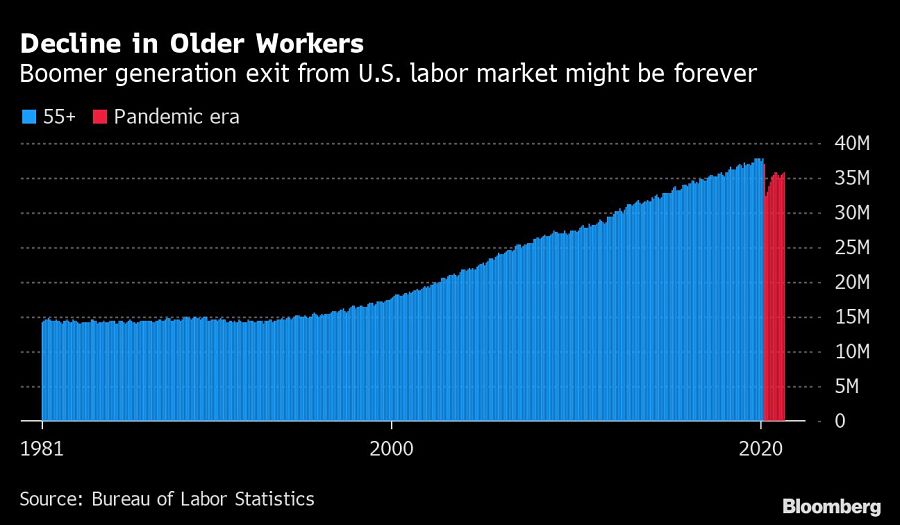

The surge in early retirements spurred by the pandemic is increasing inequality among baby boomers in the U.S., with older Black workers without a college degree more likely to be forced to exit the labor market prematurely, a study showed.

At least 1.7 million older workers retired early because of the pandemic crisis, according to a report by the New School for Social Research’s Retirement Equity Lab.

The Covid-19 health crisis is creating two classes of early retirees. People who have investments are taking advantage of the unprecedented surge in shares and home values to enjoy their silver years.

Meanwhile, many low-paid workers without much retirement savings found themselves forced out of their jobs with little prospect of finding employment again. Retiring before the full retirement age will result in a cut in their Social Security benefits, by as much as 30%.

The few years before 65 are crucial to prepare for retirement, and unplanned exits can lead to downward mobility and even poverty for these workers, said Teresa Ghilarducci, economist and director of the Retirement Equity Lab.

“The pandemic is revealing the main fault line in our broken retirement system -- inequality,” said Ghilarducci, who’s also a Bloomberg Opinion contributor.

Workers age 55 to 64 without a college degree retired at a 5% faster pace during the pandemic, while retirement for that age group with a college education declined by 4%, according to the Retirement Equity Lab report. At older ages, over 65, college degree holders were more likely to exit the labor market than pre-Covid, however.

Black workers without a college degree experienced the highest increase in retirement rate before age 65, jumping from 16.4% to 17.9% between 2019 and 2021, the data show.

The researchers found that older workers without a college degree had median household retirement savings of only $9,000 in 2019, compared with $167,000 for those with a college degree.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.