This month's edition kicks off with the big news that Apex Clearing is “going public” via a SPAC that will value the company at $4.7 billion, built primarily on the back of its success with direct-to-consumer robo-adviser and investment platforms like Wealthfront and Robinhood, SoFi and Stash, Ally Invest and Public, but with an eye on pivoting further into the world of registered investment advisers by no longer just trying to partner with existing AdviserTech platforms to reach RIAs and instead using its massive new $850 million cash infusion to build out its service and support capabilities to compete more directly head-to-head with Schwabitrade, Fidelity, and Pershing instead?

From there, the latest highlights also feature a number of other interesting adviser technology announcements, including:

• RIA custodians increasingly look to gain basis points for custody services by pairing them with asset management, as Betterment for Advisors and Altruist both expand into the paired services of model-management-plus-custody.

• SEI launches its own direct indexing solution while OSAM’s Canvas crosses $1 billion in Custom Indexing AUM in just its first year.

• InvestCloud is acquired for $1 billion and merged with Tegra118 to modernize enterprise wealth management.

• Envestnet’s MoneyGuide announces a new MoneyGuideEngine offering that will allow enterprises to leverage MoneyGuide’s underlying financial planning engine via APIs to build their own financial planning interfaces.

Read the analysis of these announcements in this month's column, as well as discussion of more trends in adviser technology, including:

• InCapital and 280 CapMarkets merge to launch a new bond trading marketplace, with a particular eye on the growth of market-linked products as a bond alternative.

• RBC launches a new Business Compass dashboard to help its advisers actually manage their practices.

• 4U Engage expands its RIA platform as technology continues to disintermediate the traditional external wholesaler for new product discovery.

• Microsoft launches a new Cloud for Financial Services to compete with Salesforce by unifying an advisory firm’s internal productivity tools.

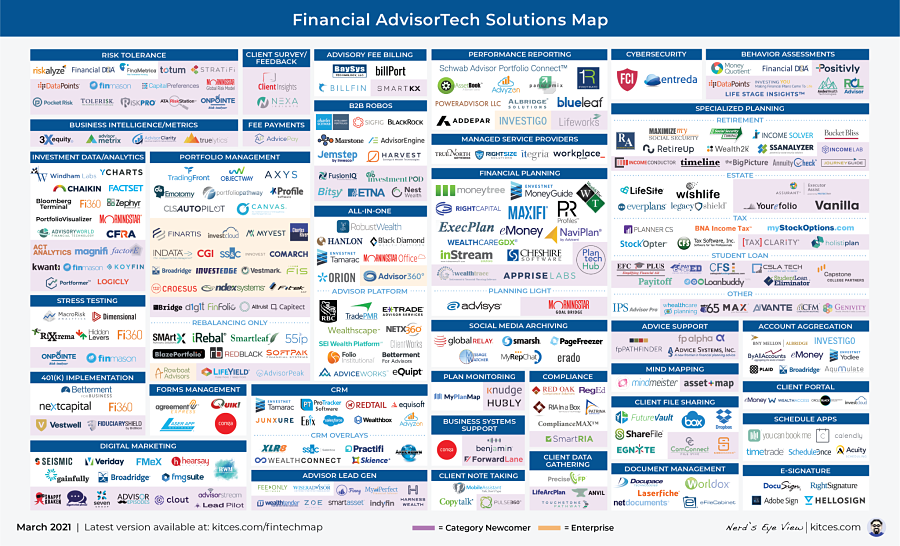

Be certain to read to the end, where we have provided an update to our popular Financial AdviserTech Solutions Map as well!

• #AdviserTech companies who want their tech announcements considered for future issues should submit to [email protected]!

