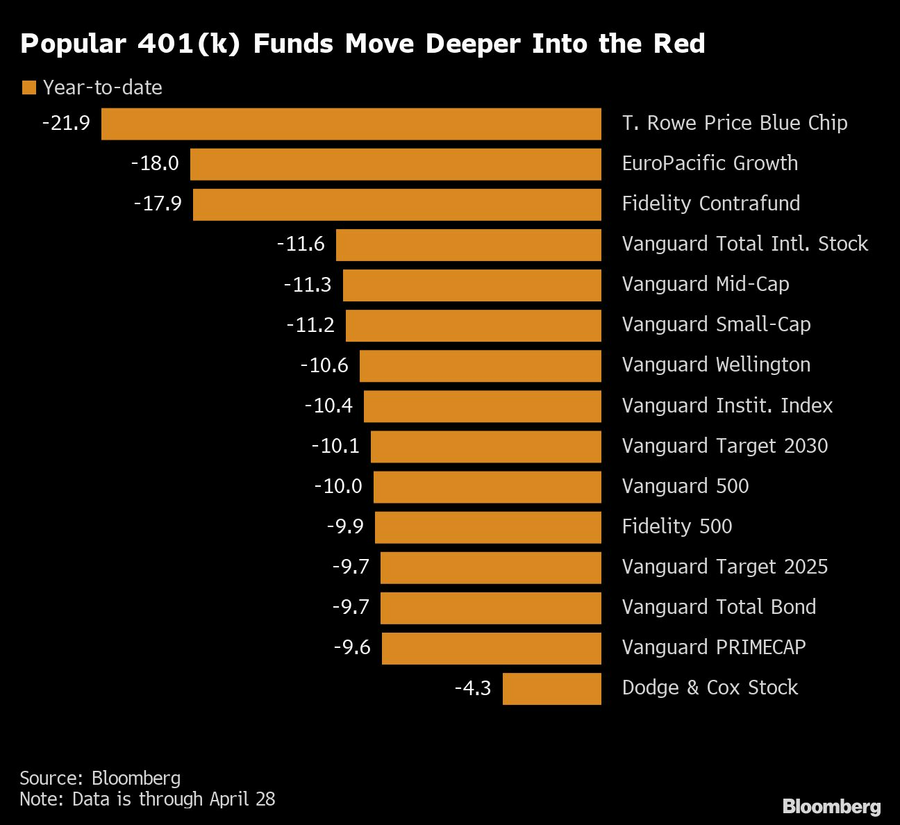

Anyone who dares peek at their 401(k) can see the carnage: Many popular funds in workplace retirement savings plans are down more than 10% so far this year. Some are even in, or approaching, bear market territory.

Many of the retirement funds are, unsurprisingly, growth-oriented and heavy on on mega-cap tech stocks such as Amazon.com Inc., which plunged Friday after the e-commerce giant reported a quarterly loss and said it may lose money again in the current period.

The epic bull run in mega-cap tech that began in March 2020 led many funds to become ever more concentrated in a handful of companies. The T. Rowe Price Blue Chip Growth fund, for example, held more than 46% of the fund in five stocks as of March 31 — Microsoft Corp. (11.6%), Amazon (10.9%), Alphabet Inc. (10.2%), Apple Inc. (8.7%) and Meta Platforms Inc. (5%) — and more than 60% of its assets in the top 10 stocks. The fund is now down almost 22% for the year.

Fidelity Contrafund, another big 401(k) plan favorite, held about 33% of the fund in its top five holdings as of Feb. 28, with Amazon its top stock, at 8%. Contrafund is now down almost 18% year-to-date.

The S&P 500 has lost more than 10% so far this year. While the recent volatility is gut-wrenching for many people nearing or in retirement, it’s an opportunity for millennial investors, said financial planner Thomas Kopelman, the 27-year-old co-founder of AllStreetWealth.

“For young people, the market going down is okay since you aren’t going to be using this money for a very long time,” Kopelman said. “So get the money in, and stop waiting for the perfect time to buy the dip.”

Elsewhere in Utah, Raymond James also welcomed another experienced advisor from D.A. Davidson.

A federal appeals court says UBS can’t force arbitration in a trustee lawsuit over alleged fiduciary breaches involving millions in charitable assets.

NorthRock Partners' second deal of 2025 expands its Bay Area presence with a planning practice for tech professionals, entrepreneurs, and business owners.

Rather than big projects and ambitious revamps, a few small but consequential tweaks could make all the difference while still leaving time for well-deserved days off.

Hadley, whose time at Goldman included working with newly appointed CEO Larry Restieri, will lead the firm's efforts at advisor engagement, growth initiatives, and practice management support.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.