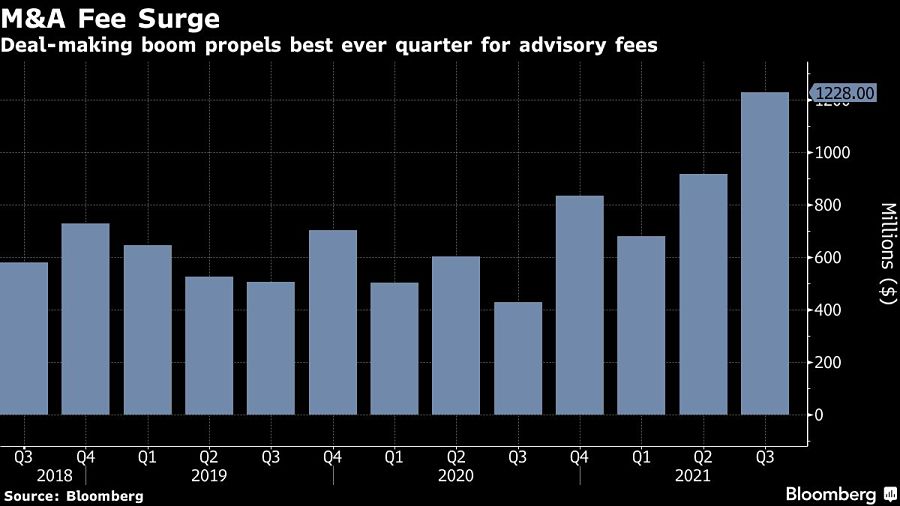

JPMorgan Chase & Co.’s dealmakers posted their best quarter yet, riding what’s on track to be a record year for mergers and acquisitions.

Fees from advising on deals almost tripled in the third quarter, crushing analysts’ estimates and helping to push the firm’s net income to $11.7 billion.

“JPMorgan Chase delivered strong results as the economy continues to show good growth — despite the dampening effect of the delta variant and supply-chain disruptions,” Chief Executive Jamie Dimon said in a statement Wednesday. Investment-banking fees jumped 52%, driven by a “surge in M&A activity and our strong performance in IPOs.”

The report provides a look into how the U.S. economy fared in the Covid-19 pandemic as the delta variant spread across the country, undercutting a return to normalcy. JPMorgan’s results also hint at what’s to come when the rest of Wall Street reports third-quarter results this week.

Loan growth has been a particular focus for bank investors frustrated by a lack of progress in the business. Wall Street executives have begun pointing to early indications that small businesses and individual consumers are taking on debt again after government stimulus checks depressed demand during the Covid-19 crisis.

JPMorgan’s total loans increased 6% from a year earlier, driven by gains in the firm’s asset and wealth management arm and corporate and investment bank. Consumer and commercial loan growth remained elusive, with period-end consumer loans down 2% and commercial loans down 5%.

Shares of JPMorgan, which gained 30% this year through Tuesday, rose 0.3% to $165.80 in early New York trading.

The bank reported $3.3 billion in investment-banking fees, topping analysts’ estimates for $2.8 billion. Debt underwriting revenue rose to $1.04 billion and equity underwriting climbed to $1.03 billion.

Results were also padded by a $2.1 billion reserve release, a benefit Dimon has downplayed as the biggest U.S. bank released large portions of what it set aside at the onset of the pandemic for potential soured loans.

The bank’s traders generated $6.27 billion of revenue in the quarter, down from a year earlier but above the $5.9 billion analysts expected.

[More: JPMorgan chases active ETFs with $10 billion mutual fund switch]

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.