When John Beatty proclaimed during his keynote at the recent Schwab Impact that the future is bright – and subsequently put on shades to prove it – he had more than half an eye on his firm’s RIA market share.

The new head of advisor services at Charles Schwab, which serves more than $4.5 trillion in assets under management and supports 15,000 advisors worldwide, used the event to drum home his calculation that “momentum and math" will propel the current $9 trillion RIA industry to $20 trillion by 2034.

Beatty, who succeeded long-serving Schwab executive Bernie Clark four months ago, also pointedly reminded the audience that $35 trillion is sitting in traditional advice models. The point was not lost on the audience: There are a lot of assets there for the taking.

Speaking to InvestmentNews the day after his keynote at the Moscone Center in San Francisco on Nov. 20, Beatty said the reaction of the big players in other advice channels was a signal as to what lies ahead.

“We see the other channels, in essence, mimicking what RIAs do in their business model,” he said. “We've seen it in the wirehouses and the IBD channels, so they see where the puck is going as it relates to fiduciary advice, independent advice, and entrepreneurial, empowering advisors. I expect it to continue to be a very competitive marketplace.”

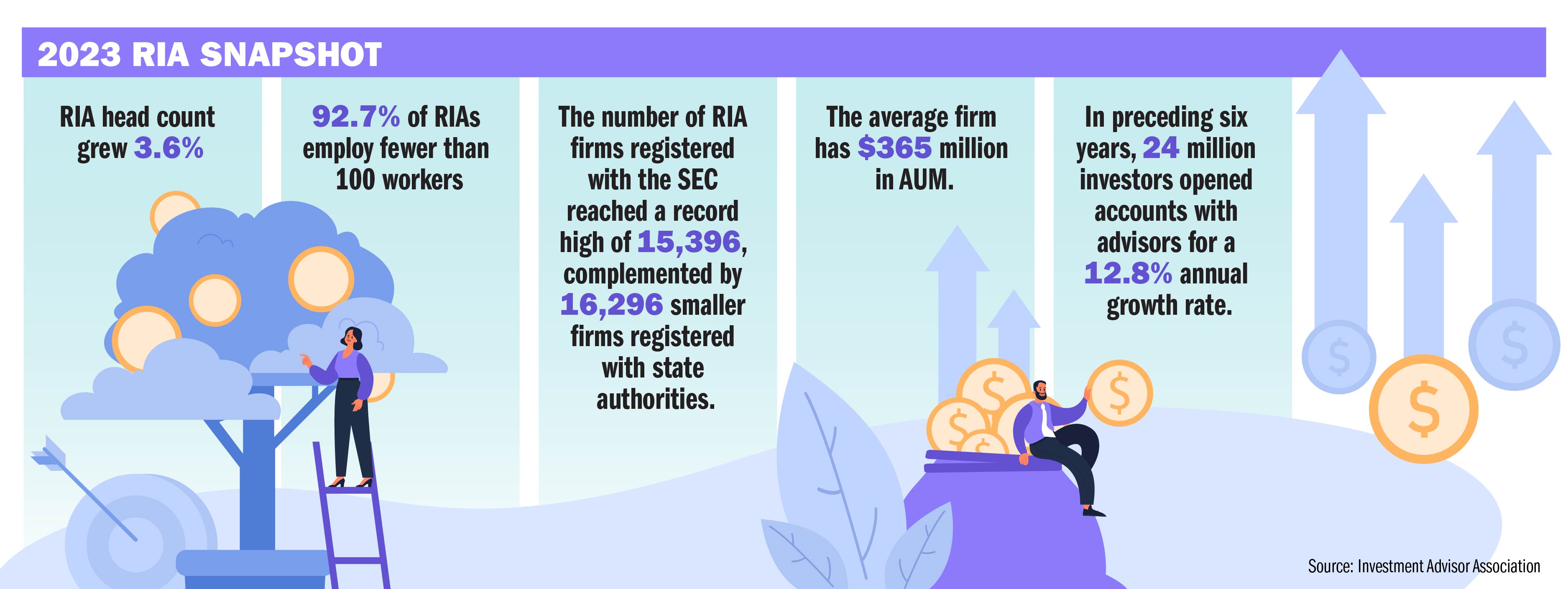

The growth of the independent channel, both in terms of advisors and assets, is undeniable. Assets have tripled from $3 trillion in 2013, while the overall headcount of independent and hybrid RIA channels has soared in the last decade, from 18 percent growth to more than 27 percent as of Aug. 6, 2024, according to data from Cerulli Associates. This number is expected to surpass the 30 percent mark in the next five years.

Beatty was too savvy to set a target on how big a piece of the $20 trillion he said Schwab should capture. But as the biggest platform in the industry, he was understandably bullish. The custodian has been building out its services for independent advisors for more than 35 years and Beatty said that if it doesn’t stray from its core purpose of helping investors reach their financial dreams, the metrics will follow. Half of Schwab’s assets, and half of its growth every year is tied to the independent channel, he said.

“The secret recipe here is commitment,” he said. “We are aligned philosophically [with advisors] on a mission based on helping investors and the fact is there's no other custodian that has more at stake in the success of advisory firms.”

Stakes were certainly high in 2023 when Charles Schwab pulled off the biggest data migration the industry has seen, moving $1.3 trillion among 3.6 million accounts at 7,000 RIAs that were previously custodied at TD Ameritrade. There were early reports of customer-service headaches and disgruntled advisors who had relied on TD Ameritrade’s user friendly technology, but many advisors also said they were happy with how the migration went.

Such a major upheaval brought challenges and feedback, prompting what Beatty described as a “period of healing” over the past 12 months. It’s now time to move on to the next chapter of growth, he stressed.

“[The migration] was a reminder that change is hard,” he said. “There were differences, many differences, between the two platforms, some positive, some not, and we tried to bring the best of both together through the transition, and we think we've done a nice job of that. But there is a period of evolving and adapting to new capabilities, and we're so grateful that our clients had the patience to do that and came along with us.”

Some believe the next phase of growth in the industry has been boosted by former President Donald Trump’s election victory, with low taxes and less regulation likely themes moving forward. Beatty said that while this is a positive as fast-growing industries need capital, the strength of the RIA movement remains its open architecture.

“[The RIA industry] is a mix of entrepreneurs expressing themselves in the business as they see fit, meeting the needs of their clients. And then you have the new entrants coming into the space; advisors leaving the traditional channels and bringing their perspective to the RIA model. They tell us in our surveys that the number one reason they leave is because they want to be able to serve their clients through the lens of what they think is best for those clients.”

Eliseo Prisno, a former Merrill advisor, allegedly collected unapproved fees from Filipino clients by secretly accessing their accounts at two separate brokerages.

The Harford, Connecticut-based RIA is expanding into a new market in the mid-Atlantic region while crossing another billion-dollar milestone.

The Wall Street giant's global wealth head says affluent clients are shifting away from America amid growing fallout from President Donald Trump's hardline politics.

Chief economists, advisors, and chief investment officers share their reactions to the June US employment report.

"This shouldn’t be hard to ban, but neither party will do it. So offensive to the people they serve," RIA titan Peter Mallouk said in a post that referenced Nancy Pelosi's reported stock gains.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.