Somebody needs to solve the succession crisis unfolding in the financial advisory industry.

VestGen founder Josh Gerry believes it might as well be him.

In the coming decade, 105,887 financial advisors plan to retire, or about 37.4 percent of industry headcount and 41.4 percent of total assets, according to the 2024 Cerulli US Advisor Metrics report. That said, more than one-quarter (26 percent) of advisors who see themselves retiring within the next 10 years are unsure of their retirement plans, with this rate being highest among advisors who are affiliated with independent RIA firms (30 percent), the study said.

Independent RIAs face a greater number of concerns associated with succession and retirement planning than affiliated wealth managers. The Cerulli study said that the most acute of those challenges are finding a qualified buyer for their practice (86 percent), structuring deal terms (63 percent), and valuing their practice accurately (53 percent).

And that’s not all the study revealed. Almost half (48 percent) of financial advisors are interested in acquiring a practice. Nearly one-third of advisors (28 percent) are open to an acquisition but not actively searching for one, while 19 percent are actively seeking acquisition opportunities, according to the study.

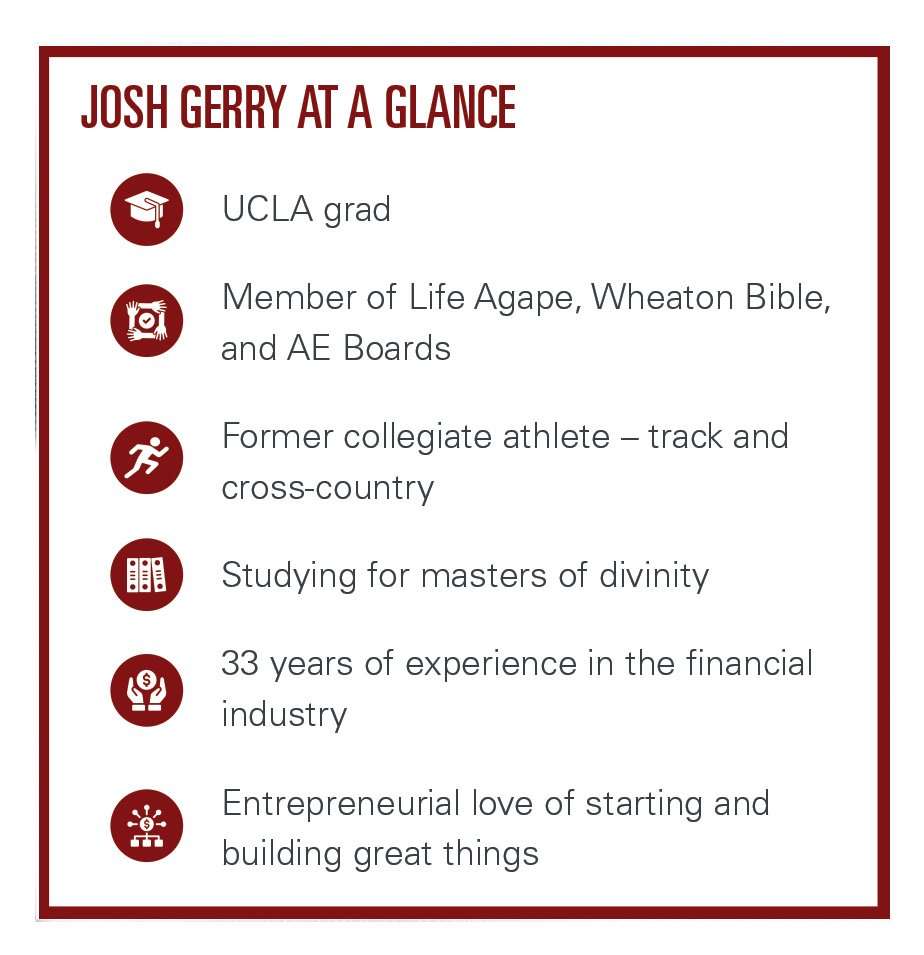

Enter Gerry, pictured above, who for almost 20 years in his early career served as a wholesaler for financial advisors across the country, building relationships that went beyond business.

