President Donald Trump’s decision to extend a student-loan freeze will take away a financial risk for tens of millions of U.S. households that now won’t have to resume paying back about $1.2 trillion of debt until at least 2021.

The measure, one of four executive actions Trump took Saturday, keeps both repayments and the accumulation of interest on hold through the end of this year. An earlier waiver, approved by Congress in March as part of the government’s main pandemic relief bill, had been set to expire at the end of September.

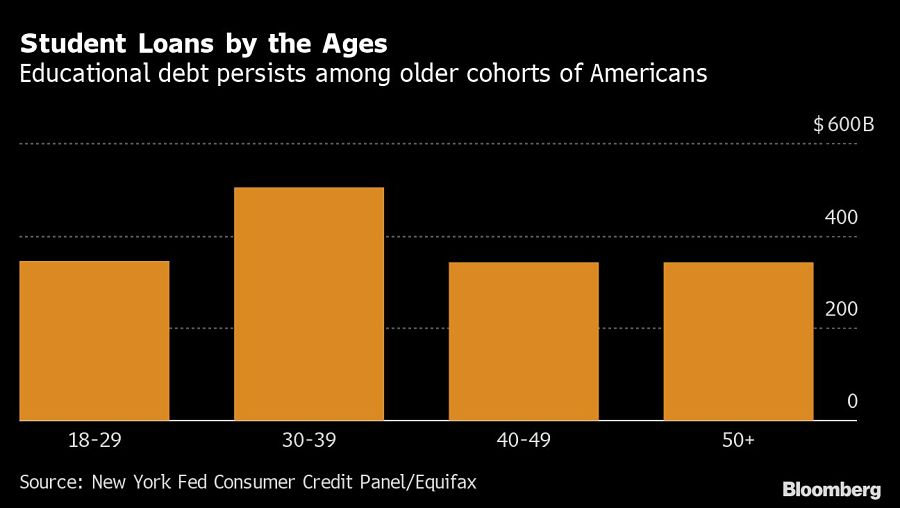

The order applies to loans held by the federal government, which make up some three-quarters of the country’s $1.54 trillion in student debt. The burden is spread across age groups, since millions of older Americans took loans to help out family members.

A Federal Reserve study in 2019 found that the typical amount of education debt was between $20,000 and $25,000, carrying a monthly payment of between $200 and $300. The New York Fed estimated earlier this year that Americans would save a total of about $7 billion a month while the freeze was in place.

Student debt has turned into a hot-button political issue, especially among younger voters, as it has increased by about $1 trillion since 2007 to become the second-largest slice of household obligations after mortgages.

Some 43 million people, about one in eight of the population, hold student loans. Roughly 20% were behind on payments before the pandemic struck, and the rate was proportionally higher among Black and Hispanic borrowers.

The reprieve doesn’t apply to those who have private student loans, about a quarter of the total. But some of those borrowers may have reached forbearance arrangements too, according to the New York Fed. In a report last week it said 88% of student-loan borrowers had a scheduled payment of zero in June.

The waiver also shields borrowers by effectively resetting credit scores, with delinquent loans now being reported as current. As a result, the average credit score of all student loan borrowers rose to 656 in June from 647 in March, according to the Fed.

A new analysis finds long-running fiscal woes coupled with impacts from the One Big Beautiful Bill Act stand to erode the major pillar for retirement income planning.

Caz Craffy, whom the Department of Justice hit with a 12-year prison term last year for defrauding grieving military families, has been officially exiled from the securities agency.

After years or decades spent building deep relationships with clients, experienced advisors' attention and intention must turn toward their spouses, children, and future generations.

The customer’s UBS financial advisor allegedly mishandled an options strategy called a collar, according to the client’s attorney.

An expansion to a 2017 TCJA provision, a permanent increase to the standard deduction, and additional incentives for non-itemizers add new twists to the donate-or-wait decision.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.