The Department of Labor’s new fiduciary rule today is out, an overhaul of a 1975 regulation that the insurance industry has fought tooth and nail, as it will for the first time subject many agents selling annuities to the Employee Retirement Income Security Act.

Despite strong industry pushback and opposition by Republicans in Congress, opponents of the proposed update to the definition of investment advice will almost certainly be disappointed, as the DOL generally only made clarifications rather than substantive changes.

“There’s nothing in these clarifications or changes that anyone should interpret as a watering down or real change in position from the proposal,” said Lisa Gomez, assistant secretary for the Employee Benefits Security Administration, in a call Tuesday with reporters before the text of the final rule was available.

New rule

The new rule and its accompanying prohibited transaction exemptions address investment advice made to retirement savers. Financial professionals who hold themselves out as providing individualized, reliable recommendations will be held as fiduciaries, and will have to give “prudent, loyal, honest advice free from overcharges,” according to the DOL. Financial institutions that oversee advisors will have to have policies to address conflicts of interest and will be responsible for compliance.

The new rule takes effect September 23, although many provisions will not be enforceable until April 2025. Starting in September, brokers relying on prohibited transaction exemptions will have to abide by impartial conduct standards and acknowledge their fiduciary status, according to the DOL. That means an obligation to be prudent and loyal, said Ali Khawar, principal deputy assistant secretary.

“You can’t lie to your customer, and the fees that you’re charging have to be reasonable,” he said.

Although the rule does not outlaw commissions on sales, it does make it harder for financial professionals to rely on the exemptions that allow them to be compensated that way.

“Trusted financial professionals deserve to be paid for their services and compete on a level playing field,” Gomez said. “We’re putting this rule in place to ensure that America’s workers can enjoy the retirement they’ve earned paycheck after paycheck, year after year.”

What’s different

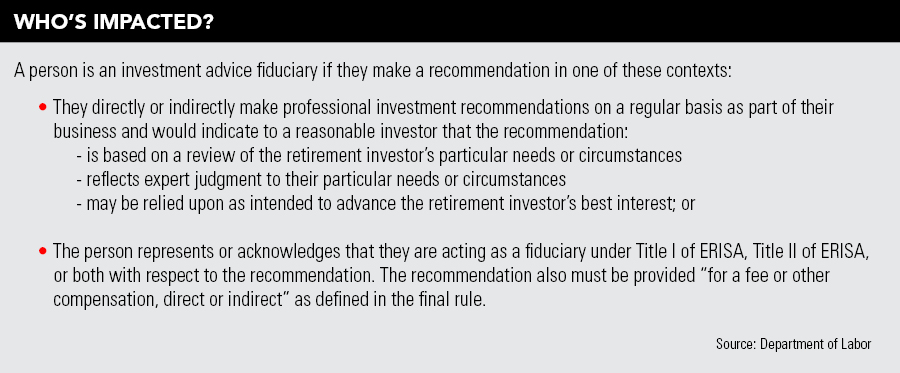

Not much changed compared with the proposed version of the rule, but the DOL did cleave one part of its three-part test for fiduciary status – the discretion over assets. That aspect is partially addressed by other parts of the Employee Retirement Income Security Act, Khawar said. Instead, the fiduciary test within the rule examines the context of a relationship with the client and whether an advisor has proclaimed a fiduciary status.

Additionally, the DOL cleaned up some language in the rule to make clear that human resources staff at companies that sponsor 401(k)s are not providing fiduciary advice just because they might educate participants about aspects of the plans.

The updated prohibited transaction exemptions, PTE 20-02 and 84-24, also had some minor changes to ensure that people who rely on them to recommend products may continue to do so in many cases, Khawar said. Further, some of the disclosure requirements under the proposal were nixed, in part because the DOL tried to harmonize the rule with the Securities and Exchange Commission’s Regulation Best Interest, he noted.

Hardest hit

The group that would seem to be most heavily affected in terms of new requirements are insurance agents who sell annuities to retirement account owners, particularly via IRA rollovers.

Regarding the agency’s focus on that area, the DOL cited an analysis by the Council of Economic Advisers that found that conflicted advice for fixed indexed annuities results in up to $5 billion in excessive costs for retirement savers annually.

