The Securities and Exchange Commission wants advice from the public about whether exchange-traded funds linked directly to the price of Bitcoin could be a vehicle for fraud, highlighting concerns about a submission from one of the biggest trusts holding the token.

The regulator issued a notice Friday calling for members of the public to submit written comment regarding Grayscale Investments’ application to turn its Grayscale Bitcoin Trust (GBTC) into an ETF tied to Bitcoin’s spot price. The SEC had done the same a few days earlier in a notice regarding another application to launch a Bitcoin ETF, this one submitted by Bitwise.

The notice requested feedback on whether the proposed ETFs would be susceptible to manipulation and fraud, and whether Bitcoin itself could be held to the same standard. The SEC has denied six similar applications since November, including those from VanEck, WisdomTree and SkyBridge Capital.

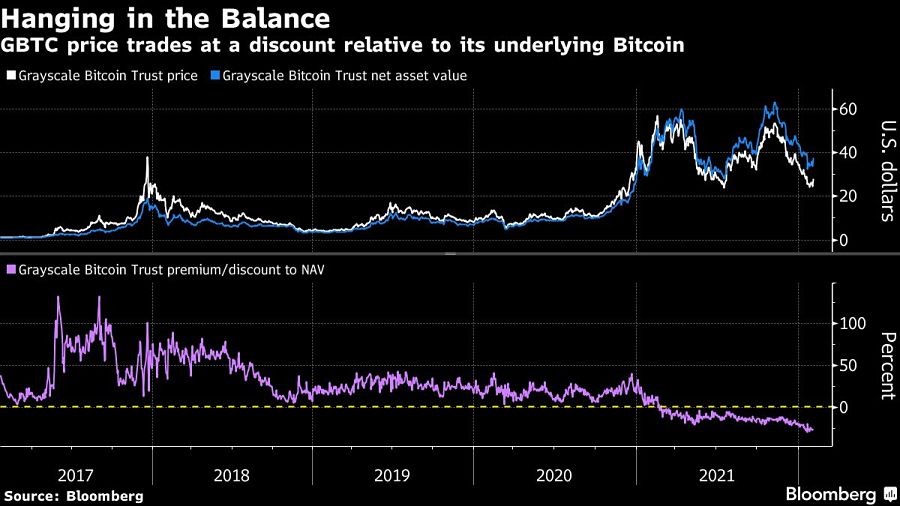

Grayscale’s $27 billion fund has been a key way for financial institutions to gain exposure to crypto since its launch in 2013, which is why it has historically traded at a premium to Bitcoin’s actual price. However, GBTC now trades at a discount after the surge in crypto prices and the launch of ETFs backed by crypto derivatives on Wall Street.

Despite the recent price volatility, demand for an ETF tied to Bitcoin’s spot price may be sustained in the near term, analysis from Bloomberg Intelligence showed Monday. BI’s Rebecca Sin and James Seyffart said trading volume among crypto ETFs remained stable in January, with relatively small flow declines.

“GBTC’s discount has weighed on shareholders for months but provides Bitcoin exposure at below-market prices,” they said in an earlier note. The gap would disappear if the SEC greenlights Grayscale’s ETF application on July 6, however, the analysts expect a denial.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.