Updated: February 7, 2024

Are investment management fees tax deductible? No, they aren’t – at least not until 2025.

The Tax Cuts and Jobs Act (TCJA) enacted major changes to what investors can and cannot claim on their tax returns. Among the most notable omissions are financial advisor fees. But while the Act eliminated deductions on most investment-related expenses, there are a few that remain eligible for tax breaks.

So, this begs the question, “when are investment management fees deductible?”

In this article, InvestmentNews explores the different ways investors can reduce taxes on investment-related spending. If your clients are looking to maximize their tax savings, this guide can help. We encourage you to share this piece with your investor clientele to help them gain a deeper insight into how taxes work when it comes to their investment portfolios.

The implementation of the TCJA brought significant changes for investors in terms of tax deductions, policies, rates, and credits. Now, the law doesn’t allow deductions of investment management fees and other related expenses. These include:

The TCJA took effect in January 2018. Prior to this, investment management fees listed above were considered as miscellaneous deductions if the amount exceeded 2% of a taxpayer’s adjusted gross income (AGI).

Here’s an illustration: Let’s say your client has an AGI of $250,000. If they spent more than $5,000 – equivalent to 2% of their AGI – on investment management fees, the excess amount can be deducted from their tax returns. So, if they paid $6,500 in fees during the tax year, the exceeding $1,500 would have qualified them for a tax break.

The TCJA is set to expire in 2025, so the tax cuts may be temporary. After this period, the changes may reverse, reinstating the tax deductibility of investment management fees. There’s also a chance that the tax cuts may be renewed for another term.

Data from the Internal Revenue Service (IRS) shows that around 46.2 million taxpayers itemized their deductions in 2017 before the TCJA was introduced. The following year, the figure dropped to 16.7 million – a 64% decline. The agency’s 2018 report also reveals that only 11.4% of those who claimed itemized deductions were individual filers.

Most taxpayers choose not to itemize their deductions because they can already use the standard deductions the IRS sets to minimize their tax liabilities. In addition, the agency raises the standard deduction threshold every year to keep in step with inflation.

In 2017, for example, the deduction threshold for single filers was $6,350 and $12,700 for joint filers. The standard deductions are now $14,600 and $29,200 for individual and joint taxpayers, respectively, based on the IRS’ 2024 inflation adjusted tax brackets.

Since these deductions are fixed dollar amounts, many investors use them to offset their taxable income, instead of keeping receipts for itemized deductions. This approach is more straightforward, especially if the amount they claim doesn't exceed standard deduction thresholds.

Some investors in the top income tax brackets were likely unaffected by the Tax Cuts and Jobs Act. Their investment management expenses often don’t exceed 2% of their AGI.

While the TCJA removed deductions on most investment-related expenses, a few remain tax-deductible. Here are some of the costs investors may be able to claim on their tax returns:

Investors who borrow funds to buy assets may be able to claim the interest in their tax returns as an investment interest expense. This includes interest from margins loans used for purchasing stocks or mortgage loans for investment properties.

The deductible amount, however, is capped at the taxpayer’s net investment income for the year. If the investment interest expense is greater than the investment income, the excess amount can be carried over to the succeeding year.

Let’s say an investor took out a $5,000 loan with an interest of 5% to purchase an investment. Unfortunately, the investment didn’t perform well and generated just 4% in returns. In this scenario, the investor would have paid $250 in investment interest. Only $200 – equivalent to the investment income – of this amount would be tax-deductible. The excess $50 can be claimed in next year’s tax return.

Qualified dividends meet certain requirements to be taxed at capital gains rate. This rate is lower compared to the ordinary income tax rate. Investors, however, can still choose to treat qualified dividends as ordinary income.

Under the right circumstances, treating qualified dividends as ordinary income can increase a taxpayer’s investment interest expense deduction. This can reduce the tax they pay to up to 0%, which is significantly lower than the 15% to 20% rate qualified dividends are normally taxed for.

Losing money from investments is never a good thing, but it’s not all that bad. Investors can use their capital losses to offset their capital gains by selling underperforming assets such as an exchange-traded funds (ETF) or individual stock. This process is called tax-loss harvesting.

The IRS allows individual investors to deduct up to $3,000 in capital losses from their ordinary income each year. Married couples filing separately can deduct $1,500 each. Any excess amount carries over to the succeeding years. This amount can be claimed against the ordinary income for those years until it’s gone.

Investors can reinvest the proceeds into a different investment better aligned with their financial objectives. Investors, however, must be careful not to violate the IRS’ wash-sale rule, which can cost them the tax benefits.

