For years, Americans have been told that higher interest rates are coming, eventually. Federal Reserve Chairwoman Janet Yellen and the Fed's Open Market Committee may now be getting ready to lift rates off the floor, probably by a quarter of a percentage point from their current range of 0% to 0.25%. It could happen at the Fed's meeting on Thursday. Or maybe the Fed will wait again.

“It's this unicorn, this mythical creature that's out there,” said Maggie Kirchhoff, a financial planner with Wisdom Wealth Strategies in Denver. “It may exist, and it may arrive, but you're not sure when.”

If rates do start rising this month, it would generally be good news for savers and bad news for debtors. But financial advisers are warning clients not to do anything rash while they wait for Ms. Yellen & Co. to act, or even after they do.

Here's some of the advice they're offering:

• Consider fixing your mortgage rate.

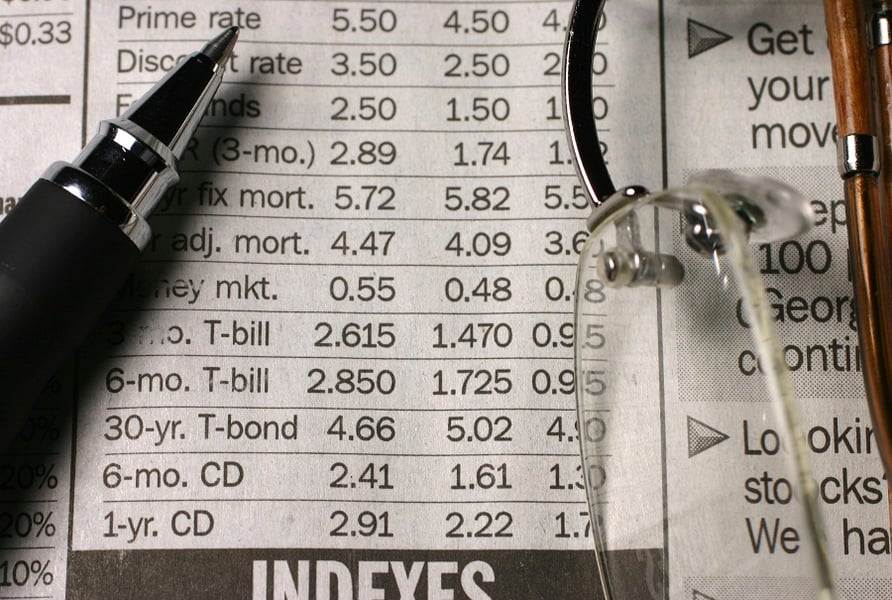

Any debt with a floating, rather than fixed, interest rate could gradually get more expensive after the Fed moves. Homeowners with adjustable-rate mortgages, or ARMs, may want to refinance to a fixed-rate mortgage. Their monthly payments may go up in the process, but they'll be locking in some of the lowest fixed-mortgage rates in history. According to a Sept. 9 Bankrate.com survey, the typical 30-year rate is 4.05%, and the average 15-year rate is 3.23%. Car loans and small-business loans with variable rates might also be candidates for refinancing to fixed-rate debt.

(More: Senior savers play waiting game to reap benefits from Fed rate increases)

• Pay off debt, judiciously.

Many Americans are already paying off debt. A Wells Fargo/Gallup investor survey finds that 46% of investors have cut debt during the past two years, and an additional 23% managed to keep their debt load stable. Higher interest rates would bolster the already rock-solid case for paying down high-interest debt as quickly as possible. If rates rise substantially — to make a big impact, it would take more than the quarter point the Fed is contemplating in its first round — expect payments to spike on home-equity loans, credit-card debt and other loans with variable interest rates.

That said, it's not necessarily smart to devote every cent of your life savings to debt payments. For one thing, home-equity loans and other variable-rate debt may have provisions that protect you from a rapid rise in rates, which few are predicting, anyway. Also, it can be dangerous to pay off debt if it leaves you short of cash in case job loss or another emergency strikes, said Barry Eckstein, a financial planner in Wantagh, N.Y.

• Find a bank that wants your deposits.

The largest U.S. banks pay annual rates of as little as 0.01% on savings accounts. After a Fed rate increase, you can expect banks to raise rates on mortgages and credit cards

far faster than savings rates. Big banks already have a glut of deposits, so they have little incentive to try to attract your money.

Rather than waiting for these rates to go up, savers can transfer money to smaller banks and online institutions that are far more eager to attract deposits. The very best rates available are a little over 1%, which could rise after the Fed acts.

The worst move a saver can make now is to lock in a low rate. This is not the time to buy a five-year certificate of deposit, for example, said Charles Bennett Sachs of Private Wealth Counsel in Miami.

• Don't make any sudden moves, or the portfolio gets it.

“Everyone makes a big deal about this,” Mr. Eckstein said. “A quarter of a point in interest rates is not going to make a difference for most people.”

Any adjustment made by the Fed would be to the

federal funds rate. That has only an indirect and unpredictable effect on the bond market, which already

seems to be expecting a Fed move, as well as on mortgage and deposit rates.

It can also be dangerous to make long-term investment decisions according to hunches about the future of interest rates. The last few years have shown how difficult it is to predict the Fed's moves far out in the future. When it comes to investing decisions, advisers say it's better to ignore Ms. Yellen's moves this week while sticking to your long-term strategy.

(More: Secrets to surviving a rising rate environment)