Financial planning might be the last thing on someone’s mind after they’re diagnosed with cancer, but it can help with their quality of life — and perhaps even prolong their life.

New research involving patients with aggressive blood cancer found a 53% higher survival rate over 12 months linked with financial planning intervention, as well as help from nurses and pharmacists who helped identify assistance programs.

“Among all patients … we found that their quality of life was greatly improved by this intervention, and this was statistically significant,” said Dr. Thomas G. Knight, a physician at the Levine Cancer Institute in Charlotte, North Carolina, one of the authors of the forthcoming paper.

“The really exciting thing to me was that the physical quality of life was better,” Knight said.

Over a year, the research provided assistance programs to people diagnosed with hematologic malignancy or bone marrow failure syndrome. The survival rate was 73% for those who received financial planning and other assistance, compared with 46% for those who did not receive it, Knight said.

The results don’t necessarily show a causal relationship as the study was observational, but there is a correlation, he noted.

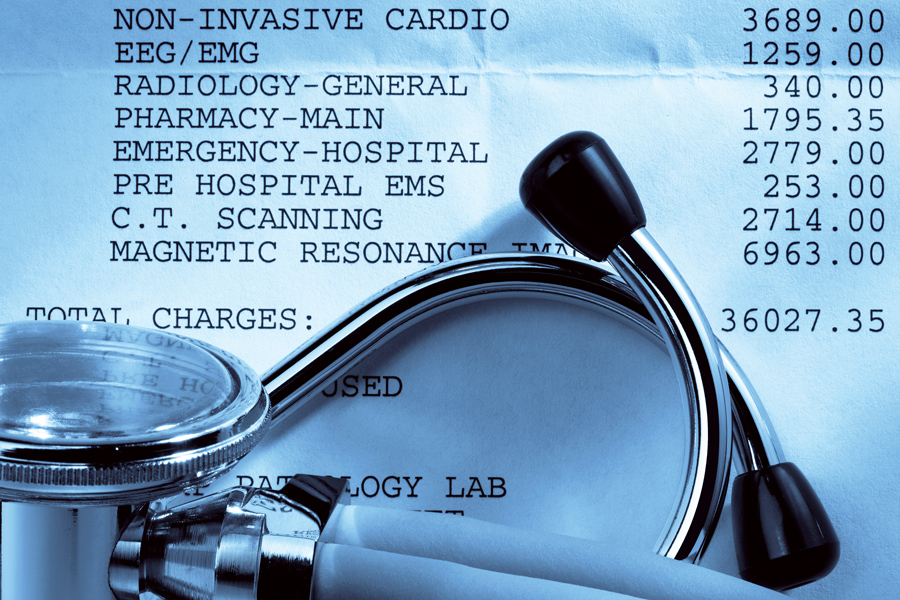

One of the reasons the research focused on patients with aggressive blood cancer is that treatment for the disease is often prohibitively expensive, totaling as much as $800,000, due to the high costs of bone marrow transplants and other therapy. Because of that, people often forgo doctors visits, skip prescriptions or try to stretch out their medications by taking less than the recommended dosage, Knight said.

About one in five people in the study could not afford prescriptions, and 11% reported stretching drugs. Those habits can result in a higher mortality rate, making financial planning and grant assistance crucial.

“If you’re missing doctor’s visits, if you’re missing medications, you’re going to be more likely to die,” Knight said. “Intervening on these things will increase survival because people will get the therapy.”

Further, some people facing these aggressive cancers were struggling to get by financially before their diagnoses. In addition to medical bills, costs spiral out of control because of lost wages, child care and other factors that can accompany fighting acute cancer, Knight said.

The monetary fallout is known as “financial toxicity.” Prior research has linked it with higher mortality rates in patients with other forms of cancer.

“There’s going to be a million things that come up in the course of treatment with these diseases,” Knight said. “One of the things we realized right off the bat was we had a huge gap in general financial planning in terms of budgeting.”

Meeting individually with financial planners, as well as nurses and pharmacists who helped identify assistance, was invaluable for patients, he said.

The Foundation for Financial Planning started a pilot program in 2018 that has since become its Pro Bono for Cancer program. The initiative now involves 300 financial professionals and has provided six months of one-on-one planning for more than 1,000 low- to moderate-income families facing cancer, according to the organization.

The Covid-19 crisis has brought more attention to the connection between income and health care, particularly for cancer patients, Knight said.

For advisers who want to get involved, there are many opportunities for virtual pro bono meetings, he said.

“My patients are very immunosuppressed — I don’t want them going around and seeing lots of people,” he said. “The idea of this virtual financial planning … it makes it easier for them, too.”

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.