Entering adulthood is hard. But parents say financially supporting grown children is harder.

Nearly 70% of parents with kids 18 or older say they’ve sacrificed their own finances to help them, according to a new Bankrate report.

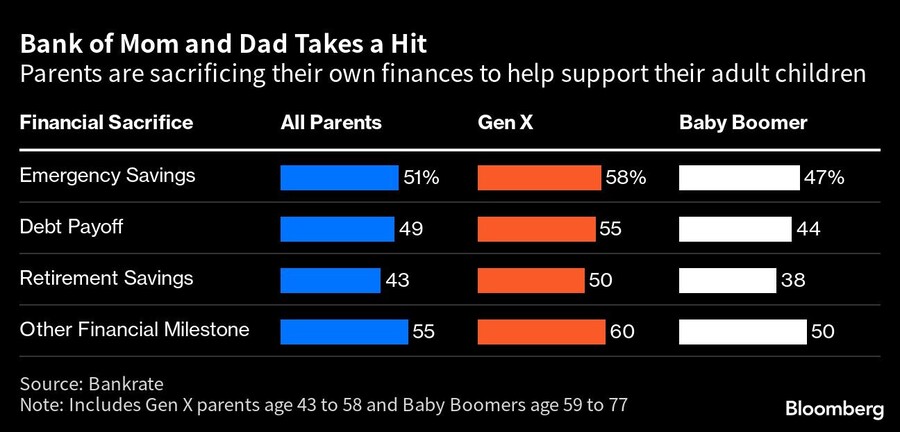

About half are forking over emergency savings or delaying paying off debt for the sake of their children. And as the market turmoil creates a $7 trillion retirement savings shortfall, 43% say supporting their adult kids has been draining their retirement funds.

Gen X parents, which the survey defined as those ages 43 to 58, were more likely than baby boomers to help their children, with 36% reporting that they made a significant monetary sacrifice.

“Remember that saying about putting your oxygen mask on before helping others,” said Bankrate senior analyst Ted Rossman. “Young adults are wrestling with student loans and high household formation costs, but if parents overextend themselves in an effort to help, they might end up jeopardizing their own financial security.”

The age at which respondents believe it’s time to start paying their own way varies by the type of expense. Both younger and older generations tended to think that people should cover their own cellphone, credit card and car insurance starting around age 20. On the other hand, people were more likely to say it’s acceptable to get financial help for longer with bills that command a higher sticker price, like housing, health insurance and student loans.

Younger generations facing high living costs and wages that aren’t keeping up with inflation tend to be worse off than their older counterparts were at the same age. That’s created a generational clash over when people should starting footing their own bill.

While members of Gen Z on average tend to think 22 is the benchmark for covering their own expenses, baby boomers said kids should be on the hook for their bills closer to age 20.

Regardless of when people think it’s time to cut off the kids, Bankrate’s Rossman said “helping out shouldn’t be seen as a blank check or an indefinite handout.”

“While we want to be empathetic and help our kids, sometimes financial assistance goes too far,” he added. “It might help to attach a specific dollar amount or time frame.”

Elsewhere in Utah, Raymond James also welcomed another experienced advisor from D.A. Davidson.

A federal appeals court says UBS can’t force arbitration in a trustee lawsuit over alleged fiduciary breaches involving millions in charitable assets.

NorthRock Partners' second deal of 2025 expands its Bay Area presence with a planning practice for tech professionals, entrepreneurs, and business owners.

Rather than big projects and ambitious revamps, a few small but consequential tweaks could make all the difference while still leaving time for well-deserved days off.

Hadley, whose time at Goldman included working with newly appointed CEO Larry Restieri, will lead the firm's efforts at advisor engagement, growth initiatives, and practice management support.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.