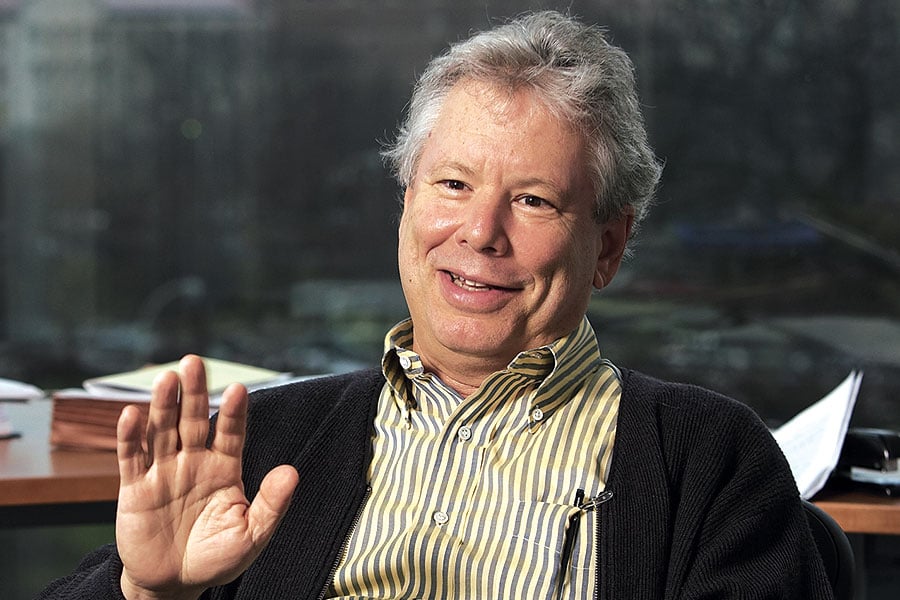

Nobel laureate Richard Thaler wants to mesh 401(k) plans with Social Security benefits to help Americans simplify what is perhaps their most daunting and complex financial issue: drawing down retirement assets.

Mr. Thaler, who

won the Nobel Prize in 2017 for his work on behavioral economics, said Americans should be allowed to contribute more into Social Security using a portion of their 401(k) benefits when they retire, which would increase the size of their monthly Social Security checks.

Allowing retirees to send up to perhaps $100,000 or $250,000 of their 401(k) balances to the Social Security Administration would deliver an inflation-adjusted annuity, guaranteed by the federal government at fair actuarial value over a retiree's lifetime — which companies in the private sector are loath to do, said Mr. Thaler, a professor of behavioral science and economics at the University of Chicago Booth School of Business.

"I'd much rather do this than have the fly-by-night insurance company in Mississippi offering some private version of the same thing," Mr. Thaler said Thursday at a retirement event hosted by the Brookings Institution, a think tank.

(More: Richard Thaler talks about the formation of his RIA ... and winning the Nobel Prize)

Such a proposal, which Mr. Thaler called his "pet idea," would help middle America achieve a more secure income stream. It would be aimed primarily at households making between $50,000 and $100,000 a year, who haven't accumulated a big retirement nest egg, rather than the wealthy or individuals at the bottom of the income ladder, who rely almost 100% on Social Security for retirement income.

While the concept may seem like a "wild and crazy idea," it would be relatively easy to execute, Mr. Thaler said. It wouldn't require additional bureaucracy, since the government already administers Social Security for Americans.

Plus, the federal government should be the natural institution to bear the risk of a "calamitous increase in life expectancy, he said, remarking on the possibility of an eventual cure for life-threatening medical conditions like cancer or heart disease.

"Everyone has Social Security as part of their portfolio," he said. "So the question is how much bigger should that share be?"

Mr. Thaler's pioneering research

led to broad adoption of now-entrenched 401(k) mechanisms to help employees save for retirement, such as automatic enrollment, which is now used in more than 60% of 401(k)s.

While accumulating assets is hard, Mr. Thaler said, drawing down that pot of money "is way harder" due largely to a retiree's uncertainty regarding life span and the relatively new trend of retirees carrying debt loads.

"No one knows they are a high risk to live to 100," he said. "You have to worry about getting unlucky and living until 100."