Under the wash-sale rule, investors cannot sell an asset at a loss and buy the same or mostly similar asset within 30 calendar days before or after the sale.

The TCJA removed the ability to deduct financial advisory fees, but there’s still a way to get tax breaks.

Investors who own an IRA can choose to pay financial planning or investment management fees directly out of the account being managed. Since the fees are considered investment expenses, they are paid on a pre-tax basis. This means investors can avoid paying income tax, something they can’t do if they pay the fees from their taxable income.

Investors, however, can only pay the percentage of the fee that's linked to the IRA. For example, an investor with $600,000 in an IRA and $200,000 in a non-retirement account paying 1% in fees can only deduct the $6,000 related to the IRA account. They can’t claim the $2,000 attributable to the non-IRA account.

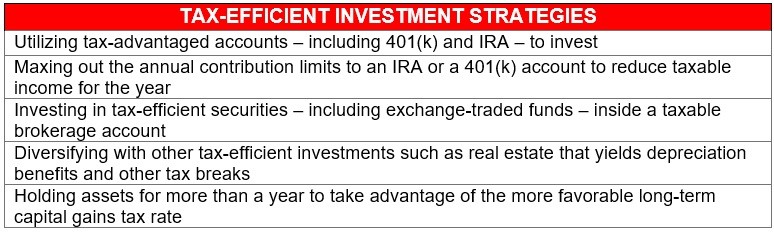

Minimizing tax liability helps investors keep more of the returns from their investments. Tax breaks on investment-related expenses is one way, but there are other strategies they can employ, including:

Financial advisors and wealth managers tasked with managing investments on their clients’ behalf charge fees for their services. Also called portfolio fees or management fees, these are calculated as a percentage of the total assets under management (AUM). The rate ranges between 0.2% and 2%, depending on several factors, including the management style and the size of the portfolio.

More aggressive investment portfolios often come with higher management fees because the higher turnover of assets requires more work. Passive funds, on the other hand, tend to have lower fees because they stick with the assets within the portfolio.

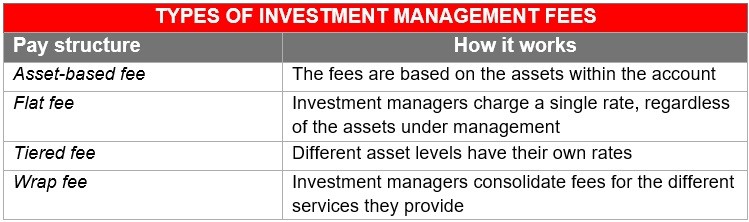

Investment management fees come in different pay structures:

Asset-based fees are based on the assets within the account. This may also mean that cash reserves on the investment portfolio may have little to no fees. Most value investors prefer this pay structure as they generally sit on cash reserves before using the funds for other investments.

Flat fees come with the most straightforward pay structure. In this type of management fee, portfolio managers charge a single rate, regardless of the asset or investment type. Some advisors may also choose to charge a lower fee as the portfolio grows.

Under this fee structure, portfolio managers charge different rates to different asset levels. Regardless of the account’s size, all clients pay the same rate at the deposit level. For example, the portfolio manager may charge 1.75% on the first $500,000, 1.5% on the next $1 million, 1.25% on the next $5 million, and so on.

This is where an investment manager consolidates the fees for the different services they provide. Apart from portfolio management, these can include investment advice, commissions, and trading fees. Wrap fees range between 1% and 3% of AUM per year, but don’t necessarily cover all possible fees.

Here’s a summary of the different types of investment management fees:

Investment management fees typically range from 0.2% to 2% of the total assets under management.

An investor with a $125,000 portfolio and pays a management fee of 2% per year, for instance, will be charged an annual investment management fee of $2,500. Depending on the arrangement, they’re expected to pay $625 per quarter or around $208 monthly.

In exchange for the fees, investors are given access to industry expertise and resources the financial advisors and wealth managers provide. These professionals can also provide personalized investment advice to assist investors in balancing their portfolio and allocating risks.

Generally, advisors and managers who use a more passive approach with their investments charge lower fees compared to their counterparts who manage investment portfolios more actively.

Financial advisors and wealth managers play an important role in shaping an investment portfolio. These industry professionals help investors understand the different assets within their portfolios, retain financial control, and achieve their investment goals faster.

For investors searching for investment professionals to manage their assets, our Best in Wealth Page is the place to go. Here, we recognize industry professionals who have shined the brightest in their respective fields. By partnering with these experts, investors can be sure that their assets are in good hands.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

MyVest and Vestmark have also unveiled strategic partnerships aimed at helping advisors and RIAs bring personalization to more clients.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.