Apex IPOs via a SPAC to become the next big RIA custodian competitor? Because the business of brokerage custody and clearing requires such scale, it has long been the case that most RIA custodians have a retail/consumer-facing portion of their business in addition to their custody services. But arguably, few better embody the modern version of this Jekyll and Hyde phenomenon when it comes to fintech than Apex Clearing. With customers like SoFi, Stash, Stocktwits, Webull, eToro, Ally Invest, Wealthsimple and hot newcomer Public, not to mention being the original platform that launched Wealthfront and Robinhood, Apex is an absolute force on the direct-to-consumer side of fintech. Though despite multiple attempts to get going with RIAs, from partnerships with the early stage B2B robo-advisers like AdvisorEngine (née Vanare), RobustWealth and Harvest Wealth (née Trizic), to more recent players like Orion, Envestnet and InvestCloud, and most recently with upstart Altruist, Apex simply has not been as hot on the advisory side of the business. To some extent, this is a classic chicken-and-egg issue. Advisers don’t select Apex as their main custodian because they believe their clients will feel more comfortable with a recognizable brand like Schwab and are concerned that Apex won’t have the full-fledged service capabilities of an established custodian (given that Apex was originally built only to be integrated and has tried to get adviser adoption through other tools advisers already know and love). Of course, Apex could build out all of these capabilities, but fully establishing the service capabilities that RIAs demand is capital-intensive unto itself, and can seem especially risky when RIA traction thus far has been so limited. At its core, the issue really boils down to the consequences of choice and competition. While Apex has to compete to get an enterprise deal with the next hot fintech, once it does, the end consumer does not have the option to use Schwab or Fidelity when they elect to invest via SoFi or Stash; Apex is the only game in town at that point. However, when working with Orion or Envestnet, every RIA custodian is available and even Apex’s superior integration capabilities don’t automatically carry the day when RIAs also have expectations of direct service and support from their RIA custodians. So when Apex's former owner Peak6 was trying to exit its investment in Apex, it had a problem finding a buyer. Allegedly, both Envestnet and Goldman Sachs took very serious looks at acquiring Apex Clearing before ultimately balking at the valuation that was being asked, ending in Envestnet kicking the clearing can down the road and Goldman acquiring Folio Institutional, despite using Apex for the newly launched Marcus Invest! Because Apex wanted those firms to pay for Apex’s dominance in the direct-to-consumer space. But the reality is that the most successful consumer fintechs often tend to migrate away from Apex as they grow — as Wealthfront and Robinhood did — while RIAs never reach the size and scale to do so and remain with RIA custodians. But the more traditional buyers focused on the RIA side of Apex’s house couldn’t make the valuation work on Apex’s limited traction with RIAs thus far. But now, Apex Clearing has announced that it is going directly to the public for its next stage of growth, as its nearly $100 billion of AUM (up from just $30 billion in late 2017) has garnered a whopping $4.7 billion IPO via a SPAC that will bring Apex a whopping $850 million in cash to deploy and finally solve its chicken-and-egg problem by building the service and support capabilities it needs to compete head-to-head with Schwabitrade, Fidelity and Pershing for the RIA marketplace. Given the crossroads that Apex was at, the SPAC frenzy arguably came at the perfect time and is the perfect vehicle for it to go public and raise a massive war chest. So now Apex has more than enough capital to deploy its leading front-end robo experience for everyone from asset managers to enterprise wealth management firms to individual RIAs. And in theory, it will be able to leverage the superior efficiency of its modern technology to price its RIA custody offering lower than the competition (the same means by which robo-advisers could build on top of Apex and compete at a lower price as well). Positioning Apex not only to jump into the gold rush of nervous RIAs looking to switch custodians after the TD Ameritrade acquisition and as the Schwabitrade integration unfolds, but also to open new doors with hybrid broker-dealers that historically have relied on legacy broker-dealer platforms like Pershing and NFP but that may be looking to rebuild their own more-RIA-centric future as well?

Betterment stakes its future on pivoting from retail robo-advise to (bps-based) RIA custody? The business of providing RIA custody services is an incredibly large and growing opportunity, and it’s an incredibly challenging opportunity to capitalize on because of the sheer size and scale necessary to provide such services profitably. In fact, it’s notable that in practice today, none of the major RIA custodians are exclusively or even primarily in the RIA custody business, and instead are all extensions ofsome other service, from Schwab and the now-former TD Ameritrade (and ETrade and Scottrade in the past) providing RIA custody services as an extension of their retail brokerage platform, Fidelity offering RIA custody as an extension of its asset management and broker-dealer custody/clearing services, and Pershing scaling its Advisor Solutions platform from its own broker-dealer custody and clearing offering. Yet at the same time, one of the key appeals of the RIA custody business is that it scales the total size of a retail brokerage platform as well, ultimately making the retail investment business more profitable with better economies of scale (even as the retail business often provides the initial economies of scale to get RIA custody off the ground). Accordingly, it was not entirely surprising that back in 2014, as the robo-adviser movement first gained steam, early leader Betterment announced its “Betterment Institutional” initiative, in which Betterment’s digital robo capabilities would be made available directly to RIAs (using Betterment’s technology, and implemented on Betterment’s own back-end custody and clearing platform). However, despite raising a substantial $60 million capital round just months later in early 2015 with the talk of “disrupting RIA custody,” in practice Betterment’s RIA custody offering grew to “only” about 400 RIAs in the four years that followed, as Betterment struggled with both the scope of service demands that RIAs have (relative to simpler direct-to-consumer needs), its limitations of only being able to handle ETFs (and not mutual funds that advisers might use or that clients might already have and need to transfer in), and the unwillingness of most financial advisers to be required to use the exact same portfolio models that Betterment already offers to its retail clients without the adviser’s involvement. In 2019, Betterment attempted to break through this roadblock by establishing a partnership with Dimensional Fund Advisors to offer DFA’s mutual funds directly with the Betterment platform, and now two years later it reports 50% growth in its RIAs (up to 600 firms) and a whopping 1,400 different model portfolios that its RIAs have built using DFA funds. And so as Betterment founder and CEO Jon Stein recently stepped down and handed the reins over to new CEO Sarah Levy, whose clear mandate is to take Betterment through the next stage of growth that can lead to an IPO, Betterment has announced that it aims to go big in competing in the RIA custody business with a vision that its RIA services may someday be even larger than its existing, primarily retail $27 billion of AUM. Betterment’s offering would, in essence, be a combination of turnkey asset management platform, RIA custodian and outsourced trading platform, essentially packaging together services that advisers are accustomed to getting for free (e.g., RIA custody) with those that typically charge far more (e.g., TAMPs and outsourced trading platforms that are often 35 basis points or more), using the combination of both to execute a “bps for custody” mode that Betterment is pricing at a flat fee of $1,800 per adviser plus 12bps to use Betterment’s custody services and manage client portfolios using its technology. With what will presumably be breakpoints on its basis point pricing for larger firms, the new Betterment model for RIAs arguably is price competitive to what RIAs might spend to in-source such trading and portfolio management anyway (where the cost of portfolio management software plus staff to execute the software can quickly add up), especially when considering the costs (albeit indirect) that clients pay for the use of the RIA custodian as well (through payments for order flow, net interest margin on client cash, etc.). And with fears that the Schwabitrade merger may not go smoothly when it comes time for integration, the new model comes at a good time to compete for TD Ameritrade RIAs that may be in motion and looking for a new home. In the end, though, the real question for Betterment for Advisors will still come down to execution, given that Betterment has talked up its future of RIA custody since 2015 but in practice has struggled to really deliver the level of RIA custodian capabilities necessary to win a material market share (starting first and foremost with its inability to hold anything beyond ETFs and DFA-only mutual funds).

