U.S. equity futures hinted at recovery from Wednesday’s retreat, even as a sell-off intensified across bond markets worldwide.

S&P 500 contracts added 0.2%, while Europe’s equity benchmark slipped 0.4%, falling under its 200-day moving average for the first time since March. While many investors had believed that the Federal Reserve was done raising interest rates, that’s no longer a sure thing after minutes from last meeting suggested officials are considering tighter policy.

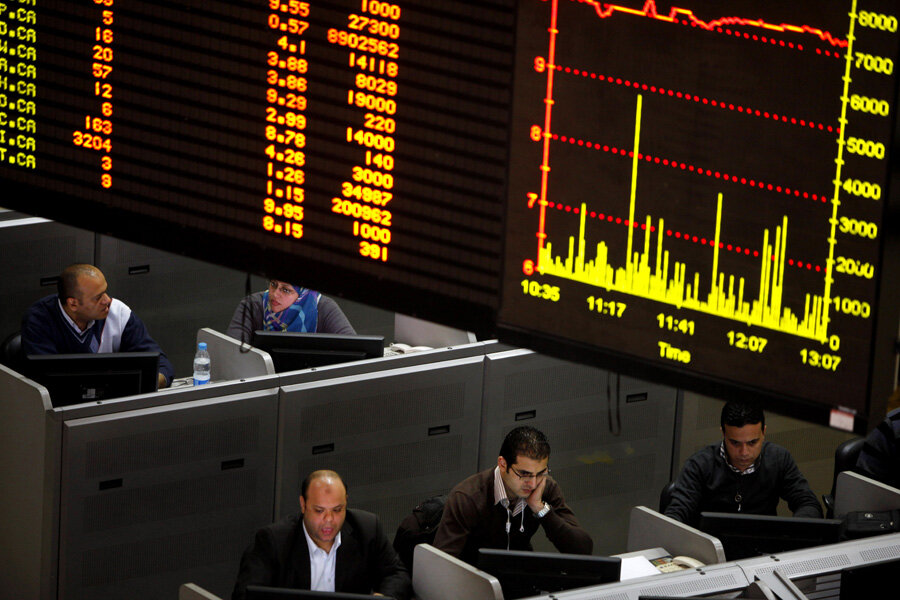

The moves across bond markets have been sharp and swift this week. The 10-year Treasury yield rose three basis points to 4.29% on Thursday, approaching the highest level since 2007. In the UK, equivalent maturity gilts were at 4.71%, the highest since the financial crisis of 2008. Japan’s 20-year bond yield surged after a debt auction drew tepid investor demand.

“Markets are taking the prospect of another hike from the Fed increasingly seriously, with futures now pricing in a 45% chance of a further hike by the November meeting,” Deutsche Bank AG strategist Jim Reid wrote. “Investors are adjusting to the fact that rates could remain at a higher level for some time.”

Treasuries have been a key driver of the global debt selloff as resilience of the world’s largest economy defies expectations that a run of Federal Reserve interest-rate hikes would spark a recession. In the UK, the surge in gilt yields comes after sticky inflation and strong wage data boosted investor bets that the Bank of England will need to raise interest rates further to 6% and keep them high for longer.

In corporate news, BAE Systems Plc agreed to buy the aerospace division of soda-can giant Ball Corp. for $5.6 billion. Shares of BAE fell as much as 4.8% in London, its biggest drop in nine months, as investors weighed the cost of the purchase.

China also continued to weigh on sentiment. The picture emerging from property agents and private data providers suggest the slump in the real estate market may be worse than official reports show. These figures show existing-home prices falling at least 15% in prime neighborhoods of major metropolitan areas like Shanghai and Shenzhen.

China ramped up its efforts to stem losses in its currency on Thursday by offering the most forceful guidance since October through its daily reference rate for the managed currency. The offshore yuan slipped against the greenback.

“Equity markets are currently faced with two headwinds — first, real rates are surging again, as the US economy is showing numbers consistent with an economic recovery,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management. “Second, China is starting to emit dire signals that must remind investors of the awful summer 2015, with a troubled housing market and shadow banking system.”

Key events this week

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.