The Federal Reserve raised interest rates by a quarter percentage point and signaled hikes at all six remaining meetings this year, launching a campaign to tackle the fastest inflation in four decades even as risks to economic growth mount.

Policy makers led by Chair Jerome Powell voted 8-1 to lift their key rate to a target range of 0.25% to 0.5%, the first increase since 2018, after two years of holding borrowing costs near zero to insulate the economy from the pandemic. St. Louis Fed President James Bullard dissented in favor of a half-point hike, the first vote against a decision since September 2020.

The hike is likely the first of several to come this year, as the Fed said it “anticipates that ongoing increases in the target range will be appropriate,” and Powell has pledged to be “nimble.”

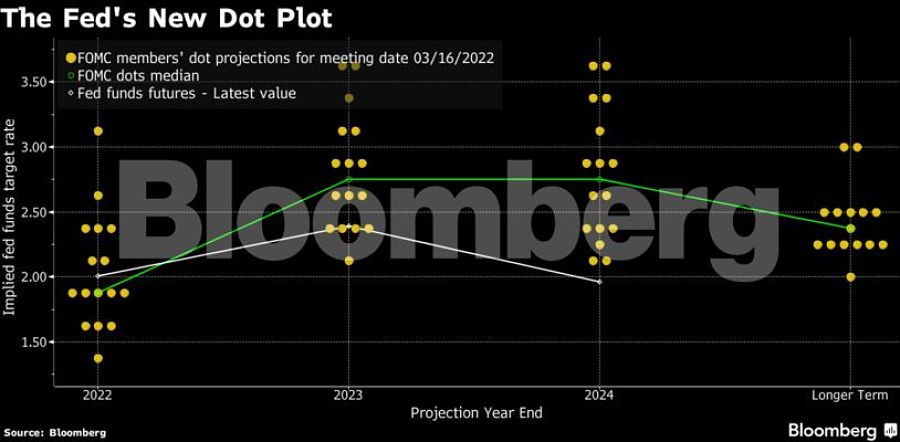

In the Fed’s so-called dot plot, officials’ median projection was for the benchmark rate to end 2022 at about 1.9% — in line with traders’ bets but higher than previously anticipated — and then rise to about 2.8% in 2023. They estimated a 2.8% rate in 2024, the final year of the forecasts, which are subject to even more uncertainty than usual given Russia’s invasion of Ukraine and new Covid-19 lockdowns in China are buffeting the global economy.

“The invasion of Ukraine by Russia is causing tremendous human and economic hardship,” the Federal Open Market Committee said in a statement Wednesday following a two-day meeting in Washington, the first held in person — rather than via videoconference — since the pandemic began. “The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.”

Treasury yields jumped and the curve flattened following the decision. The S&P 500 index erased most of its gains and the dollar index pared losses.

The Fed said it would begin allowing its $8.9 trillion balance sheet to shrink at a “coming meeting” without elaborating. The purchases of Treasuries and mortgage-backed securities, which concluded this month, were intended to provide support to the economy during the Covid-19 crisis and shrinking the balance sheet accelerates the removal of that aid.

The statement omitted previous language saying that the economy’s path depended on the course of the coronavirus, though it kept a reference to the pandemic’s impact on inflation.

Powell, who is currently serving as chair pro-tempore as he awaits Senate confirmation for a second term, will hold a virtual press conference at 2:30 p.m. Washington time.

The Fed faces the arduous task of securing a soft landing for the world’s largest economy for the first time since the early 1990s. Tighten too slowly and it risks allowing inflation to run out of control, requiring even tougher action. Shift too quickly and the central bank could roil markets and tip the economy into recession.

A new analysis finds long-running fiscal woes coupled with impacts from the One Big Beautiful Bill Act stand to erode the major pillar for retirement income planning.

Caz Craffy, whom the Department of Justice hit with a 12-year prison term last year for defrauding grieving military families, has been officially exiled from the securities agency.

After years or decades spent building deep relationships with clients, experienced advisors' attention and intention must turn toward their spouses, children, and future generations.

The customer’s UBS financial advisor allegedly mishandled an options strategy called a collar, according to the client’s attorney.

An expansion to a 2017 TCJA provision, a permanent increase to the standard deduction, and additional incentives for non-itemizers add new twists to the donate-or-wait decision.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.