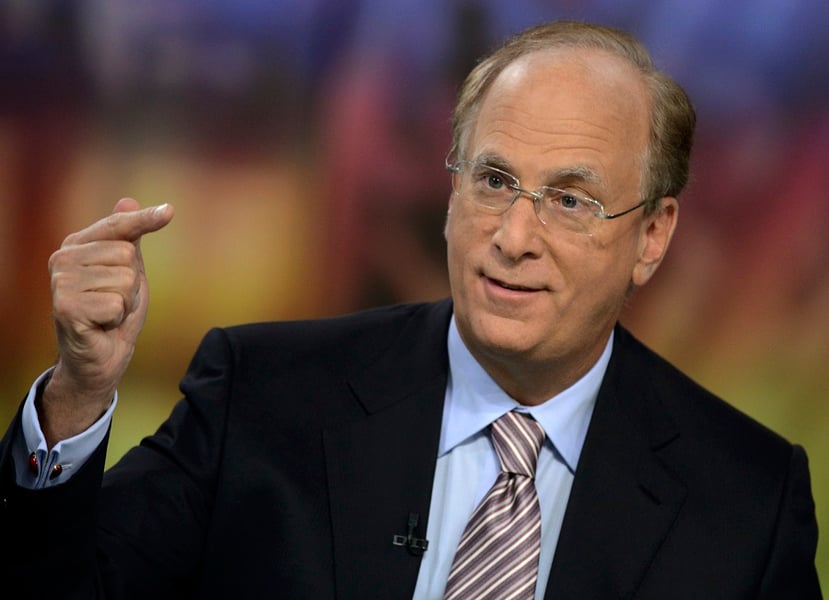

BlackRock Inc. Chief Executive Larry Fink warned that companies will be left behind if they don’t embrace sustainable business practices, hitting back at critics who say that considering environmental impact in investing decisions is a politically motivated fad.

“Stakeholder capitalism is not about politics,” Fink wrote in his annual letter to CEOs. “It is not a social or ideological agenda. It is not ‘woke.’”

In the decade that Fink’s been writing his letter, BlackRock has ballooned to more than $10 trillion in assets, giving it significant stakes in many large companies. It’s also been a major beneficiary of the boom in sustainable investing: its portfolio includes $509 billion in sustainable assets, more than double the amount a year ago.

It also sees more on the horizon. But BlackRock’s growth and Fink’s high-profile missives have drawn critics from all corners. On the left, progressives complain that BlackRock and others aren’t using their financial clout to do more, faster. On the political right, some U.S. states have declared that they won’t do business with asset managers that, for example, eschew oil and gas investments.

Fink used this year’s letter, published on the asset manager’s website late Monday in New York, to clearly state its position on fossil fuels. “Divesting from entire sectors — or simply passing carbon-intensive assets from public markets to private markets — will not get the world to net zero,” he said. “And BlackRock does not pursue divestment from oil and gas companies as a policy.”

In fact, it does the opposite. The company’s ESG exchange-traded funds not only hold stakes in fossil fuel giants such as Exxon Mobil Corp. and Chevron Corp., its biggest ESG ETF holds a heavier weighting in 12 fossil-fuel stocks than the S&P 500 does, according to Bloomberg Intelligence, the research arm of Bloomberg.

Capitalism — not climate — took center stage in this year’s letter, a marked change from the last few years. “We focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients,” Fink wrote, encouraging companies to prioritize long-term profits over short-term results.

He also called on companies to make themselves more appealing to employees in a tight labor market, saying that “workers demanding more from their employers is an essential feature of effective capitalism.”

Fink didn’t mention climate until the final sections of his letter, and then just four times, including once in the context of the Task Force on Climate-related Financial Disclosures and once to say that businesses “cannot be the climate police.” He also emphasized the immediate need for fossil fuels to ensure energy supplies, saying that ambitious goals take time.

Environmental activists almost immediately registered their disappointment, accusing Fink of trying to play both sides.

“Fink apparently wants to be above the political fray, but by playing nice with those profiting off of the causes of climate change, he’s making the political choice to reject climate science,” said Moira Birss, climate and finance director for Amazon Watch, a rainforest protection group based in California.

For BlackRock and others, ESG investing has become a highly lucrative strategy. Philipp Hildebrand, the asset manager’s vice chairman, said in October that BlackRock expects “a vast reallocation of capital toward sustainable products.”

Fink also prodded shareholders and governments for action. Governments, he said, should offer more guidance on sustainability policy, regulation and disclosure across markets. BlackRock is also working on an initiative that would give clients more power to vote their proxies.

• The pandemic has fundamentally shifted the nature of work, leading to more turnover and more staff seeking flexibility. “Companies not adjusting to this new reality and responding to their workers do so at their own peril.”

• Sustainable investments have reached $4 trillion and will continue to rise. “The decarbonizing of the global economy is going to create the greatest investment opportunity of our lifetime. It will also leave behind the companies that don’t adapt.”

• BlackRock is working to expand an initiative for investors to use technology to cast proxy votes. “We are committed to a future where every investor — even individual investors — can have the option to participate in the proxy voting process if they choose.”

• Fink said that he plans to launch a Center for Stakeholder Capitalism to create a “forum for research, dialogue, and debate.” The center will help to explore the relationships between companies and their stakeholders, he said.

A new analysis finds long-running fiscal woes coupled with impacts from the One Big Beautiful Bill Act stand to erode the major pillar for retirement income planning.

Caz Craffy, whom the Department of Justice hit with a 12-year prison term last year for defrauding grieving military families, has been officially exiled from the securities agency.

After years or decades spent building deep relationships with clients, experienced advisors' attention and intention must turn toward their spouses, children, and future generations.

The customer’s UBS financial advisor allegedly mishandled an options strategy called a collar, according to the client’s attorney.

An expansion to a 2017 TCJA provision, a permanent increase to the standard deduction, and additional incentives for non-itemizers add new twists to the donate-or-wait decision.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.