Altruist turns to the model marketplace approach of bps for custody and gets closer to custody disruptors Vanguard And DFA. It’s no secret that many RIAs with less than $100 million in AUM have felt left in the lurch by the news that Schwab was acquiring TD Ameritrade. In most cases, such advisers had not been big enough for Schwab (or Pershing, or Fidelity) to give them the attention that they received at TDA, and in some cases, the advisers were “too small” and had been outright rejected by the others and forced to go to TDA in the first place! So the idea of being a TD Ameritrade small RIA that was being acquired by the very RIA custodian that once rejected them was not appealing to many. Accordingly, newcomer RIA custodian competitor Altruist has been scooping up those advisers with regularity over the past 12 months, especially with the documented service issues TDA is having as it integrates into Schwabitrade. Of course, there are a number of other RIA custodians competing for advisory firms looking for new pastures in the midst of the Schwabitrade merger, but Altruist has been able to effectively differentiate itself by creating a “Mailchimp for Advisors” experience. The beauty of Mailchimp is that it’s extremely easy for a small business to adopt — with a compelling price point and a simple onboarding process — and just as Mailchimp grew with its small businesses (pricing up additional services as its clients needed them), Altruist can provide a capable all-in-one solution that is competitive with smaller RIAs even if it doesn’t have some of the bells and whistles that its larger competitors provide. In fact, such a digital all-in-one experience is what many B2B robo-adviser solutions have been trying to build for years now, except most are missing one crucial piece: custody, which Altruist has solved for by starting with custody (today built on Apex Clearing, though it’s likely only a matter of time until it owns that itself). The caveat, though, is that RIA custody itself is in the midst of a hyper-competitive price war. In fact, the irony is that Altruist itself originally made a splash in 2019 with its launch of a “commission-free” digital custodian, only to have Schwab cut trading commissions to zero (and bring the rest of the RIA custodians with it) just a few months later. Because in the end, the modern RIA custody business entails making money on almost anything and everything except the custody itself, from the net interest margin on cash to payments for order flow and revenue-sharing from asset managers. In this context, it is not particularly groundbreaking or surprising to hear that last month, Altruist announced the launch of a new model marketplace, featuring Vanguard and DFA funds, and its own in-house portfolios. That follows in the footsteps of other RIA custodians that have similarly tried to profit from the asset management business that flows across their platform, from TD Ameritrade, which has/had a model marketplace and a managed account solution, through VEO, Fidelity’s FMAX managed accounts solution, and Schwab’s TAMP marketplace. All of which are significant not only because they can drive additional revenue, but in particular because they can drive basis-point revenue that grows with the advisory firm, in a world where RIA custodians are finding their fixed-fee payments (e.g., trading commissions) under pressure, and it’s difficult to charge bps for custody services that competitors already provide for free. That couples well with the collective industry bet on the rise of advisers outsourcing money management and the use of models (and model marketplaces). The addition of DFA and Vanguard to the platform is also notable. Both DFA and Vanguard have had a strained relationship with RIA custodians for many years because of their refusal to pay large platform or other revenue-sharing fees, often resulting in higher commissions or fees on DFA and Vanguard products than other mutual funds. The rise of ZeroCom has at least partially reduced this pressure, but as many RIA custodians still try to find ways to get platform and shelf space fees from asset managers, it’s significant that DFA and Vanguard are planting their flags in the new RIA custody player on the block by striking this type of partnership early on. In addition, the deal with DFA and Vanguard, the two asset management firms boasting the rockiest histories with RIA custodians, also gives them an opportunity to monitor the growth of Altruist (which also recently added former Vanguard CEO Bill McNabb to its advisory board). It has long been rumored that either DFA or Vanguard might launch its own RIA custodian someday, but perhaps if they like what they see in Altruist enough, an even faster pathway to a competing RIA custodial offering through acquisition may be in the air.

