Adviser recruiting activity appears to be slowing down as firms increasingly grow their head count and assets through deal-making, according to an analysis of the most recent industry data.

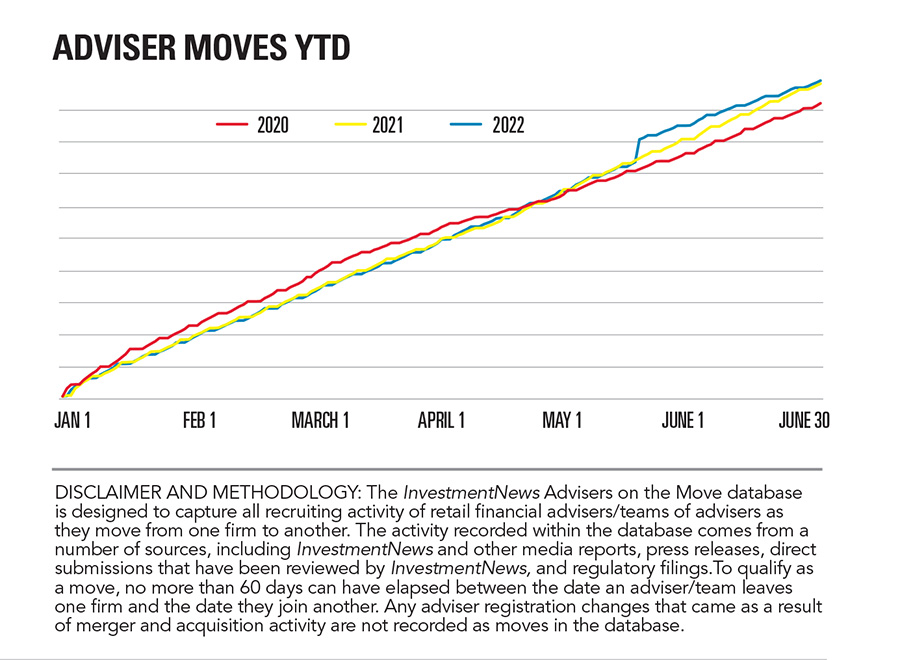

Total moves of advisers between firms were up only 1% during the first half of the year compared to the same period a year earlier, according to the InvestmentNews Advisers on the Move Database. The data include advisers who transition between firms, excluding those that result from a merger or acquisition.

Still, the lift over the first two quarters came in large part from a June deal that brought CUNA Brokerage Services’ brokerage and advisory assets to LPL Financial, resulting in more than 500 advisers moving their registrations to the independent broker-dealer. LPL did not outright buy the brokerage, which had $36 billion under management.

Even including those transitions, first-half moves of experienced advisers were down 7% from the first half of 2019.

Volatile markets, which can be a difficult time to transition assets, may be holding recruiting activity back from its breakneck pre-pandemic pace. But mergers and acquisitions have more than rebounded from the 2020 low.

M&A in wealth management grew by 39% year over year in the first half, according to the latest quarterly report from Echelon Partners. The bank and wealth management consultancy projects 2022 to be another record-breaking year following the highest volume in any second quarter since it began tracking data.

In other words, if this year has been slow for individual advisers and teams on the move, entire firms are changing hands more than ever.

In the second quarter, 840 advisers on net moved to independent broker-dealers, 270 to registered investment advisers, 114 to discount brokerages and 18 to the institutional channel. Meanwhile, a net 639 advisers moved from banks, 418 from wirehouses, 156 from insurance broker-dealers and 29 from regional broker-dealers.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

A new PitchBook analysis unpacks sticking points relating to liquidity, costs, and litigation risk for would-be investors and plan sponsors.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

The collaboration will give RIAs yet another access point into the alternatives space through a new unified managed account capability.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.