Vanguard Group has ushered in a new world order in the fixed-income exchange-traded fund arena.

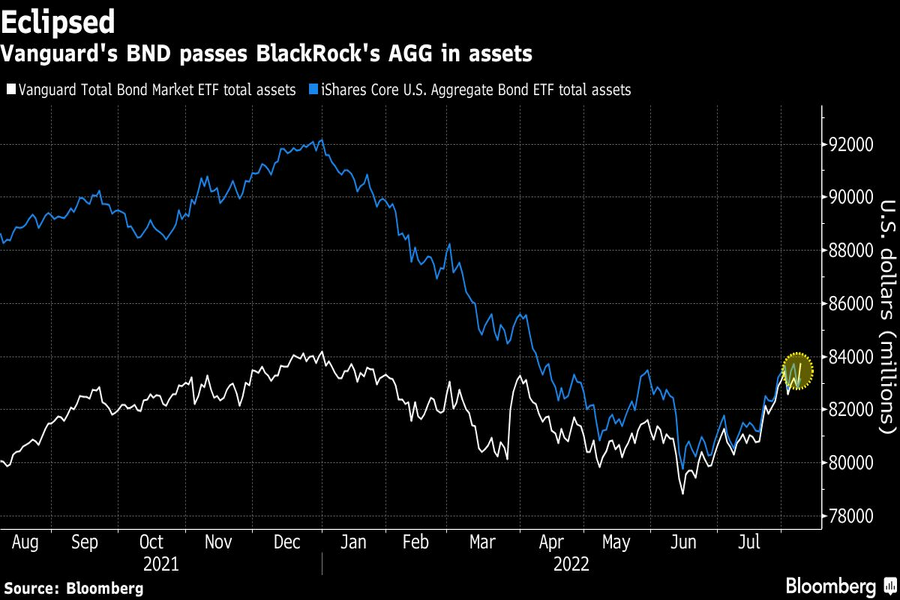

The Vanguard Total Bond Market ETF (BND), with assets of roughly $83.8 billion, has surpassed the $83.2 billion iShares Core U.S. Aggregate Bond ETF (AGG) to become the world’s biggest bond ETF, Bloomberg data show.

Larry Fink’s BlackRock Inc. has long reined as the largest issuer in the $6.6 trillion ETF arena, but Vanguard has been tightening its grip on the industry. Armed with ultra-low fees, the John Bogle-founded giant, which is now the second-biggest U.S. ETF issuer, has increased its market share of industry assets for 20 straight years. That has dramatically narrowed the gap between Vanguard’s $1.86 trillion U.S. ETF assets under management and BlackRock’s $2.2 trillion U.S. ETF business.

“A down market is Vanguard’s Briar Patch. This is when their products climb categories the fastest, since asset growth can only come from flows and BND is an inflow machine,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. “This is also a result of the great cost migration that Vanguard has ushered in.”

The flip comes despite BlackRock’s attempts to lure investors to its bond funds. The asset manager cut fees on AGG to 0.03% from 0.04% in April to match BND’s expense ratio. It also lowered costs on two other fixed-income ETFs in January, countering similar moves from State Street Corp. and Vanguard.

“Fixed income ETFs have experienced enormous growth since iShares introduced them 20 years ago and are now fundamental to how investors of all types access and trade the fixed income markets,” a BlackRock spokesperson wrote in an email. “Despite the most challenging fixed-income environment in many decades, iShares is leading the industry in fixed-income ETF inflows with over $62 billion so far this year, more than twice the nearest competitor.”

But Vanguard’s dominance extends down the leaderboard. While BlackRock still has the most fixed-income ETF assets under management, four of the top five largest funds are Vanguard products.

AGG has seen its assets drop after entering the year with over $92 billion, but BND has stayed approximately the same size amid a turbulent market. Despite both ETFs posting comparable returns, investors have poured roughly $8.2 billion into BND and have yanked nearly $100 million from AGG this year, according to Bloomberg data.

As other states curb non-competes, the East Coast growth hub could soon become the most employer-friendly jurisdiction in the US.

Last summer, the two, David Gentile and Jeff Schneider, were found guilty of fraud in federal court in Brooklyn and received their sentencing today.

Early parenthood linked to lower fulfillment and fewer leadership roles, despite otherwise strong industry-wide support.

“It's the Golden Age, we're all blessed that this is where we are, what we do for a living, and that the sun is shining on the transition towards the RIA space," Creative Planning CIO Jamie Battmer said at a forum hosted by Goldman Sachs.

Strategists expect municipal bonds to best Treasuries during the four-month window from May until August, following a historical trend.

From direct lending to asset-based finance to commercial real estate debt.

RIAs face rising regulatory pressure in 2025. Forward-looking firms are responding with embedded technology, not more paperwork.