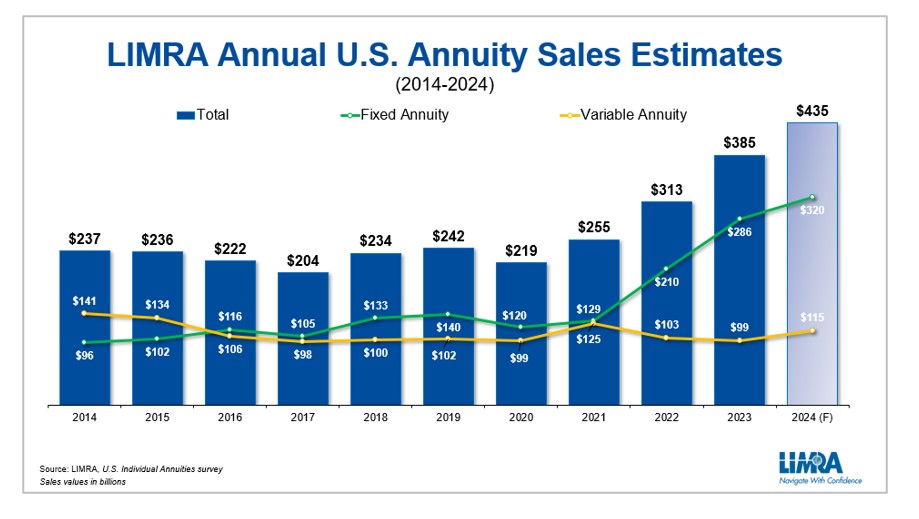

After experiencing robust growth in recent years, the US annuity market is set to face mixed prospects in 2025, according to a new report from Limra.

While demographic trends and demand for retirement income solutions remain strong, the analysis from Limra notes that falling interest rates may slow the momentum for certain fixed annuity products.

In its latest outlook, Limra projects total annuity sales in 2025 to range between $364 billion and $410 billion, a potential pullback from the anticipated full-year record of $430 billion for 2024.

While the 2025 forecast is a definite dip compared to the recent short term, it remains more than 50 percent above levels seen pre-pandemic.

“The past few years have been remarkable for the US annuity market,” Bryan Hodgens, senior vice president and head of Limra Research, wrote in the new analysis. “The growth was largely driven by fixed-rate deferred annuity sales, but fixed indexed annuities and registered indexed-linked annuities will also set records in 2024.”

Fixed-rate deferred annuities, which made up over 40 percent of 2023 annuity sales, are expected to face headwinds in 2025 due to an anticipated decrease in interest rates. Limra estimates a sales drop of 15 to 25 percent for these products, with projections between $122 billion and $147 billion, after an expected full-2024 record of $160 billion in sales.

In a similar vein, sales of fixed indexed annuities are also expected to dip slightly in 2025 after setting a pace to surpass $120 billion 2024, nearly double the amount in 2021. Still, FIA sales are projected to remain strong, exceeding $100 billion.

Meanwhile, registered indexed-linked annuities are anticipated to maintain their upward trajectory after an eleven-year streak of record sales up to 2024. Driven by investor interest in protected growth and strong equity markets, Limra predicts RILA sales this year to match or edge out their 2024 record, landing between $62 billion and $66 billion by the end of 2025.

“RILA’s [sic] success is due to continued investor uncertainty about the economy. ... Momentum is growing for this product line,” said John Carroll, senior vice president, head of life and annuities at Limra and LOMA. “We see investors seeking products that offer a combination of downside protection and upside growth potential.”

Apart from the need to keep pace with inflation, Limra’s report also highlights the influence of demographic shifts, with the population aged 65 and older expected to grow by 7.5 million between 2023 and 2027. This trend supports continued demand for income-focused products, though lower interest rates could constrain growth for income annuities in 2025.

“While market conditions will influence sales, investors are increasingly recognizing the value of protection-based solutions for retirement security,” Hodgens added.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.