U.S. stocks rallied the most since May and Treasuries surged as investors recalibrated their portfolios for a future without massive debt-fueled spending or a rollback of Donald Trump’s signature tax cuts.

The Nasdaq 100 surged more than 4% as the uncertain outcome did little to deter bulls who have already stared down a global pandemic that brought the fastest bear market on record. While the vote outcome is delayed and Trump has threatened to contest the result, traders are speculating that he won’t touch off a protracted legal battle.

Expectations that a Democratic sweep would usher in massive stimulus vanished, but traders piled into the megacap technology shares that are seen reaping the benefits of what growth there is, especially if the raging virus leads to additional restrictions. Traders are also betting on stocks that could benefit from a Congressional stalemate. That outcome makes a rollback of Donald Trump’s signature tax reforms less likely and dents the prospects for strict regulations on the tech companies that dominate the economy.

The dwindling hope for a large spending bill deprived financial and industrial shares of the juice needed to expand profits in an economy still struggling to recover from virus lockdowns. The 10-year Treasury yield tumbled below 0.8% as traders cheered the prospects for less debt-funded spending.

Traders also speculated that the Federal Reserve, long begging for fiscal support, may be forced to increase its monetary buttressing if economic data remains tepid. On Wednesday, a private payrolls report fell short of estimates and the services sector expanded at the slowest pace in five months.

“Tech is doing well because the market is essentially reacting to the reality there will not be large-scale stimulus coming down the line,” said Tom Essaye, a former Merrill Lynch trader who founded “The Sevens Report” newsletter. “At that point growth is at a premium and you’re seeing money flood into growth stocks. There was the hope that if there was a blue wave you’d see those value and cyclical stocks take off.”

The benchmark S&P 500 Index rose for a third day after futures swung from losses to gains during the early U.S. morning. Prices recovered from the dive they took earlier when President Donald Trump falsely claimed victory and threatened to ask the Supreme Court to intervene in the election.

With millions of votes in battleground states still being counted, and close contests in five key states, the presidential outcome may not be decided for days, or longer. It’s clear that the election is turning out to be messier and more drawn-out than Wall Street had hoped.

“There will be very little cooperation on fiscal policy, very little cooperation relative to policy related to containing COVID, very little cooperation on infrastructure, or basically anything that will stimulate the economy,” said George Pearkes, Bespoke Investment Group’s global macro strategist. “If that’s the case, then what we’ve got is a repeat of the last recovery, almost to the letter.”

Meanwhile, Uber Technologies Inc. and Lyft Inc. jumped after California voters approved a measure to protect the companies’ business models from efforts to reclassify their drivers in the state as employees.

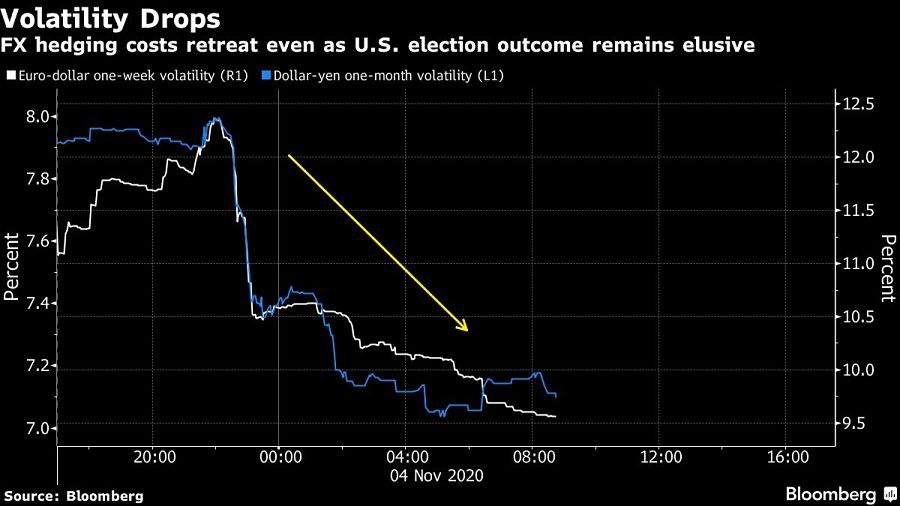

Back in global markets, the dollar fluctuated against many of its major peers, while gold slipped. In Asia, Alibaba Group Holding Ltd. tumbled 7.5% in Hong Kong after China halted the initial public offering of Ant Group Co., in which Alibaba owns about a one-third stake.

The S&P 500 Index climbed 1.6% to 3,424.49 as of 9:32 a.m. New York time, the highest in more than a week. The Nasdaq 100 Index increased 3.3% to 11,655.11, the highest in more than a week on the biggest climb in about six months. The Dow Jones Industrial Average increased 0.9% to 27,729.61, the highest in more than a week.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.