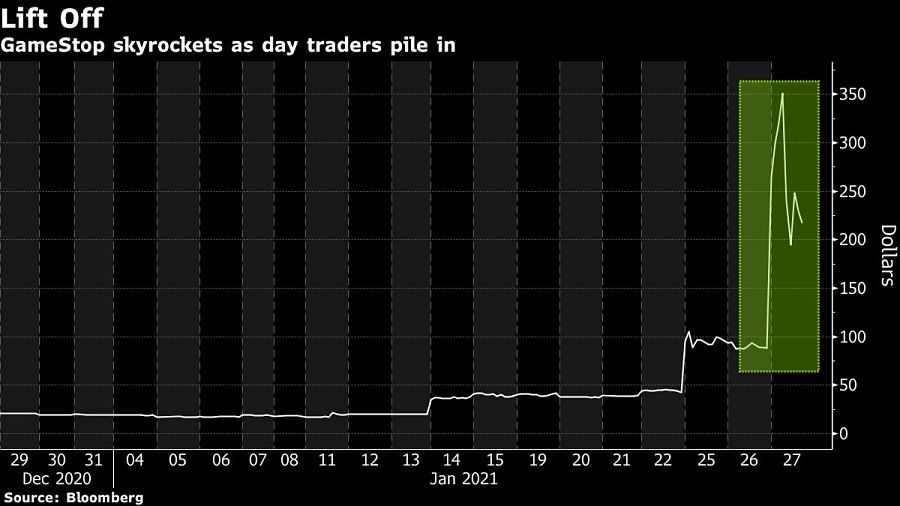

GameStop Corp.’s wild ride continued in premarket trading as the stock whipsawed following reports of short sellers capitulating.

The shares were up 42% at $210.03 as of 8:28 a.m. in New York, having earlier more than doubled from the last close of $147.98. Melvin Capital closed out its short position, while Citron Capital’s Andrew Left said the firm covered the majority of its short in “the $90’s at a loss of 100%.”

“It does feel like rationality and fundamentals are just kind of dead,” J Capital Research co-founder Anne Stevenson-Yang said by telephone. “If you’re short, you’re in a very difficult position because you have to buy the stock to get out, so you end with a heavily overvalued stock.”

GameStop didn’t immediately respond to a request for comment.

The stock has gyrated wildly since Tuesday’s 93% surge, a move that meant GameStop has risen more than eightfold this month in a dizzying rally fueled by Reddit-charged day traders.

“It really just goes to show the classic saying that markets can stay irrational longer than you can stay solvent,” said Greg Taylor, chief investment officer at Purpose Investments. “So you can try to fight this as long as you want but at some point you just have to give in and just step to the sidelines.”

GameStop’s gains reached new extremes outside regular hours after Tesla Inc. chief Elon Musk tweeted a link to a Reddit thread about the company. Famed fund manager Michael Burry warned that the manic rally has gotten out of hand, calling the stock’s rise “unnatural, insane, and dangerous.”

“That feels like the phase of the market we’re in right now, where things are going a little crazy and definitely divorced from fundamentals,” Taylor said.

Another note of caution was provided Wednesday by Bank of America Corp. analysts. While raising their price target to $10 from $1.60 to reflect the stock’s recent surge, they noted that GameStop is in “a weaker not a stronger place” and reiterated their underperform recommendation.

“While it is difficult to know how much very high short interest and retail ownership could continue to put upward pressure on the shares, we think fundamentals will again factor into valuation,” analysts led by Curtis Nagle wrote in a note. “We remain skeptical on the potential for a turnaround.”

Euphoria born in day-trader chat rooms has turned GameStop into the biggest story stock of the retail era, its improbable surge an emblem of the newfound power of individual investors. At the same time, it’s become a major headache for institutional investors betting it would fall.

An epic short squeeze lifting the shares has set off a search for other companies that might be similarly vulnerable, with Express Inc., Bed Bath & Beyond Inc. and AMC Entertainment Holdings Inc. among stocks surging in premarket trading on Wednesday.

“The thing about these manias is there’s always enough people who make 600% or 1,000% and tell everybody about it that everybody gets excited about it,” said Anne Stevenson-Yang. “The thing is it’s not the majority of those people and eventually a whole bunch of people lose money.”

A Texas-based bank selects Raymond James for a $605 million program, while an OSJ with Osaic lures a storied institution in Ohio from LPL.

The Treasury Secretary's suggestion that Trump Savings Accounts could be used as a "backdoor" drew sharp criticisms from AARP and Democratic lawmakers.

Changes in legislation or additional laws historically have created opportunities for the alternative investment marketplace to expand.

Wealth managers highlight strategies for clients trying to retire before 65 without running out of money.

Shares of the online brokerage jumped as it reported a surge in trading, counting crypto transactions, though analysts remained largely unmoved.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.