Eventually, Gerry’s clients started passing away. Some unexpectedly. And what made it even more painful for him was to learn that many of them hadn’t properly planned for succession, a business oversight that heavily impacted their own families.

“I studied the dilemma in the industry and became resolutely committed to solving for the wave of retiring advisors who might not have a clear succession plan,” Gerry says.

VestGen’s mission, according to Gerry, is to become the premier destination for advisors looking toward succession.

“Our retiring advisors can trust VestGen’s NextGen advisors to care for their clients and loved ones well into the future,” he says.

Gerry launched VestGen late last year, recruiting 13 experienced advisors across 10 practices with assets totaling almost $5 billion.

As for VestGen’s target market, Gerry is eyeing small to mid-size wealth managers in the $100–$500 million AUM range. And, yes, he is well aware that’s a pond that most of the private equity-backed RIAs are choosing not to fish in, opting instead to roll up billion-dollar-plus advisory practices instead.

Not a problem, says Gerry. There’s plenty of value in the market’s minnows in his opinion.

“At that specific size, you have a successful business. These advisors know they are good at what they do, both as business owners and for their clients. What they also realize is that to get to the next level, there would be quite a bit of heavy lifting from an infrastructure and build-out perspective,” Gerry says.

In other words, Gerry sees it as a “firm-wide investment.” While a lot of these practice owners know that they have the capability to reach the next step, many of them would rather do it together, with other firms, to lighten the load. And especially for retiring advisors who often find it difficult to find trustworthy partners that can acquire or merge them.

“The businesses that these [retiring] advisors have built are incredibly valuable, so finding someone who is reliable, trustworthy, and has the capacity to acquire or merge them can be a tall order. This is where VestGen comes into play – and executes,” Gerry says.

Starting up a new financial venture is fraught with peril even in a stampeding bull market. But late last year Gerry decided to press ahead with VestGen during what were clearly the tail ends of the financial and economic cycles, not to mention the start of a new presidential administration.

It’s also pretty safe to say that the first quarter of 2025 has been anything but placid for those involved with the stock market. Such a volatile environment generally causes market participants to sit on their hands. Still, Gerry remains unrelenting.

“Time waits for no one, and advisors need succession resources, regardless of the prevailing market conditions,” Gerry said.

Furthermore, he does not worry that the market’s recent downturn will throw him off his long-term plans.

“We don’t define ourselves per se by our assets or growth. But, due to the tremendous need for what we offer, we don’t see any limit to what our headcount or AUM size will be in the long run,” Gerry says.

Gerry is okay with the demands of constructing a brand-new boat, even when the waves are crashing around him.

“I get great enjoyment out of seeing the disparate pieces coming together to form something meaningful and exceptional. It is really fun to see our advisors energized and our staff and teammates driven by a common goal and cause,” Gerry says.

And when he’s not busy building VestGen from the ground up, Gerry enjoys spending time with his wife, Cindy, and their five kids, three of whom are married. He also has a granddaughter, and one on the way.

“We love being involved in our community and church, and getting out for routine bike rides, and jogs. I live with intentionality and with a recognition that our days are numbered, and that every day is special,” Gerry says.

Preparing your clients to withstand the ups and downs of change – both external and internal – could be the key to unlocking their loyalty, trust, and confidence.

After leaving LPL in 2020, it hasn’t gone Cornick’s way at Osaic.

The finance professor and quant investing veteran believes with the right guardrails, artificial intelligence could be trusted to meet the high bar of fiduciary advice.

UBS has also regained some ground as it recruited an experienced Merrill advisor in New York.

The ex-Bay Area broker reportedly continued to peddle fake bond investments, promising rates of returns exceeding 20%, even after FINRA suspended his license in 2014.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.