New York City-based RIA Future You Wealth has been acquired by the finance content giant NerdWallet, as the publicly-traded firm expands further into wealth management services.

Future You Wealth, which disclosed it manages nearly $178 million in its April 2025 Form ADV filing with the SEC, will now form the newly launched fee-only advisory NerdWallet Wealth Partners. The NerdWallet Wealth Partners website says it charges a “maximum all-in fee at 0.9% of assets managed — the more you invest, the lower your fee. On average, we charge 30% less than other wealth management firms” with its clients typically having at least $100,000 in investable assets.

Future You Wealth was founded in 2019 by Ryan Sterling, who has started a new role as CEO at NerdWallet WealthPartners. “This partnership [with NerdWallet] gives us even more tools to help clients make smarter, more confident financial decisions,” Sterling wrote on LinkedIn. Joining Sterling from Future You Wealth to NerdWallet Wealth partners include CPA James Bashall and CFP Will Toczylowski.

Charles Schwab will serve as a custodian of client assets at NerdWallet Wealth Partners, whose website says the firm will offer portfolio and investment management, retirement planning, tax strategy, budgeting, estate planning and trusts, and insurance advice. “The vast majority of partners meet with their clients virtually,” reads the website.

NerdWallet Wealth Partners follows last year’s launch of the subscription-based RIA NerdWallet Advisors, as reported by Citywire. The latest Form ADV filed in May of this year from NerdWallet Advisors says it provided advisory services to 4,640 clients over the past year, but it does not manage any assets and instead collects fees to refer users to other third-party RIAs.

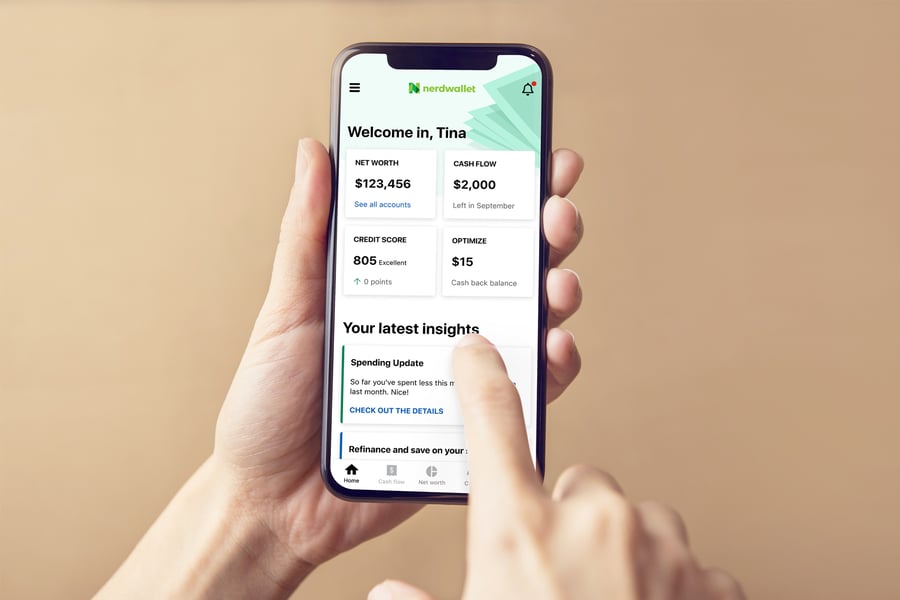

NerdWallet’s website and app provide financial content for consumers by analyzing and comparing products across different types of credit cards, bank accounts, loans, and insurance plans, as well as calculators for assessing mortgage rates, taxes, and budgeting. The company has an editorial team of over 100 staff and makes money through affiliate marketing, advertising, and lead generation for its partnered financial institutions.

"It’s a natural evolution for NerdWallet to enter wealth management as it looks to capture greater revenue than it can earn referring leads outside of its proverbial walls, but doing so comes with added responsibility to ensure they're acting in the best interest of the consumers who consider their brand to be trustworthy,” Brian Thorp, CEO of financial content and advisor matchmaking service Wealthtender, wrote in an email to InvestmentNews.

NerdWallet’s press team did not respond to an email from InvestmentNews seeking comment on the launch of NerdWallet Wealth Partners. NerdWallet reported $209 million Q1 revenue this year led by its insurance and banking businesses, a 29% YOY increase.

Nerd Wallet’s stock was trading around $10.83 as of late Tuesday afternoon. NerdWallet’s past acquisitions include buying business loan provider Fundera in 2020, consumer debt robo-advisor platform On the Barrelhead in 2022, and mid-sized mortgage broker Next Door Lending last year.

"NerdWallet’s move is bold, but it changes the game. They’re no longer just a guide to help consumers find advisors, they’re a competitor,” Thorp said. “As the lines between consumer media and money management blur, NerdWallet owes it to consumers to find ways to ensure those lines remain visible.”

While industry statistics pointing to a succession crisis can cause alarm, advisor-owners should be free to consider a middle path between staying solo and catching the surging wave of M&A.

New joint research by T. Rowe Price, MIT, and Stanford University finds more diverse asset allocations among older participants.

With its asset pipeline bursting past $13 billion, Farther is looking to build more momentum with three new managing directors.

A Department of Labor proposal to scrap a regulatory provision under ERISA could create uncertainty for fiduciaries, the trade association argues.

"We continue to feel confident about our ability to capture 90%," LPL CEO Rich Steinmeier told analysts during the firm's 2nd quarter earnings call.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.