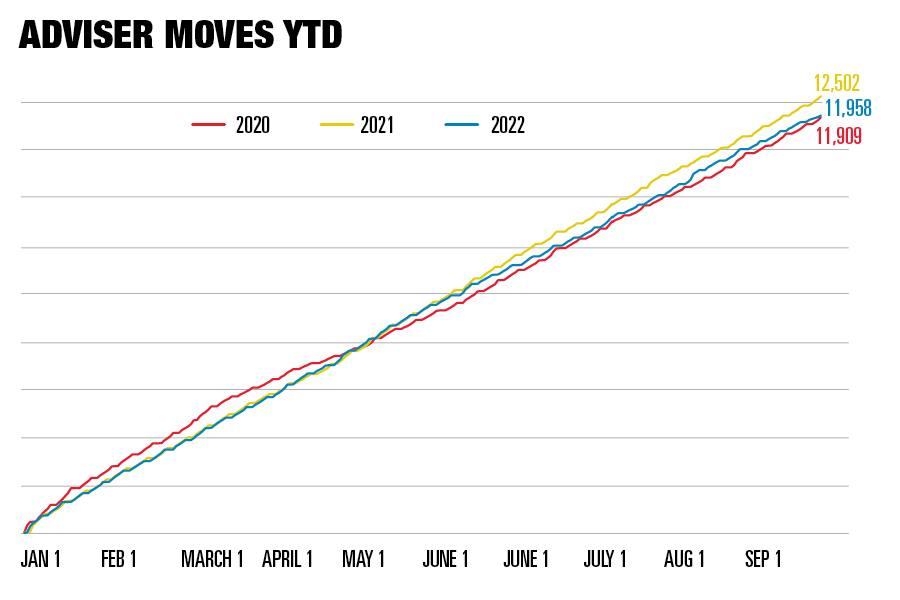

Recruiting activity among advisory firms slowed considerably during the summer as the industry continued to face economic headwinds, according to the latest Advisers on the Move data.

Through September, total moves of experienced advisers between firms fell 4.4% compared with 2021. Year-to-date recruiting activity was just ahead of the pandemic-skewed year of 2020 but 14.3% below 2019. The data exclude moves between related firms and those resulting from a merger or acquisition.

Much of the slowdown occurred in the third quarter. But don’t chalk that up to beach vacations and summer reading. Since 2010, the third quarter has accounted for exactly 25% of annual recruiting activity on average, meaning there is typically no meaningful seasonal impact on the numbers.

Activity from July through September was especially low relative to comparable periods of recent years. Third-quarter recruiting on its own was down 6% year-over-year from 2021, 3.7% from 2020 and a whopping 20.4% from 2019.

High inflation, poor market returns, rising interest rates and their anticipated impact on the economy may have advisers staying put. According to InvestmentNews Research polling data, for the past three quarters, most advisers have been anticipating at least a yearlong economic slowdown. In the most recent quarter, market sentiment among the industry was at its lowest since at least mid-2020, with 29% of advisers expecting stocks to slide further over the next year.

Firms, meanwhile, appear to be looking to grow in larger bites. While individual recruiting activity is down, mergers and acquisitions in the industry are set for new records despite the dismal macroeconomic environment.

