Beacon Pointe is ending the year with a bang as it seals two RIA partnerships to push it over a key asset milestone.

Beacon Pointe's two latest acquisitions, announced Tuesday, bring the firm’s total assets under advisement to approximately $40 billion at year-end.

The leading women-led RIA's newest strategic partners, Boston-based Artemis Financial Advisors and WhiteRock Wealth Management, which will join Beacon Pointe’s existing team in Dallas, collectively add $613 million in assets under management.

Artemis Financial Advisors, which manages $350 million, specializes in providing financial, charitable, and retirement planning advice through a fee-only model for retirees, affluent women, physicians, and young professionals.

Leigh Bivings, founder and CEO of Artemis, emphasized alignment with Beacon Pointe’s client-focused approach.

“We are thrilled to partner with Beacon Pointe and are especially excited to collaborate closely with their talented Boston team,” Bivings said in a statement. “Beacon Pointe’s people-first culture and client-centric approach align perfectly with our own values and mission.”

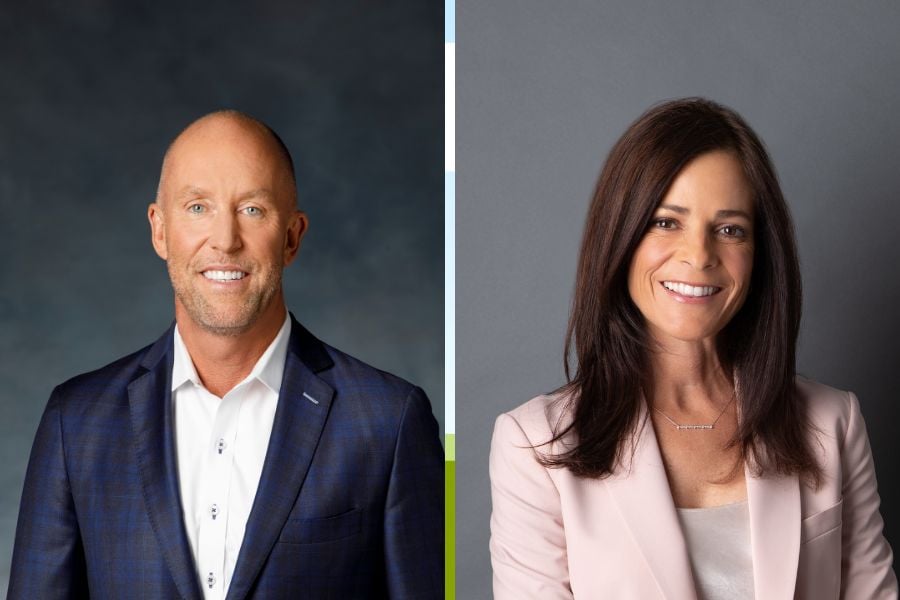

"We're very excited to welcome the Artemis team ... This continues a trend of strong female leadership in major markets for Beacon Point," said Beacon Pointe President Matt Cooper.

Meanwhile, the team of four seasoned professionals at WhiteRock Wealth Management, a family-owned firm managing $263 million, provides investment management, tax and estate planning, and retirement services.

“Our team is excited to join Beacon Pointe knowing the philosophy we followed for three decades is aligned with the company’s core values,” said WhiteRock President and CIO David Gurun. “The depth of Beacon Pointe’s infrastructure will allow our multi-generational clients to benefit from their comprehensive, personalized wealth management services.”

Shannon Eusey, CEO and founder of Beacon Pointe said the firm remains focused on "the booming Dallas-Fort Worth market," where WhiteRock will integrate, as "a key area of growth."

"This is our seventh acquisition in the Lone Star state," Eusey said. "Together, we're positioned to provide an even higher level of personalized service and meet the exciting demand of local client growth."

Beacon Pointe's strategic partnerships in Massachusetts and Texas come on the heels of a key appointment earlier this month, in which the California-based RIA tapped Capital Group alum Greggory Cowan as its newest retirement plan business consultant.

After closing out its 2024 deal calendar with seven transactions, including its October deal with $1 billion Landmark Wealth Management Group in Minnesota, Beacon Pointe now has more than 580 employees across 64 offices nationwide.

The policy research institution calculates thousands in tax cuts for Washington, Wyoming, and Massachusetts residents on average, with milder reductions for those dwelling in wealth hotspots.

The race to 100 transactions ended a month early this year, with April standing out as the most active month on record for RIA dealmaking.

Wells Fargo has also added more than $800 million in new AUM with recruitments from UBS, Osaic, and Merrill Lynch.

Also, Merit has added an $860 million RIA to bolster its Texas presence while Concurrent's asset management arm partners with a boutique investment shop.

Wells Fargo, Commonwealth, UBS are the firms losing advisor teams.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.