A group of banks led by Barclays Plc and Morgan Stanley is working on a compromise deal to unlock a months-long stalemate that’s stalled efforts to calculate and disclose the carbon footprints of the industry’s capital-markets operations.

Any agreement would mark a milestone in climate finance. Assigning responsibility for so-called facilitated emissions — or those that are enabled through debt and equity underwriting — remains a divisive subject, which is the main reason climate accounting has so far focused on direct lending. But that’s about to change.

The Partnership for Carbon Accounting Financials, or PCAF, a global alliance of banks created to figure out how to get the industry to align with the goals of the Paris climate accord, initially indicated that a deal may be reached during the first quarter. That target was missed after banks involved in the talks disagreed over how much banks should disclose.

Some banks in the eight-member PCAF working group for capital markets emissions, including NatWest Group Plc, want the industry to report 100% of their facilitated emissions. Others argue the figure should be 17%, which reflects capital markets’ share of all industry financing and derives from analysis by the Basel Committee on Banking Supervision.

To end the stalemate, banks in the PCAF working group have revived a previously rejected option of 33%, according to a person familiar with the process who asked not to be named discussing nonpublic information. After months of deadlock, the figure looks like a viable path to breaking the impasse, the person said. Still, there’s no guarantee the group will coalesce around that number.

Reporting facilitated emissions means the global capital markets will no longer be free to ignore their contribution to greenhouse gas emissions. The development is “key in delivering the low-carbon transition,” according to ShareAction.

But a number of banks involved in the PCAF talks “are pushing hard to water down” the standard, ShareAction said in an analysis shared with Bloomberg. The nonprofit warned that anything less than 100% would fail to address the challenges of climate change.

“This could probably be one of the biggest pieces of greenwashing we’re going to see this year if the weighting is lower,” said Xavier Lerin, a senior researcher at ShareAction.

A spokesperson for Barclays, which co-chairs the PCAF working group on facilitated emissions, said the bank supports the work that PCAF and other industry initiatives are undertaking to establish standards for financed and facilitated emissions. The spokesperson declined to comment on the 33% proposal. A spokesperson for Morgan Stanley, the other co-chair, also declined to comment. A PCAF representative said “we don’t have an update.”

Activists are starting to take their grievances to the courts. BNP Paribas SA was recently sued by nonprofits targeting its climate policies, with the bank’s lack of reporting for its underwriting business singled out. That’s amid growing evidence that global warming is intensifying at a dangerous pace.

On Wednesday, the World Meteorological Organization published a report showing there’s now a 66% chance that the annual global surface temperature will temporarily be more than 1.5C above pre-industrial levels for at least one of the coming five years.

Meanwhile, concerns are being raised about the appropriateness of leaving climate disclosure talks with the finance industry.

“While voluntary initiatives like PCAF have been positive, there reaches a point where it can’t just be for the banks to decide on matters like this by themselves,” said James Vaccaro, executive director of the Climate Safe Lending Network, a global network of bankers and academics focused on decarbonization. “We need the regulators and scientists in the room to provide the necessary rigor and credibility.”

Barclays was among the first major banks to start calculating its facilitated emissions and applies a 33% weighting to the figures it discloses. The rest is allocated to investors.

Several major banks, including signatories to the Net Zero Banking Alliance such as Citigroup Inc. and HSBC Holdings Plc, have said they’ll disclose their facilitated emissions once the PCAF standard is published.

And while pressure builds to reach a deal, agreeing on a weak standard might backfire for the banks. That’s because international sustainability and net zero verification organizations may reject any proposal that’s seen as allowing banks to under-report.

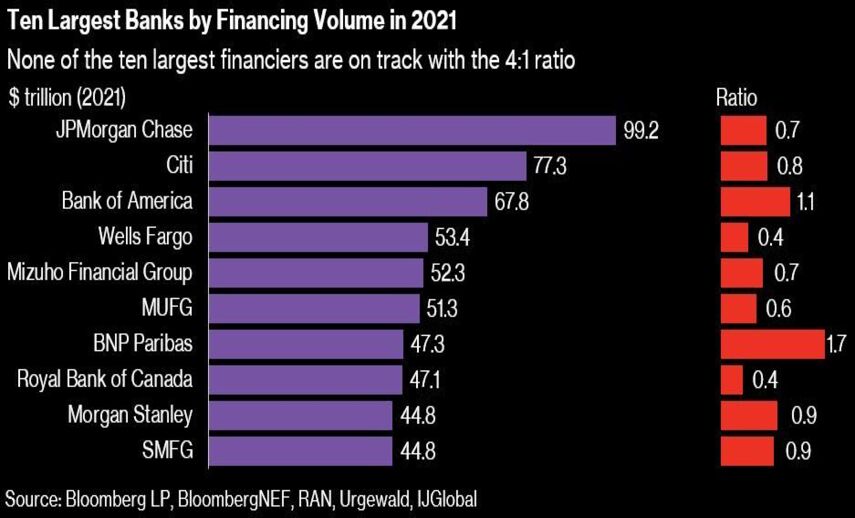

An analysis by BloombergNEF suggests the finance industry remains a long way from achieving the balance that’s needed to steer the planet toward the 1.5C goal. The ratio of clean-energy lending and equity underwriting relative to fossil fuels needs to hit 4 to 1 by the end of the decade to live up to the Paris climate agreement, according to BloombergNEF.

As recently as the end of 2021, Morgan Stanley’s financing split resulted in a ratio of 0.9, broadly in line with the average for the broader finance industry, BloombergNEF said. At Barclays, the ratio was 1.7.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.