President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

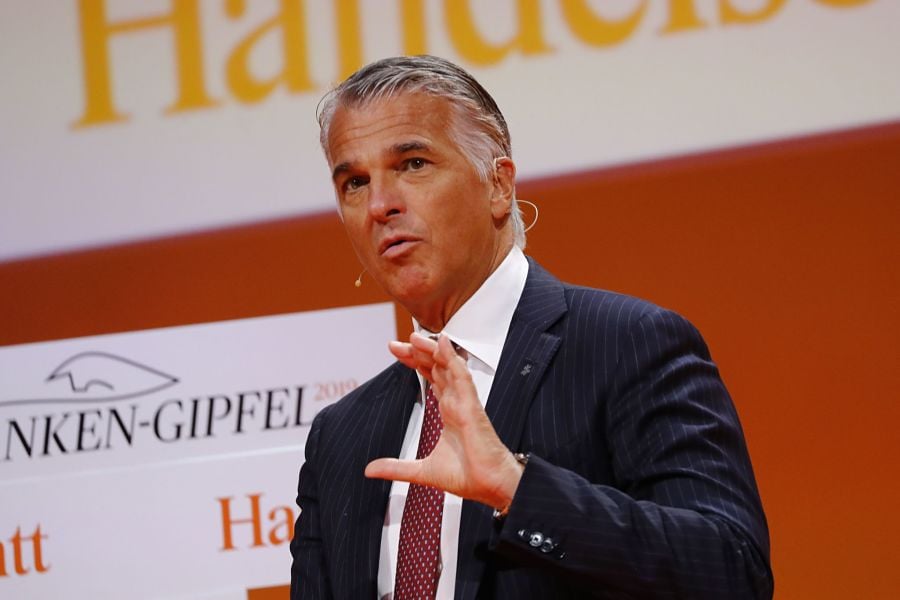

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.