2020 was a year we will never forget — for the depth of difficulties people faced, the breadth of challenges charities encountered and the incredible generosity from donors to support those who were most impacted. In this year of historic tumult and uncertainty, Schwab Charitable donors recommended $3.7 billion in grants, over $230 million of which was specifically earmarked for Covid-19 relief.

Despite the ongoing challenges and uncertainty that have carried over into 2021, the environment remains favorable for charitable giving. Consider the following primary factors.

Historic market performance: The S&P 500 Index has neared record highs recently, and many investors have highly appreciated noncash assets they've held for more than one year in their portfolios. Clients may see this as an opportunity to give stock, mutual fund or exchange-traded fund shares to minimize their taxes and maximize their philanthropic impact.

Current tax benefits for giving: Existing tax laws offer incentives to donors who contribute cash or appreciated noncash assets. Annual income tax deduction limits for gifts to public charities, including donor-advised funds, are 30% of adjusted gross income for contributions of noncash assets held more than one year or 60% of AGI for contributions of cash. Donation amounts in excess of these deduction limits may be carried over for up to five tax years.

Extension of the provisions of the Coronavirus Aid, Relief and Economic Security Act: There are also significant tax incentives for charitable giving through provisions in the CARES Act that have been extended through 2021. Clients taking the standard deduction can claim an additional deduction of up to $300 for cash contributions directly to operating charities, and couples taking the standard deduction can claim up to $600.

Donors who itemize deductions may elect a CARES Act 100% of AGI deduction limit for cash contributed directly to operating charities, and deduction amounts above this limit may be carried over for up to five tax years. In addition, the annual deduction limit for cash contributions by a business stays at 25% of taxable income instead of reverting back to the 10% cap.

CARES Act incentives are not applicable for contributions to donor-advised funds, supporting organizations or private foundations.

As you contemplate how to help clients maximize their impact with their giving in 2021, there are a few key strategies to consider.

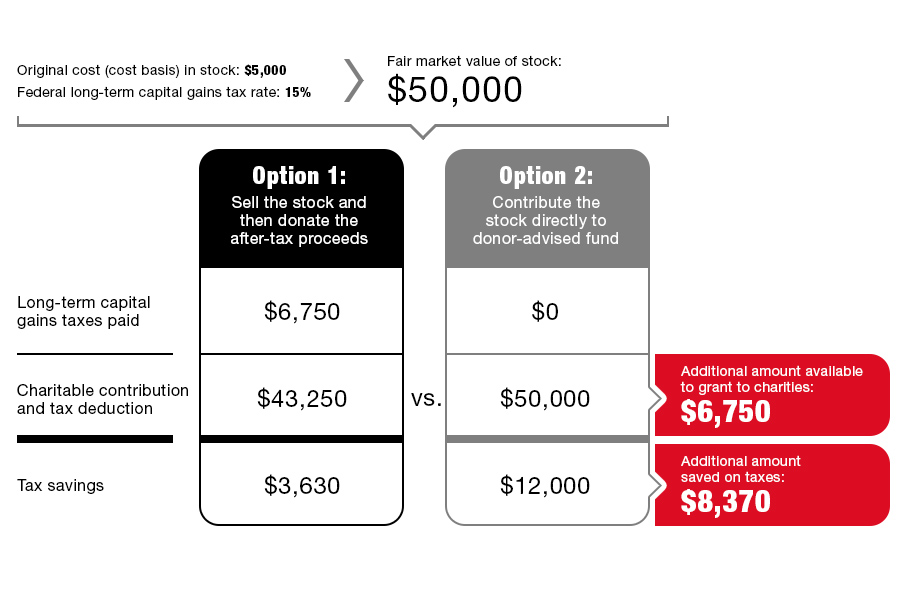

For those who itemize deductions, appreciated non-cash assets held more than one year may offer an additional tax benefit in comparison to cash donations. Beyond claiming a deduction for the fair market value of an asset, clients can potentially eliminate the capital gains tax they would otherwise incur if they sold the asset and donated the cash proceeds. This can mean even more going to charity and less to taxes, as shown in the example below.

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor’s income tax rate (24% in this example), minus the long-term capital gains taxes paid.

1. Give beyond existing limits and carry over the excess deduction. Clients who wish to itemize deductions for non-cash assets, cash, or a combination of both may choose to give beyond annual deduction limits and carry over the excess amounts up to five years.

2. Bunch contributions. Some clients may find that the total of their itemized deductions for 2021 will be slightly below the level of the standard deduction. They may find it beneficial to bunch 2021 and 2022 charitable contributions into one year (2021), itemize their deductions on 2021 taxes, and take the standard deduction on 2022 taxes. In addition to achieving a large charitable impact in 2021, this strategy could produce a larger two-year deduction than two separate years of itemized deductions, depending on income level, tax filing status, and giving amounts each year.

Donors who bunched two or more years of contributions into 2020 and subsequently will take the standard deduction for 2021 may also consider taking the special $300 or $600 deduction for cash donations made to operating charities in 2021.

1. Make a qualified charitable distribution of IRA assets. Whether itemizing or claiming the standard deduction, individuals age 70½ and older can direct up to $100,000 per year tax-free from their individual retirement accounts to operating charities through QCDs. By reducing the IRA balance, a QCD may also reduce the donor’s taxable income in future years, lower the donor’s taxable estate and limit IRA beneficiaries’ tax liability.

2. Use a charitable deduction to help offset the tax liability of a retirement account withdrawal. Those over age 59½ (to avoid an early withdrawal penalty) who take withdrawals from retirement plan accounts in 2021 may use deductions for their charitable donations to help offset income tax liability on the withdrawals. As with the above strategy, this offers the additional benefits of potentially reducing a donor’s taxable estate and limiting tax liability for account beneficiaries.

3. Convert retirement accounts to Roth IRAs. Individuals who have tax-deferred retirement accounts, such as traditional IRAs, can use charitable deductions to help offset the tax liability on the amount converted to a Roth IRA. The primary benefits of a Roth IRA are tax-free growth, potentially tax-free withdrawals (if holding period and age requirements are met), no annual required minimum distribution, and the elimination of tax liability for beneficiaries (depending on the timing). Be sure to talk with a tax professional or financial adviser before deciding to do a Roth IRA conversion.

Financial advisers are well-positioned to help clients navigate the giving landscape and utilize tax-smart giving strategies to maximize their charitable impact. According to Schwab’s 2020 RIA Benchmarking Study, 84% of advisers today provide charitable planning for their clients. There are many online tools, information, and other resources available to inform advisers helping to guide donors throughout their philanthropic journey. Noteworthy resources at the start of a new year include:

Caleb Lund is managing director of the charitable strategies group at Schwab Charitable. Hayden Adams is director of tax and financial planning at the Schwab Center for Financial Research.

Wealth management unit sees inflows of $23 billion.

Deal will give US investment bank a foothold in lucrative European market.

New report examines the impact that the initiative has had on philanthropy.

Few feel confident that they will meet their retirement goals.

Catch-up contributions, required minimum distributions, and 529 plans are just some of the areas the Biden-ratified legislation touches.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.