SEI launches direct indexing solution as OSAM’s Canvas crosses $1 billion in direct indexing AUM in just its first year. Direct indexing is an investment approach in which, in lieu of owning index funds, the investor owns the underlying stocks ofthe index directly in the appropriate percentages, managed by an investment manager and/or software to ensure the allocations stay on target. It was first rolled out by pioneers like Parametric nearly 20 years ago for ultra-high-net-worth investors (who relished the ability to do tax-loss harvesting at the individual stock level even if the index overall was up), and popularized into a more mainstream offering by Wealthfront in 2014 with its retail direct indexing offering with a mere $100,000 minimum. Ultimately, though, the opportunity of direct indexing goes far beyond just a stock-level tax-loss harvesting strategy (as valuable as that may be to some); in the end, unbundling the index fund also makes it possible for investors (or their advisers) to create their own customized version of index funds, from their own factor investing funds (e.g., smart beta without the mutual fund wrapper), to implementing their own SRI/ESG preferences (e.g., the S&P 500 but without tobacco or firearms stocks and an overweight to green energy), or replicating any other passive, static or otherwise rules-based investment strategy that could be programmed into direct indexing technology. Stated more simply, direct indexing and the customization it allows creates the potential to disintermediate much of the existing multi-trillion-dollar mutual fund and especially ETF marketplace. Over the past year, direct indexing has witnessed a number of high-profile headlines, including Morgan Stanley acquiring Eaton Vance (and its crown jewel, direct indexing pioneer Parametric), and BlackRock shortly thereafter acquiring No. 2 direct indexing provider Aperio. Continuing the theme, this month mega-TAMP provider SEI announced its own direct indexing solution, dubbed Systematic Core, to provide a direct-indexed core to what might otherwise be a core-and-satellite portfolio design approach (with the ability to add screens to implement an ESG overlay), while O’Shaughnessy Asset Management (OSAM) announced that it had crossed the $1 billion AUM mark in its own direct indexing platform (known as Canvas). One of the interesting aspects of the rise of direct indexing is that many different types of players are eyeing the opportunity to enter the market and disrupt existing industry channels, from asset managers looking to compete and pick up market share from mutual funds and ETFs (e.g., Parametric, or OSAM with Canvas), to TAMPs and other outsourced investment platforms trying to avoid being disintermediated themselves (e.g., SEI) and fintech providers using direct indexing as a wedge to break intothe investment marketplace (e.g., OpenInvest or JustInvest). While the question remains which competitor will win the race, the fact that so many providers all see an opportunity to disrupt the existing mutual fund and ETF ecosystem means an increasing number of bets are being made, further increasing the likelihood that one of them does in fact manage to become the Next Big Thing?

SmartLeaf announces sub-advised trading service as fintech continues to disaggregate the traditional TAMP. The modern financial adviser has gone through three different epochs over the past 50-plus years: The first was the financial adviser as a stockbroker (selling individual stocks and bonds, primarily those underwritten or sold from the inventory of their broker-dealer); the second was the financial adviser as a mutual fund salesperson (with the mutual fund boom of the 1980s and 1990s); and the third and most recent was financial adviser as a portfolio manager (creating diversified asset-allocated portfolios for clients). In each cycle, the tools and platforms of financial advisers evolve with them, from the wirehouse and regional broker-dealer model of the first epoch, the independent broker-dealer model of the second epoch, and the RIA (and more generally fee-based asset management) platform of the third epoch. In practice, this has led over the past 20 years to the rise of the turnkey asset management platform, or TAMP, as a solution that allows advisers to outsource the portfolio design and trading process to a third party that creates and implements diversified portfolios in a centralized and highly scaled manner. The irony is that the recurring revenue business model and scalability of portfolio management services has not only driven the growth of the TAMP but also the growth of advisory firms themselves, to the point that, increasingly, many of them are large enough to “in-source” their own portfolio management processes, thanks in large part of the rapid rise of fintech solutions like rebalancing software to expedite and automate much of the process. That in recent years has led to the beginning of TAMP unbundling, with various combinations of retaining or outsourcing the portfolio design and implementation process, from advisers outsourcing it all (to a TAMP), designing and implementing their own portfolios (leveraging technology), or selecting a third-party model (e.g., from a model marketplace) to implement themselves. The caveat, however, is that the fourth combination — in which the adviser designs the model but outsources trading implementation — has been difficult, as the nature of “every adviser with a different model” is the antithesis of the systematization and standardization that makes outsourcing efficient (for the outsourcing provider). Yet as technology continues to make portfolio management more and more efficient to manage an ever-wider range of models, AdviserTech providers are no longer just providing the software for advisers to implement the trades in their adviser-designed portfolios, but are also providing trading implementation services forthose adviser-designed portfolios (through the provider’s software), as epitomized by the recent announcement that portfolio rebalancing solution SmartLeaf is now offering trading services as a sub-adviser for users of its software. From the perspective of Smartleaf (and other AdviserTech providers), the appeal of moving from trading software to trading implementation is that in exchange for the burdens of ensuring and facilitating best execution, the business model can pivot from dollars (for software licensing fees) to basis points (more typical of the TAMP/asset manager model), providing the potential for far more revenue per adviser as the provider. From the adviser’s perspective, trading implementation turns from a fixed cost (of staff resources or the adviser’s own time) into a variable expense that aligns well to whatever the size of the firm, from the lifestyle adviser who wants to outsource trading to free up their time and doesn’t have a need for a full-time trader in the first place, to the rapidly growing adviser enterprise that is having trouble maintaining the hiring pace for its trading team and wants to outsource that aspect of its scaling needs. From the broader industry perspective, “trading implementation of adviser-designed portfolios/models” fills the last gap in the spectrum of adviser needs (from fully internal to fully outsourced), which both expands the size of the market for investment outsourcing (for those who wanted to outsource trading but weren’t willing to outsource the models themselves to a TAMP), but will also put even more pressure on bundled TAMP solutions to justify why the adviser should consider outsourcing “everything” if they are actually comfortable designing portfolios and just didn’t want to be responsible for pressing the button to trade and implement them?

