It’s every quant’s nightmare: Trades that look good on paper break down in the real world. And in the $1 trillion business of smart-beta investing, it’s happening on an industrial scale.

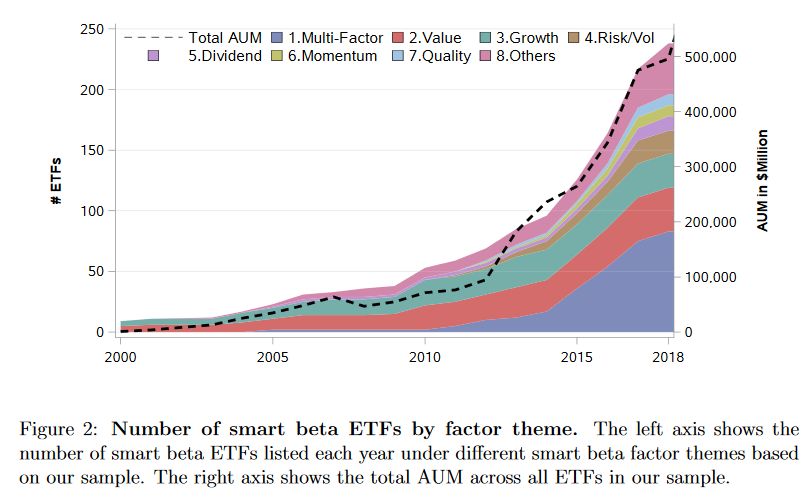

According to a new study, hundreds of strategies that showed significant outperformance in backtesting are failing to live up to their hype once they're packaged and sold as exchange-traded funds.

The average above-market return for smart-beta strategies is 2.77% per year before they are listed. That flips to a loss of 0.44% after fees once they actually become ETFs, according to researchers Yang Song at the University of Washington and Shiyang Huang and Hong Xiang at the University of Hong Kong.

“Stellar performance only exists in backtests and has no indicative power for ‘real’ performance,” the authors wrote. “We find strong support that data mining in backtests accounts for the performance deterioration.”

In other words, ETF sponsors are finding strategies that worked brilliantly according to their historic data -- but that aren’t working now.

Of more than 700 U.S.-listed smart-beta ETFs, about 60% have undershot their indexes since the start of this year, according to data compiled by Bloomberg. The median fund has lost about 1.5% on a total return basis, compared with a more than 10% gain for the Vanguard Total Stock Market ETF.

The booming smart-beta industry accounts for more than a fifth of the $4.8 trillion U.S. ETF market.

It’s a blend of active and passive investing that seeks to deploy popular quant strategies in an ETF wrapper. Rather than weight stocks simply by market capitalization like a vanilla index fund, it typically uses factors such as how cheap they are or their growth potential.

The research, titled “The Smart Beta Mirage,” is the latest in a series of criticisms leveled at industry, but smart beta still has plenty of advocates. The strategies used by the investing style are designed to work over the long term, so periods of underperformance are expected and deviation from the benchmark is practically by design.

Smart beta fans like Rob Arnott of Research Affiliates have repeatedly argued that the basic concept of breaking the link between market capitalization and weighting in a portfolio still holds good -- even if the industry’s breakneck growth has stretched the definition.

Nonetheless, the new study’s findings echo much earlier observations in the ETF sphere.

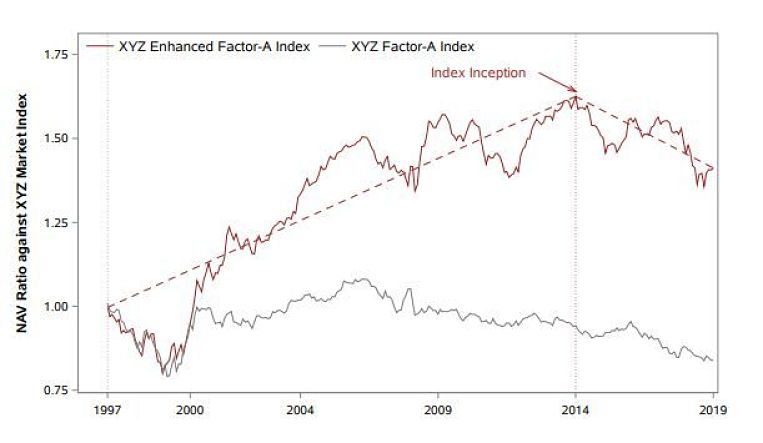

A white paper from Vanguard Group in 2012 identified a pattern among indexes created for fund launches using backfilled performance data in which most fared well before inception but generated weaker returns once turned into ETFs.

Early parenthood linked to lower fulfillment and fewer leadership roles, despite otherwise strong industry-wide support.

“It's the Golden Age, we're all blessed that this is where we are, what we do for a living, and that the sun is shining on the transition towards the RIA space," Creative Planning CIO Jamie Battmer said at a forum hosted by Goldman Sachs.

Strategists expect municipal bonds to best Treasuries during the four-month window from May until August, following a historical trend.

Elsewhere, Raymond James adds two advisors from Edward Jones and LPL, forming an LGBTQ+ focused practice in New Hampshire.

Leading estate-planning tech provider Vanilla has also unveiled key AI upgrades to help its advisor users.

From direct lending to asset-based finance to commercial real estate debt.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.