While RIAs and enterprise advisors may have the same priorities when it comes to serving their clients, new data from Envestnet suggest the two groups differ on several counts.

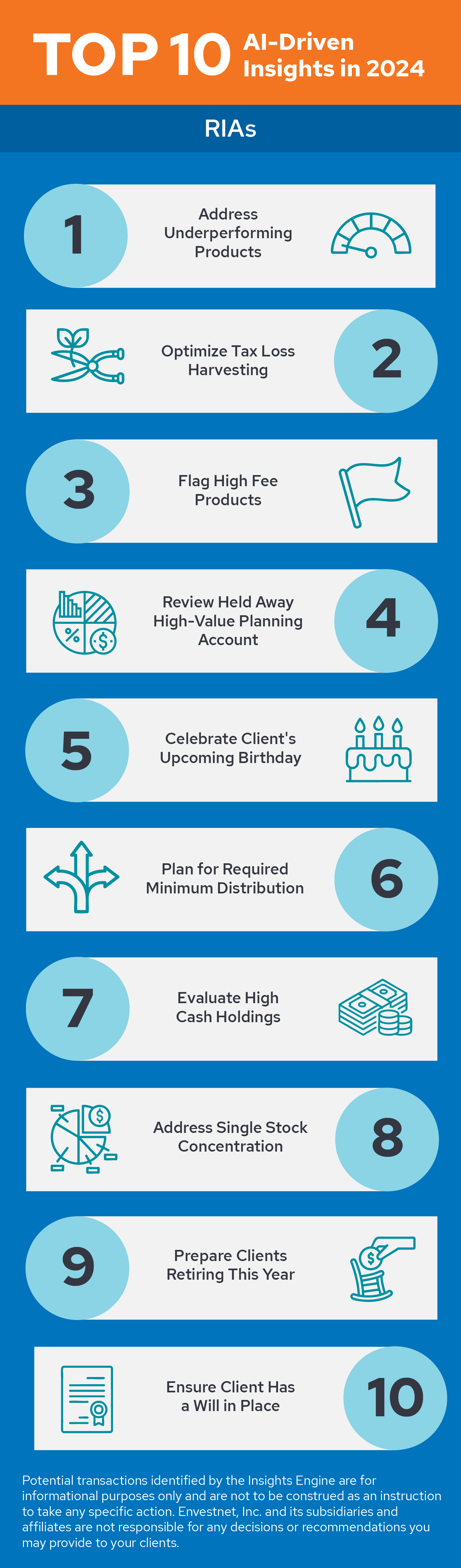

The wealth tech giant has revealed the most significant AI-driven insights among financial advisors in 2024, which showed notable overlaps and differences between RIAs and advisors at other enterprises.

Powered by its AI-driven Insights Engine, the findings reveal how enterprise advisors and RIAs are prioritizing specific areas to improve client outcomes and grow their practices.

"Advisors are leveraging these insights to enhance their clients' portfolios and develop more personalized, tax-efficient strategies," Molly Weiss, group president of Envestnet’s wealth management platform, said in a statement announcing the results.

The analysis identified two common priorities across both advisor groups: addressing underperforming products and utilizing tax-loss harvesting to mitigate tax burdens.

But enterprise advisors cited life insurance gaps as their third key priority area, reflecting an increased focus on holistic financial planning. In contrast, flagging high-fee products took third place on RIAs' insight rankings, highlighting a push toward cost-efficient investment solutions for clients.

"Having underperforming products and tax-loss harvesting at the top of both lists shows that advisors are increasingly turning to these insights in an effort to improve client outcomes, regardless of advisor type," said Jeremi Karnell, head of Envestnet data solutions. "These strategies help mitigate risk and optimize tax advantages, making them valuable in any market environment."

Looking further down the lists, the data also showed a growing focus on retirement planning, with both RIAs and enterprise advisors identifying “clients retiring this year” as a priority.

The release comes as AI adoption continues to grow within the advisory industry. Citing data from Cerulli, Envestnet said 9 percent of advisory practices currently use AI tools, but 72 percent plan to integrate AI into their operations within the next three years.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.