The S&P 500 is about to drop sharply, Morgan Stanley’s Michael J. Wilson warned, as investors struggle to find havens amid fears of a recession and aggressive tightening by the Federal Reserve.

“With defensive stocks now expensive and offering little absolute upside, the S&P 500 appears ready to join the ongoing bear market,” said Morgan Stanley strategists in a note on Monday. “The market has been so picked over at this point, it’s not clear where the next rotation lies. In our experience, when that happens, it usually means the overall index is about to fall sharply with almost all stocks falling in unison.”

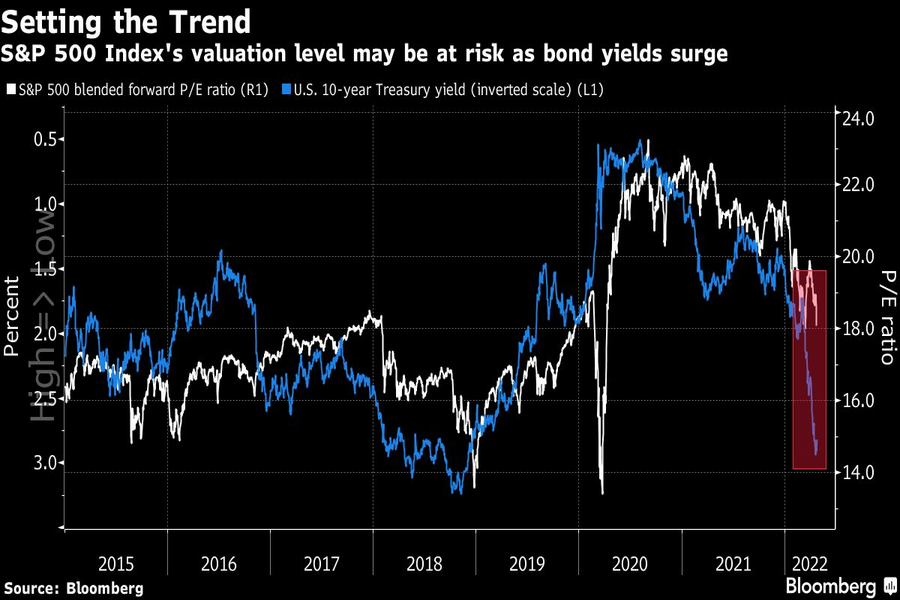

The S&P 500 Index has slumped for three weeks in a row, sinking to the lowest level since mid-March on Friday as investors fled risk assets amid fears of rapid monetary tightening and its impact on economic growth. Fed Chair Jerome Powell’s endorsement of aggressive actions to curb inflation sent traders racing to price in half-percentage-point interest-rate increases at the bank’s next four meetings.

Morgan Stanley strategists said a quickly tightening Fed is looking “right into the teeth of a slowdown” and that while defensive positioning has worked well since November, they don’t see more upside for these stocks as their valuations have swelled.

At the same time, the strategists said that large-cap pharma and biotech shares’ defensive characteristics make them consistent outperformers in an environment of slowing earnings growth, decelerating PMIs and tighter monetary policy.

“As the U.S. economy moves to a late cycle phase and GDP/earnings growth rates decelerate for the overall economy and market, we think Pharma/Biotech’s defensive properties will outweigh policy concern and drive relative performance higher,” they wrote.

Many people have already continued working past their planned retirement date

A new analysis finds long-running fiscal woes coupled with impacts from the One Big Beautiful Bill Act stand to erode the major pillar for retirement income planning.

Caz Craffy, whom the Department of Justice hit with a 12-year prison term last year for defrauding grieving military families, has been officially exiled from the securities agency.

After years or decades spent building deep relationships with clients, experienced advisors' attention and intention must turn toward their spouses, children, and future generations.

The customer’s UBS financial advisor allegedly mishandled an options strategy called a collar, according to the client’s attorney.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.