Today the Federal Reserve opted to keep the benchmark interest rate unchanged, maintaining a range between 4.25% and 4.5%. However, Fed Chair Jerome Powell said during a press conference that, due to President Donald Trump's announced tariffs, there is a risk of a "rise in inflation, a slowdown in economic growth, and an increase in unemployment."

Powell’s remarks follow Trump’s implementation of tariffs on U.S. trading partners, most notably a 145% series of duties on imports from China.

Despite these concerns, Powell emphasized that the economic outlook is not entirely bleak. "Despite heightened uncertainty, the economy remains in a solid position," he said. "The unemployment rate is low, and the labor market is at or near maximum employment. Inflation has declined significantly but continues to run somewhat above our long-term 2% objective in support of our goals."

When asked what level of economic weakness - such as multiple months of negative job reports - would prompt the Fed to lower interest rates, Powell indicated that such conditions have not yet materialized.

"We have 4.2% unemployment. Good [labor] participation. Wages behaved very well. With the labor market, we would look at the totality of the data," Powell said. "We'd look at the level of the unemployment rate. We'd look at the speed with which it's changing. We would look at the whole huge array of labor market data to get a sense of whether conditions are really deteriorating or not."

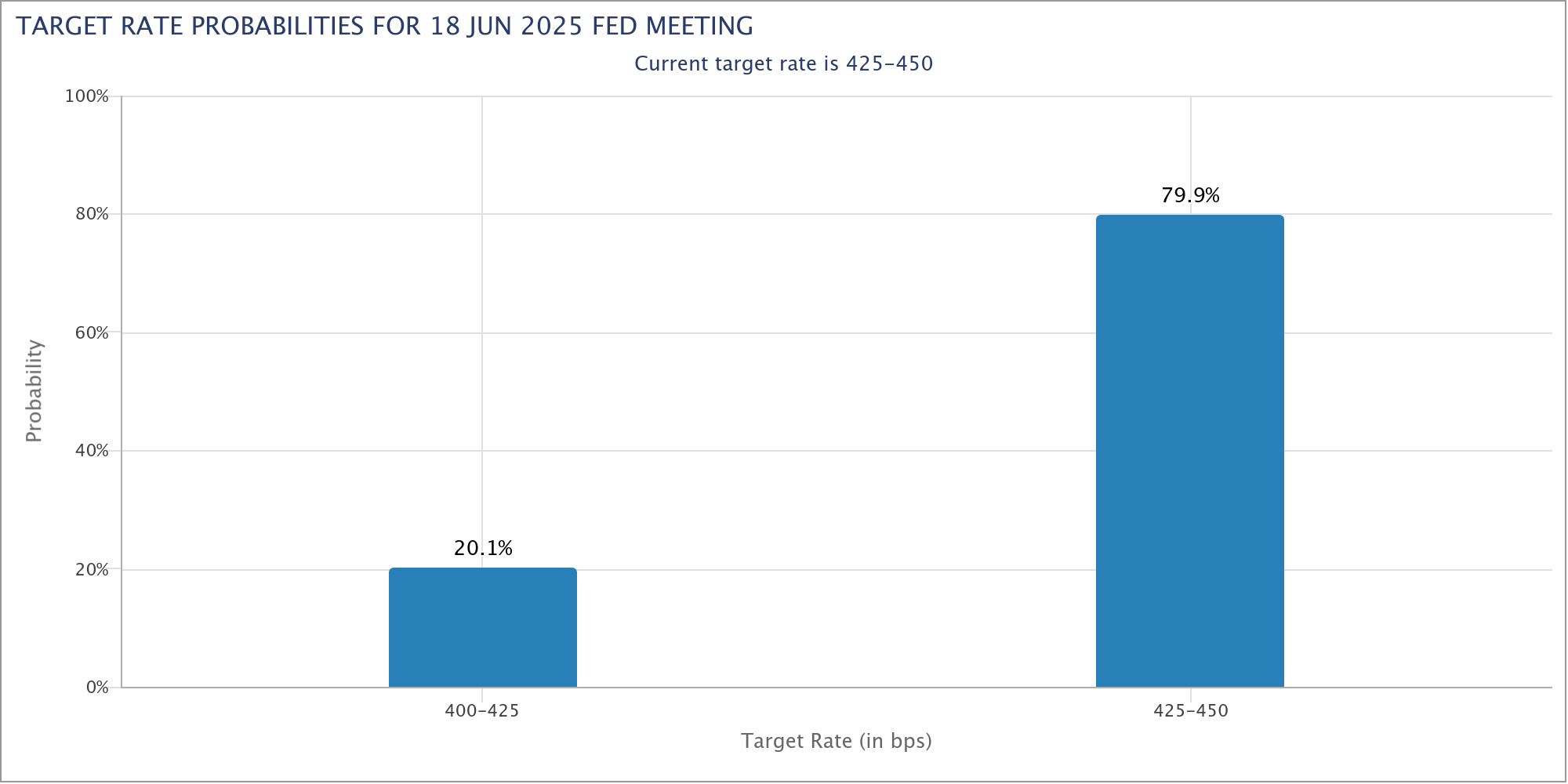

According to CME FedWatch, the Fed's scheduled June 18 meeting is once again expected to see the benchmark rate remain unchanged.

“The Federal Reserve's decision to maintain the federal funds rate target range at 4-1/4 to 4-1/2 percent reflects a cautious approach in an environment marked by economic uncertainties," Dan Siluk, Head of Global Short Duration & Liquidity and Portfolio Manager at Janus Henderson, said to InvestmentNews.

"The Committee's emphasis on the heightened risks to both employment and inflation reveals a vigilant approach towards emerging economic pressures, Siluk said. "This balanced yet cautious outlook reflects a commitment to steering the economy towards the Fed's long-term goals of maximum employment and a 2 percent inflation rate, while also being prepared to make adjustments should adverse risks materialize."

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.