InCapital and 280 CapMarkets merge to build a market-linked product marketplace? It’s now been more than a decade since the Fed first implemented its historic quantitative easing intervention after the 2008-09 financial crisis. Despite fears at the time that it would cause inflation to spike and future interest rates to skyrocket, in practice, interest rates remained low, and in fact have ground even lower in the 10 years since. From the capital markets perspective, a decade of ultra-low interest rates has now sparked concerns about “bubbles” or more generally of stoking asset price inflation (as the S&P 500 itself has grown nearly six times from the post-crisis lows). From the financial adviser perspective, though, the primary impact of persistently low bond yields is a driving pressure to either trade and manage bonds more proactively (in the hopes of scraping out more total return), or instead to own anything butbonds, given that for many fixed-income vehicles, the after-tax yield on the bond is less than or equal to the advisory firm’s own AUM fee (resulting in a net negative yield after all expenses). In turn, the hunger for alternatives to low-yield bonds has created an explosion inalternative investments, from private equity and hedge funds to real estate and commodities, as well as growth in a wide range of “bond-like investments with equity-like returns,” broadly labeled “market-linked products,” which range from equity-indexed CDs to structured notes (and their annuity brethren, the RILA, or registered index-linked annuity). In this vein, it is notable that last month InCapital (one of the leading underwriters and distributors of market-linked products) announced a merger with 280 CapMarkets (an emerging fintech platform focused on fixed-income trading), to form the newly branded InspereX (a blend of the “In” of InCapital, the “X” of 280 Cap’s innovation and “spere” as Latin for trust). At its core, InspereX is being positioned as a “bond aggregation platform,” built around 280 Cap’s capabilities of providing transparent price quotes for bonds and then trading them directly via the platform, while working with issuers looking to tap bond investors to give them a deep(er) marketplace into which they can distribute. But given InCapital’s relationships with issuers and role as a distributor of market-linked products as well, the deal appears to be more of a vertically integrated distribution strategy, in which InCapital can facilitate the issuance of market-linked products and then distribute them directly through its 280 Cap-now-InspereX fixed-income marketplace (highlighted by InspereX’s “commitment’ to “industry-leading market-linked securities expertise and education initiatives” coupled with what is nominally just a bond aggregation and trading platform), in yet another example of a fintech-platform-turned-product-distribution-channel. Though given 280 Cap’s success in establishing a fixed-income marketplace and trading platform already, coupled with the strong demand from financial advisers for alternatives to traditional fixed-income investments, the merger appears to leave InCapital well-positioned to expand its distribution reach!

InvestCloud sold for $1 billion and attached to Tegra118 to modernize enterprise wealth management. The reality of building technology is that not everything can be done perfectly the first time. In some cases, it’s because the landscape of the future changes in ways that simply couldn’t have been foreseen early on, necessitating a subsequent rebuilding of the technology to modernize it. In other cases, the reality is simply that it’s not actually cost-effective to build the entire infrastructure for the future upfront, and instead, firms build the expedited version of what they need now, recognizing that they are incurring a “technical debt” of challenges that will need to be refinanced (or in coding terms, refactored) in the future. Yet even though incurring technical debt may be a conscious choice in the technology building process, that doesn’t make it any easier to figure out what to do when the debt comes due, which, over the span of years (or more than a decade), can amount to an absolutely immense cumulative cost to rebuild for the next generation. As one of the long-standing players in the world of wealth management, Tegra118 — formerly the investment services division of Fiserv that was spun off in early 2020 — is a major player that has incurred its share of technical debt, putting it in the challenging position of so many large-scale legacy providers to wealth management enterprises of having immense distribution and a huge customer base and an extremely stable software solution and a financially successful business, but a truly daunting mountain to climb in figuring out how to refinance its technical debt to rebuild for the decades to come. At the same time, more modern “upstarts” like InvestCloud — a more recent entrant that has gained significant traction with wealth management enterprises in Europe but thus far more limited adoption in the U.S. — have the benefit of being built more recently and architected on a more modern infrastructure (one that legacy players couldn’t have even foreseen because they were built too long ago), but the challenge that it’s hard to get in the door of an established wealth management enterprise because the scope and scale of switching infrastructure platforms are immensely costly to the end enterprise as well (not to mention risky when the current solution is otherwise so stable and working well). The end result is often a sort of stalemate, where legacy enterprises remain stuck with legacy technology, where the technical debt prevents the legacy technology player from modernizing (quickly or at all) and the switching costs prevent the legacy enterprise from just choosing to switch and select a more modern solution themselves. And so in this context, it was notable that this month specialist private equity firm Motive Partners engineered an acquisition of InvestCloud (for $1 billion!) to pair together with its prior acquisition of Tegra118 from Fiserv last year to form a new competitor in enterprise wealth management. At its core, the proposition is rather straightforward: Tegra118 has the existing customer base of enterprises that would rather see their existing provider “modernize” than go through the trouble of switching, while InvestCloud has the more modern data architecture, infrastructure, and user experience that can get in the door with those enterprises as an upgraded/integrated offering to Tegra118 (rather than needing to compete against Tegra118 directly). In fact, some have raised the question of whether the newly formed InvestCloud-Tegra118 enterprise could become an Envestnet challenger, though in practice Envestnet itself is pivoting away from a pure software solution to expand into its growing range of insurance/annuity/credit/services exchange platforms (not to mention that Envestnet has always driven significant revenue from its TAMP business as well), and Envestnet competes heavily in the small-to-midsize RIA and broker-dealer world that InvestCloud-Tegra118 may not even wish to compete for (focusing instead on banks, major broker-dealers, and other more large-scale enterprises). And of course, InvestCloud’s existing international business gives Tegra118 more opportunities to expand internationally (as opposed to just cross-selling InvestCloud capabilities to existing Tegra118 and new enterprises here in the U.S.). Nonetheless, the sheer size and scope of the InvestCloud-Tegra118 deal represent a significant shake-up in the world of enterprise wealth management solutions, and signals more generally that notwithstanding all the ongoing fears of fee compression among wealth managers, the big money is still making big bets on the financial opportunity in the wealth management business.