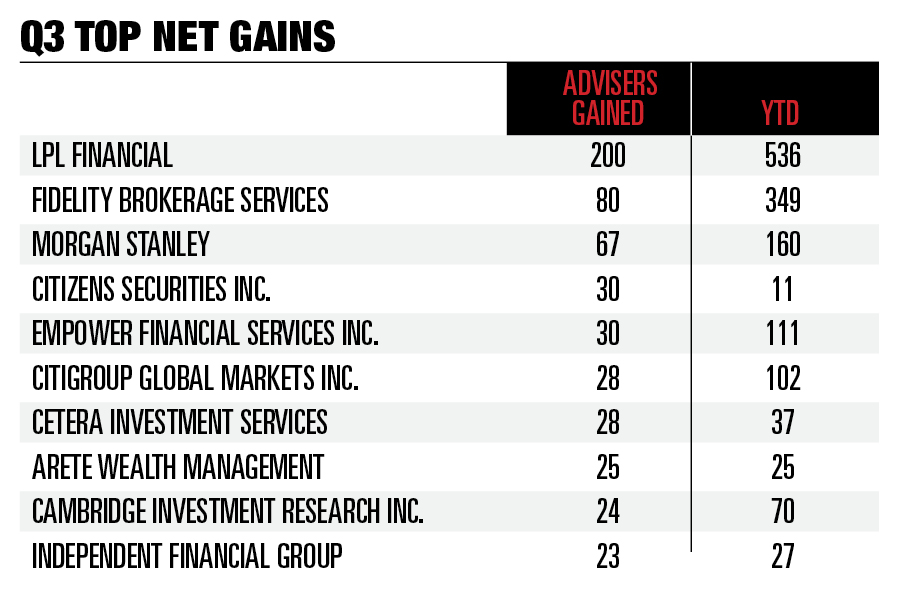

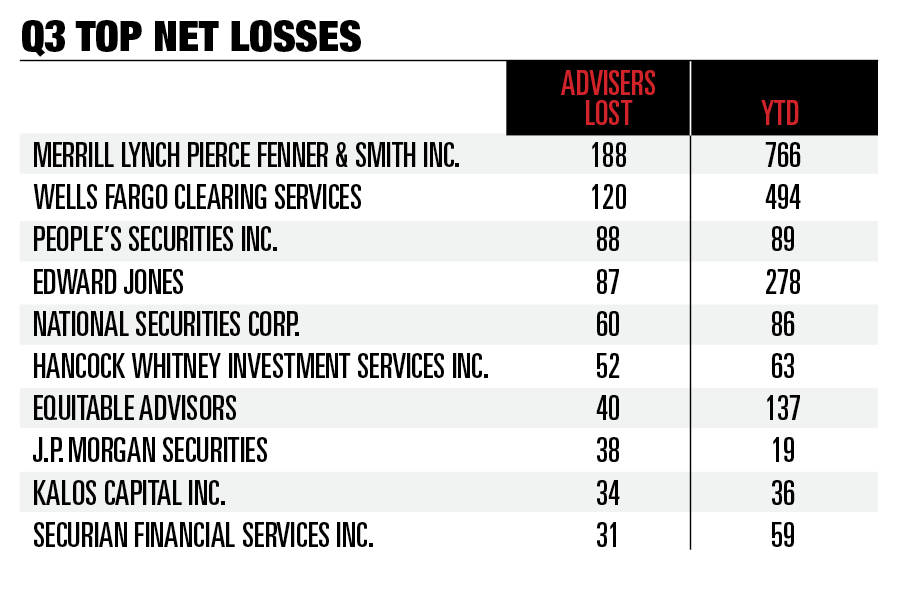

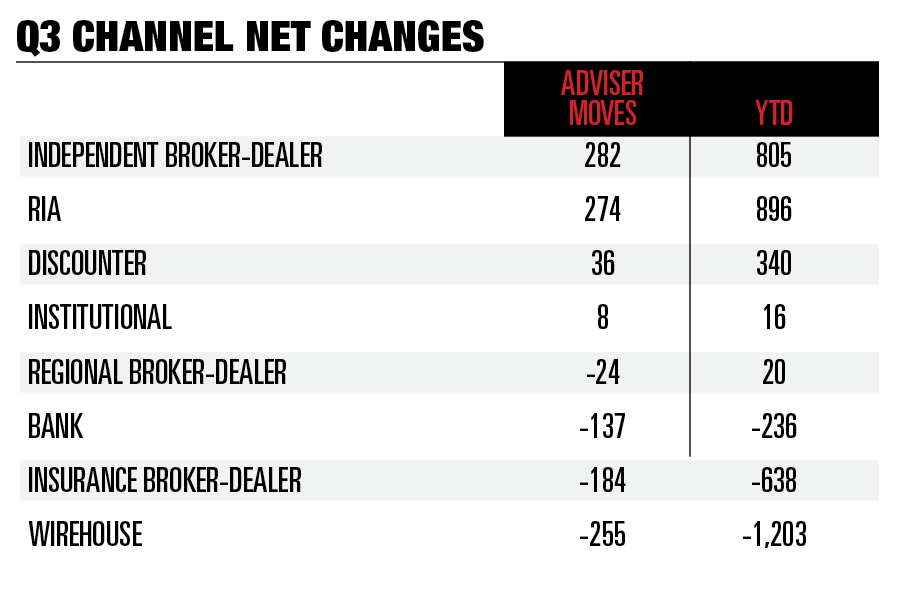

Even if overall recruiting is smaller compared with recent years, it has maintained a similar shape, with advisers largely leaving wirehouses for registered investment advisers and independent broker-dealers — though Morgan Stanley continues to buck that trend, ranking among the top firms in net gains this quarter.

Overall, 1,203 advisers on net left wirehouses through September, while 805 joined independent broker-dealers and 896 went to RIAs.

The move to charge data aggregators fees totaling hundreds of millions of dollars threatens to upend business models across the industry.

The latest snapshot report reveals large firms overwhelmingly account for branches and registrants as trend of net exits from FINRA continues.

Siding with the primary contact in a marriage might make sense at first, but having both parties' interests at heart could open a better way forward.

With more than $13 billion in assets, American Portfolios Advisors closed last October.

Robert D. Kendall brings decades of experience, including roles at DWS Americas and a former investment unit within Morgan Stanley, as he steps into a global leadership position.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.