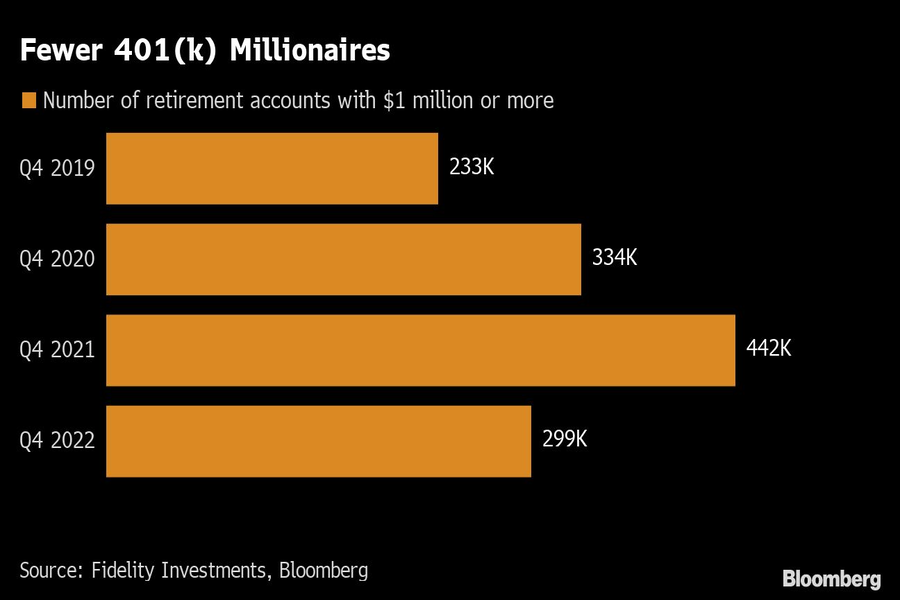

The 401(k) millionaire club has shrunk by a third.

Fidelity Investments had just 299,000 seven-figure workplace retirement accounts at the end of 2022, down from 442,000 a year prior, according to data from the asset manager.

The decline in million-dollar-plus savings came as the average 401(k) lost 20% of its value last year, hit by the slump in bonds and mega-cap tech stocks. The outlook isn’t much better for 2023, as investors continue to battle big headwinds from persistent inflation and continued economic uncertainty. Investors including Rob Arnott, co-founder of Research Affiliates, warn that the U.S. stock market “crash is far from finished.”

Investors may have multiple 401(k)s at Fidelity so it isn’t clear exactly how many individuals are represented in the diminished pool of accounts with at least $1 million. Most accounts are far, far smaller, with the average 401(k) account at Fidelity standing at $103,900 in 2022’s fourth quarter.

While many savers would be happy to have even that amount, one group of investors thinks far more is needed to achieve a comfortable retirement — the 553 people surveyed in Bloomberg’s latest MLIV Pulse survey said they’d need between $3 million and $5 million. About a third of investors pegged a comfortable retirement at $3 million, and roughly another third at $5 million.

Most respondents of the MLIV Pulse survey are optimistic they’ll move closer to their retirement goal by ending 2023 with more in retirement savings than at the end of 2022. Last year, inflation and rising borrowing costs hammered stocks, and since bond prices also plunged, the average U.S. 401(k) retirement account was down 20% at plans where Vanguard Group is a record keeper.

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.