4U Engage partners with Morningstar Office to reinvent wholesaler distribution Of compliance-approved product content. For most of our history, financial advisers were not actually in the business of providing financial advice, but in the business of distributing financial services products, from the “captive” employee field forces of wirehouses and insurance companies to the “independent” distribution partners of independent broker-dealers. In this context, it was the job of wholesalers representing various product companies to build relationships with and partner with individual financial advisers to build together, with the wholesaler providing the latest information about the company’s products for the financial adviser to use to sell their clients. However, as financial advisers shift to become financial advicers — no longer in the business of distributing financial services products to clients, but instead being in the business of financial advice and serving as gatekeepers for clients — the traditional adviser-wholesaler relationship has been turned upside down, as financial advicers increasingly say “Don’t call on us, we’ll call on you when we need information on your company’s products.” From the perspective of product manufacturers and their wholesalers, that has led to growing frustration about the inaccessibility of much of the fee-based (and especially the RIA) channel. From the perspective of financial advisers, it creates challenges when advisers want to do due diligence across multiple companies’ products, and/or actually dowant to stay up to date on the latest from various companies (which usually means contacting each company, one at a time, to get their latest and greatest). In this context, it was notable that last summer, a startup solution called 4U Connect emerged with the vision of connecting financial advisers to the information they’re seeking from various product companies, all in one centralized place (and subject to one centralized compliance review process to ensure those materials have been reviewed by the firm and approved for client use!). Now, 4U is expanding further with its 4U Engage platform, partnering with Morningstar Office to create an entire searchable marketplace of product provider content for financial advisers to access (directly, on their own terms, without needing to contact the company directly unless they wish to do so!), with a specific focus on providing the content that most engages financial advisers. From the product company perspective, when it’s so hard to get the right product material in front of the right advisers — especially in the hard-to-reach gatekeeper-style fee-based adviser — channels like 4U Engage become especially appealing, especially since 4U can then report engagement metrics back to product providers, allowing them to shape their own materials to be even more relevant to the adviser community, and connecting advisers directly to internal wholesalers to address more detailed questions. From the adviser perspective, the appeal of 4U is both the efficiency of a more centralized compliance review process (especially for larger multi-adviser firms) and the ability to search and find the materials of greatest interest (far more expeditiously than wading through a number of external wholesaler calls and meetings). Though arguably, in the long run, the greatest impact potential of a platform like 4U Engage is that, if it does in fact gain high adoption, it may fundamentally alter the nature and role of the external wholesaler, if meetings with wholesalers cease to be the discovery process by which financial advisers find new products and companies to work with in the first place.

Adviser demand for marketing automation grows as eMoney relaunches Advisor-Branded Marketing, rebranded as Bamboo. In an industry where financial advisers historically were recruited first and foremost as salespeople who were expected to “smile and dial” from Day One to get their own clients, only the strongest (or at least most trainable) salespeople and prospectors survived. The end result of this approach, after decades of self-selection and survivorship bias, is that most experienced financial advisers have solid sales skills, but remarkably little in marketing skills. After all, the whole nature of marketing revolves around making investments into building awareness that takes time to pay off — which is impractical for what was both a business with heavy sales pressure to meet production requirements (i.e., a multiyear marketing strategy wasn’t useful if your company would terminate you after 12 months for low production) and a very transactional business where it was difficult to sustain an ongoing marketing effort with predominantly one-time commission-based revenue. However, as the advisory business shifts to a more recurring-revenue fee-based approach, the economics of marketing change, both because advisory firms accumulate to the point where they have a stable base of ongoing revenue — a portion of which then becomes available to reinvest into marketing — and also because ongoing fee-based clients with high retention rates produce stunningly high lifetime client values. After all, a “mere” $500,000 AUM client who pays a 1% fee pays $5,000 of AUM fees per year. With client retention rates of 97%-plus for top advisory firms, that results in an average tenure of more than 30 years at a 3% attrition rate, or a cumulative lifetime value of $5,000/year x 30 years = $150,000 of fees for a single client and nearly $40,000 of net profits at a typical 25% profit margin. At a lifetime client value of nearly $40,000 of net profits over the tenure of just a single client relationship, there is a lot of room for advisers to invest further into marketing! Accordingly, in recent years there have been a growing number of new entrants to the category of adviser marketing tools. One of the first, eMoney Advisor and its Advisor-Branded Marketing solution, is now reinvesting and relaunching as Bamboo (intended as a metaphor for something that is strong, fast-growing and can be cultivated with little active effort!). At its core, Bamboo is a content marketing platform, where any of 2,000-plus pieces of content (created in partnership with Financial Media Exchange) can be scheduled to go out to prospects via email or social media channels. Notably, though, eMoney is also positioning Bamboo as a client retention tool, with content that can go out to existing clients to keep them engaged (e.g., between client meetings and throughout the year), as well as educational material for newer clients to assist with the client onboarding process. In the end, the reality is that much of what advisers do from a marketing perspective still isn’t actually all that complex — mostly relying on various forms of formerly-newsletter-now-email drip marketing strategies with educational content — that in practice could be replicated in any number of non-adviser-specific marketing automation tools like MailChimp or ActiveCampaign. However, financial advisers have long shown a preference for industry-specific tools that understand and cater directly to their industry-specific needs (particularly when it comes to a compliance-heavy arena like marketing, where Bamboo’s partnership with FMeX’s Finra-approved content is appealing), especially when the solutions can integrate deeply to the adviser’s existing technology stack (e.g., the 70,000-plus financial advisers already leveraging eMoney’s financial planning software and popular client portal).