The insurance industry has disputed that conflicted advice around annuity sales and other products hurts consumers, countering that commissions are what allow savers without high asset levels to access any kind of investment advice.

“I continue to believe the DOL is conducting an ideological campaign to ban commissions, as evidenced by their inflammatory and offensive framing of this rule when they initially proposed it, the unAmerican and absolute disgrace of the lightning pace at which they have pushed this rule through, and the lack of questions or even spirited debate on the substantive issues within this rule,” Finseca CEO Marc Cadin said in a statement.

The Insured Retirement Institute, whose members include annuity providers, “is not optimistic that DOL’s final rule will heed the substantial stakeholder input and data indicating that this rule will inflict significant harm on consumers,” IRI CEO Wayne Chopus said in a statement.

But the wider financial services industry and its lobbying groups are not necessarily opposed to the new rule. The American Retirement Association, whose members include retirement plan advisors and professionals working in a fiduciary capacity, largely supported to proposed rule, though it did recommend minor changes to the text.

Additionally, groups like the CFP Board and CFA Institute have praised the DOL based on the proposed rule it was moving forward.

Fast pace

But much has been made by opponents about the speed at which the Biden administration rolled out the rule, a fast pace that observers was necessary ensure it will fall outside of the Congressional Review Act and thus make it difficult for Congress and a new president to block. The attempt is the third across three administrations to institute a new definition of investment advice for retirement assets. A version of the rule finalized in the late days of the Obama DOL did not survive a legal challenge and was vacated by the Fifth Circuit Court of Appeals in 2018. Another version passed by the Trump administration was less burdensome, requiring brokers who provide one-time rollover advice to disclose conflicts of interest and follow impartial-conduct standards rather than having fiduciary status.

“In the brief time the 2016 rule was in effect, it caused millions of consumers to lose access to the professional financial guidance of their choice and to products and strategies to help them achieve a financially secure retirement. We anticipate today’s final rule will produce comparable or worse outcomes,” Chopus said. “This regulation is the product of a severely flawed rulemaking process and defies applicable judicial precedent and the limitations on DOL’s rulemaking authority as established by Congress.”

However, the DOL has since at least 2010 been working on different iterations of a fiduciary rule overhaul that include most of the same components. After proposing the new rule last year, the agency collected public comments and has since reviewed more than 20,000, including petitions,

“There was a substantial amount of conversation we had with stakeholders, including members of the insurance industry,” Khawar said. “Those conversations were reflected in the approach that we took in our proposal. This is a very long-running project.”

Knut Rostad, president of the Institute for the Fiduciary Standard, said in an email that, “industry complaints are laughable, failing under the slightest review. They know they were not rushed in opposing the rule. They know the rule will only make getting sales recommendations, not fiduciary advice, harder to get. ”

Tim Hauser, deputy assistant secretary, noted that “a lot of the concerns we’ve heard from the insurance industry just reflect a disagreement about how we should move forward with this process.” He said he was confident that insurance agents and insurance companies will be able to adhere to basic standards of care, much as broker-dealers and investment advisors must.

Although a legal challenge to the new rule is expected, the DOL spent considerable time studying the court decision over the 2016 rule, ensuring that the version it came up with is more likely to withstand litigation, Khawar said. The court criticized the older rule for being too broad in recommendations that would be considered fiduciary, but it was also too complicated in the way that it used carveouts and exemptions around fiduciary status, he said.

“That is not the approach we have taken this time,” he said. “This is not a warmed-over version of the 2016 rule.”

After a two-year period of inversion, the muni yield curve is back in a more natural position – and poised to create opportunities for long-term investors.

Meanwhile, an experienced Connecticut advisor has cut ties with Edelman Financial Engines, and Raymond James' independent division welcomes a Washington-based duo.

Osaic has now paid $17.2 million to settle claims involving former clients of Jim Walesa.

Oregon-based Eagle Wealth Management and Idaho-based West Oak Capital give Mercer 11 acquisitions in 2025, matching last year's total. “We think there's a great opportunity in the Pacific Northwest,” Mercer's Martine Lellis told InvestmentNews.

Osaic-owned CW Advisors has added more than $500 million to reach $14.5 billion in AUM, while Apella's latest deal brings more than $1 billion in new client assets.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.