Shares of Apple Inc. (AAPL) rallied above $500 for the first time after a two-week gain spurred by the iPhone maker's first-quarter earnings report approached 20 percent.

Apple increased 1.5 percent to $500.60 at 10 a.m. in New York. In the Standard & Poor's 500 Index, Google Inc. (GOOG) and Priceline.com Inc. (PCLN) cost more per share, at $612.23 and $564.55. Intuitive Surgical Inc. (ISRG) is at $502.23.

“It reminds us all of the amazing transformation of Apple over the past eight years,” Timothy Ghriskey, who owns Apple and oversees $2 billion as chief investment officer of Solaris Group LLC in Bedford Hills, New York, said in a telephone interview today. “We think the stock has higher to go, $600 is next,” he said. “It's still an inexpensive stock for a company that is executing at the very highest level and continues to innovate.”

Apple has climbed 11 of the 14 days since reporting quarterly results. Its earnings are expanding so fast that even with the rally, the shares are trading at less than half their median valuation since 1990, data compiled by Bloomberg show. The gain since Apple reported results is almost four times as large as the advance in the Nasdaq 100 Index.

The world's largest company by market capitalization said on Jan. 24 that profit in the quarter ended Dec. 31 was $13.1 billion, 36 percent more than the average analyst projection, while revenue beat forecasts by $7.3 billion, the most ever. The Cupertino, California-based company single-handedly erased a drop in S&P 500 earnings for the October-to-December period, turning a 4.2 percent decline into a 4.4 percent gain.

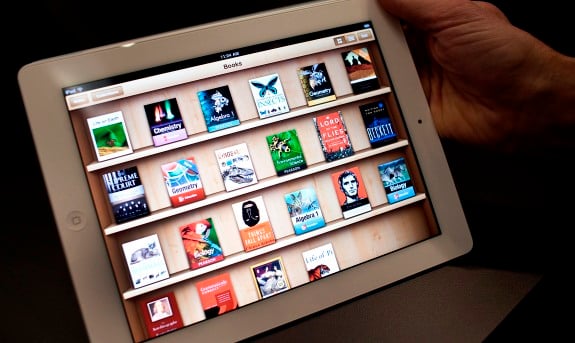

Shares of the maker of the iPod, iPhone and iPad have risen 17 percent over the past month, the biggest gain since August 2009 rolling back as of Feb. 10. The stock rose 22 percent this year through the end of last week, compared with a increase of 12 percent for technology companies in the S&P 500.Shares of Apple Inc. (AAPL) rallied above $500 for the first time after a two-week gain spurred by the iPhone maker's first-quarter earnings report approached 20 percent.

Apple increased 1.5 percent to $500.60 at 10 a.m. in New York. In the Standard & Poor's 500 Index, Google Inc. (GOOG) and Priceline.com Inc. (PCLN) cost more per share, at $612.23 and $564.55. Intuitive Surgical Inc. (ISRG) is at $502.23.

“It reminds us all of the amazing transformation of Apple over the past eight years,” Timothy Ghriskey, who owns Apple and oversees $2 billion as chief investment officer of Solaris Group LLC in Bedford Hills, New York, said in a telephone interview today. “We think the stock has higher to go, $600 is next,” he said. “It's still an inexpensive stock for a company that is executing at the very highest level and continues to innovate.”

Apple has climbed 11 of the 14 days since reporting quarterly results. Its earnings are expanding so fast that even with the rally, the shares are trading at less than half their median valuation since 1990, data compiled by Bloomberg show. The gain since Apple reported results is almost four times as large as the advance in the Nasdaq 100 Index.

The world's largest company by market capitalization said on Jan. 24 that profit in the quarter ended Dec. 31 was $13.1 billion, 36 percent more than the average analyst projection, while revenue beat forecasts by $7.3 billion, the most ever. The Cupertino, California-based company single-handedly erased a drop in S&P 500 earnings for the October-to-December period, turning a 4.2 percent decline into a 4.4 percent gain.

Shares of the maker of the iPod, iPhone and iPad have risen 17 percent over the past month, the biggest gain since August 2009 rolling back as of Feb. 10. The stock rose 22 percent this year through the end of last week, compared with a increase of 12 percent for technology companies in the S&P 500.

--Bloomberg News--