The separation of interfaces and engines accelerates as MGP launches MoneyGuideEngine API. One of the biggest integration challenges in the world of AdviserTech is that the most valuable pieces of the data engines that power beloved pieces of software, like financial planning software, were directly tied to the user experience ofthe software itself. The end result is that if an advisory firm wanted to show a financial planning widget — like MoneyGuidePro’s popular financial planning success meter — within another piece of software, like their client portal or their CRM, that was no problem. But if the firm wanted to pull the underlying data to recreate an entire financial plan from within their own systems? “Nope, sorry, can’t do that. You’re going to need to SSO over to our user interface.” But the world is changing, and APIs are the future! To attempt to illustrate it, let’s connect it to a concept the financial advice industry knows well — outsourced asset management. The pitch for outsourced money management is that the experts at your favorite asset management company are better than advisers at building portfolios because they are laser-focused on that one specific thing. It’s the only thing that they need to care about, as opposed to client reviews, marketing their business, hiring and managing staff, compliance, etc. The pitch continues that not only are these experts better than advisers at building portfolios, but it will create a ton of efficiency for firms to outsource this large task, freeing up more time to focus on growing and running their business. It’s compelling, and it’s exactly why API-first companies are exploding outside of the AdviceTech space. And we won’t be far behind. Let’s use the poster child for this movement, Stripe, to explain it further. If you’re not familiar with Stripe, it is the payment processing behemoth behind most of your favorite apps. When you place a lunch order with DoorDash or one of their many restaurant partners, it isn’t DoorDash that processes your credit card, it’s Stripe. When you place a grocery delivery order with Instacart or one of their many grocery partners, it isn’t Instacart that processes your credit card, it’s Stripe. You get the drift. Why on earth would a company try to build its own payments infrastructure? You’d have to take an entire team of engineers off of a core project, have them learn payments (which is likely not their core competency), and work for years to get to the basic functionality that Stripe already has. Or you could let the 2,500 people at Stripe who spend every waking moment thinking about the payments infrastructure worry about it for you. This is why APIs are going supernova. A company at DoorDash can be hyper-focused on its unique value proposition of connecting you to the food you love and getting it delivered as quickly as possible. Then it outsources everything else to APIs. Now, at long last, a major domino fell last month for the growth and innovation of the AdviceTech world as MoneyGuidePro launched MoneyGuideEngine, which effectively detaches its popular financial planning brain or engine from the MoneyGuidePro user interface. As MoneyGuide founder Bob Curtis has said for years: “Everyone needs and deserves a quality financial plan.” This is an incredible mission statement, and arguably that goal will be achieved much faster through the launch of MoneyGuideEngine, as now high-quality financial plans can be distributed through other AdviceTech applications, advisers (or at least large-scale adviser enterprises) can build their own experiences (and in fact, Commonwealth specifically cited RightCapital’s similar API-based approach in selecting it as its financial planning software engine of choice several years ago), and financial planning can expand into more channels as well (e.g., asset management companies can offer financial plans, record keepers can offer better financial plans, etc.). More generally, though, the emergence of API engines is further bifurcating the decision of many adviser enterprises in the traditional “build versus buy” decision. Increasingly, they want to be able to buy and build by buying the engine and building their own interface over top. That positions adviser enterprises to be able to add their own proprietary layer — and unique value proposition — to the mix, while not needing to build the underlying engines that niche AdviceTech applications will increasingly provide (at least those that make the conscious decision to be the engine and not “just” the fully bundled interface as well?).

