.

The image, evoking a moment when the artist was seized with anxiety while walking along a road near Oslo, was to be the central element in his “Frieze of Life” series.

Of the variants, this Sotheby's (BID) version is closest in composition to the one in Norway's National Gallery. The pre- auction view in New York will be the first time it has been exhibited in the U.S. for decades, said Sotheby's. It is also notable for having a hand-painted inscription by Munch on the frame, explaining the genesis of the work.

RELATED ITEM What to tell clients about investing in art »

“I was walking along the road with two friends, the sun was setting,” reads the frame. “The sky turned a bloody red and I felt a whiff of melancholy. I stood still, deathly tired -- over the blue-black fjord and city hung blood and tongues of fire. My friends walked on -- I remained behind. Shivering with anxiety, I felt the great scream in nature.”

Pablo Picasso's 1932 painting of his mistress Marie-Therese Walter, “Nude, Green Leaves and Bust,” sold for a record $106.5 million at Christie's International (CHRS) in New York in May 2010. Last year, Paul Cezanne's painting “The Card Players” was bought by the emirate of Qatar for $250 million, the most ever paid for a work of art, Vanity Fair magazine reported on Feb. 2.

--Bloomberg News--

(Scott Reyburn writes about the art market for Muse, the arts and culture section of Bloomberg News. Opinions expressed are his own.)