Since Charles Schwab first announced plans to acquire TD Ameritrade, much of the conversation in the wealth management industry has been about how the deal will impact the small financial advisory firms TD was known for supporting.

But large firms are also feeling confused about the current landscape of custodians, according to a survey from F2 Strategy, a consulting firm that works primarily with registered investment advisors, broker-dealers and asset managers with at least $1 billion in assets under management. In a survey of 29 firms that represent a combined $6 trillion in assets, F2 found it isn’t just small firms that are frustrated with a lack of integration, automation or innovation from their custodians.

Fewer than half of the firms polled are satisfied with native data download tools provided by their existing custodian, as opposed to 83% being satisfied with third-party data delivery tools. This may be the result of 70% of firms using at least two custodians.

Large firms will take the path of least resistance when recruiting new advisors. While working with multiple custodians brings a unique set of challenges, particularly in data management, it is typically less painful than the repapering process required to move client accounts to a new custodian.

“Each RIA may take a different approach to aggregating data and will expect their custodian to help them,” F2 founder and co-CEO Doug Fritz wrote in the report. “Currently, firms are not relying on their custodians for innovation and they want more out of what they have and will get it in whatever way they can to solve their challenges.”

Fritz was unable to provide additional comment.

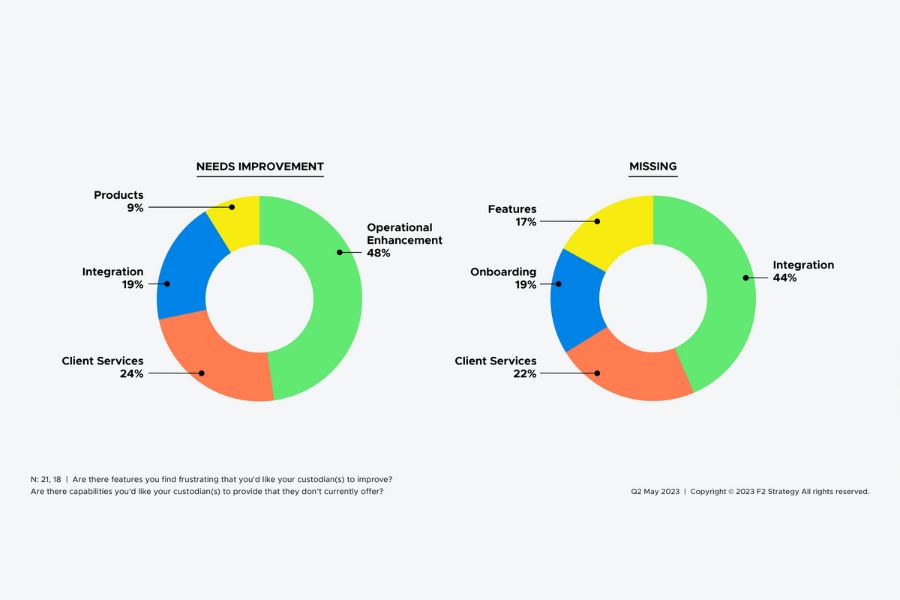

Many large advisors are also disappointed in their custodian’s ability to integrate technology, a problem that is persistent across the independent advisor market. Of the firms polled by F2, 44% said their custodian doesn’t offer integration, while 19% said it needs improvement.

Firms want efficient processes for getting data from custodians into their own tools for processing and reporting, but there are still gaps, Fritz concluded.

“Given the collective frustration with the lack of integration and disappointment in the pace of innovation, it’s not hard to understand why most RIAs go to other vendors for more efficient technology,” he wrote. “Custodians should listen to their RIA clients to plan project roadmaps and update functionality that meets expectations.”

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.