RBC launches Business Compass to fill the void in practice management dashboards. When financial advisers ran commission-based businesses selling insurance and mutual funds, there was only one business metric that really mattered: “production,” otherwise known as the amount of commission revenue the adviser generated. Those with the most commission sales were “Top Producers,” and because most advisory firms had little to no staff (as few hire anything more than some administrative staff support when the commission-based business resets to near-zero revenue after year), almost everything advisers generated in revenue simply dropped straight to their personal bottom line. As the advisory business has shifted from commission-based revenue to AUM (and other recurring revenue) models, though, a new form of scalability emerges, where advisory firm founders can get clients, hand them off to service-minded advisers to support, use the ongoing, recurring revenue to pay the ongoing staff salary commitments, and earn a profit on the difference between what the client pays and what it costs the firm to staff the servicing. The caveat, though, is that growing and scaling an advisory business, with recurring revenue serviced by staff advisers and a growing operational overhead infrastructure, requires far more data to track and manage than just the amount of gross revenue production of the adviser themselves. That results in the increased popularity of various industry benchmarking studies to measure and track the economics of the best-run advisory firms, and a void in tools that help to gather the data, manage the data and visualize the data to actually put it into use to make good business decisions. In this context, it’s notable that RBC this month announced the launch of its new Business Compass solution, which will allow its 2,000 advisers to digitally track key metrics in their advisory firm from one centralized dashboard (from number of households to AUM) and more importantly, to frame business goals and track progress toward those goals directly from the dashboard. Of course, the reality is that many portfolio management solutions already provide key investment/AUM metrics for an advisory firm, but Business Compass is distinct in that it will allow advisers to generate tasks for themselves and team members to take key steps toward improving the metrics and understand how they’re doing relative to others, and home office practice management consultants will be able to see the health, status and pain points of their advisers to create more targeted practice management coaching and support. In other words, Business Compass aims to go beyond just reporting key investment metrics, and actually help advisers track and manage key business metrics for success, putting the actual “practice management” into what most (portfolio management- or CRM-based) practice management dashboards lack today.

Microsoft launches Cloud For Financial Services to compete against Salesforce and Google for adviser enterprises. One of the biggest complaints about the adviser technology ecosystem is that not all of the key components of the adviser technology stack talk to each other very well (or in some cases, at all), leading to an ever-growing frustration over the lack of sufficient integrations to move data and manage workflows across the multiple systems that integrate with an adviser’s CRM hub. However, in practice, advisory firms not only struggle with their adviser-specific applications “talking to” one another, but also the fact that their core internal systems, from document management to team communication, exist in a siloed world of various “productivity” systems (from file storage systems to email and other communication tools), leading to a second patchwork of internal systems from Dropbox to Slack to Google Apps. But this month, Microsoft announced the launch of a new Cloud for Financial Services, which aims to weave together its core Microsoft applications — from Office 365’s Word, Excel, PowerPoint and Outlook, to Teams for communication, OneDrive for file storage, and PowerBI for business intelligence — to Microsoft’s own Dynamics CRM, all built in a scalable cloud environment that can serve complex financial services enterprises. Nominally, Microsoft’s new cloud solution will compete against both Salesforce’s Financial Services Cloud for adviser CRM systems and tools like Google Apps for office productivity. But unlike either, Microsoft is uniquely positioned to weave it all into a single solution, as one of the only players that spans both the office productivity tools (Word/Excel/PowerPoint/Outlook) and CRM systems (Dynamics), creating the exact kind of single-system unified environment that advisory firms have struggled to create via a patchwork of integrations, hosted in a robust Microsoft Azure environment that would allow large adviser enterprises to further extend their own integrations into key adviser-specific applications. Of course, the reality is that Microsoft’s Office applications are already so ubiquitous that most other tools can already relatively easily attach standard file formats and open files directly into Microsoft applications. And Microsoft has already had the component parts — from Dynamics to Office — for many years but has struggled to gain traction as CRM systems like Redtail and Wealthbox have risen steadily among smaller advisory firms and Salesforce has dominated among larger enterprises. Nonetheless, as advisory firms accelerate their transition into a more fully virtual world thanks to the pandemic where new systems like Teams (for communication) become yet another essential component of the advisory firm’s internal technology systems, being able to run the entire business from one consistent technology ecosystem becomes more and more desirable. So Microsoft and its new Cloud for Financial Services seems uniquely positioned for success, especially among the largest adviser enterprises, where Microsoft is already so widely used.

In the meantime, we’ve updated the latest version of our Financial AdviserTech Solutions Map with several new companies, including highlights of the Category Newcomers in each area to highlight new fintech innovation!

So what do you think? Will Apex be able to gain real traction as an RIA custodian competitor? What about Better? Or Altruist? Is direct (or custom) indexing really the future of portfolio management after mutual funds and ETFs? Would you prefer to search on a platform like 4U for new products instead of talking to wholesalers? Please share your thoughts in the comments below!

Special thanks to Kyle Van Pelt, who wrote the sections "Apex IPOs via a SPAC to become the next big RIA custodian competitor?" "Altruist turns to the model marketplace approach of bps for custody and gets closer to custody disruptors Vanguard And DFA," and "The separation of interfaces and engines accelerates as MGP launches MoneyGuideEngine API." You can connect with Kyle via LinkedIn or follow him on Twitter at @KyleVanPelt.

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay, and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’sEye View. You can follow him on Twitter at @MichaelKitces.

Wealth managers highlight strategies for clients trying to retire before 65 without running out of money.

Shares of the online brokerage jumped as it reported a surge in trading, counting crypto transactions, though analysts remained largely unmoved.

President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.