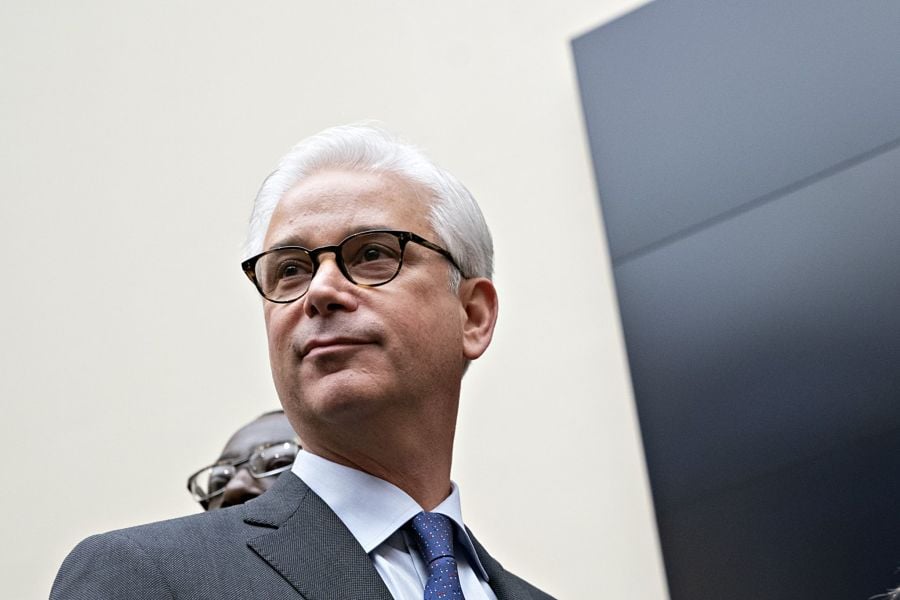

Wells Fargo & Co. cut Chief Executive Charlie Scharf’s compensation about 12% for 2020, a year in which shares tumbled and the company slashed its dividend and reported its first quarterly loss since 2008.

The board paid Scharf $20.3 million for 2020, his first full year atop Wells Fargo, down from $23 million for 2019. The San Francisco-based firm was the worst performer in the KBW Bank Index for the year, sinking 44% compared with the index’s 14% decline.

Wells Fargo is still operating under a Federal Reserve-imposed cap on growth, which bit harder last year by limiting the bank’s ability to finance clients and react to the changing economic environment. Net interest income, the company's biggest source of revenue, sank 16% for the year, with the regulatory restriction hampering efforts to offset lower interest rates with volume.

Scharf, 55, joined the firm in late 2019 with a mission of moving it past a series of scandals that began with the 2016 revelation that employees opened millions of fake accounts.

Last year, he started a restructuring by conducting strategic reviews, installing new leaders and splitting what was three business lines into five.

He’s repeatedly lamented Wells Fargo’s high costs and pledged to ultimately cut $10 billion from annual expenses. Head count reductions that could ultimately number in the tens of thousands will pare U.S. banking’s largest workforce.

Earlier this month, Scharf told analysts that the company has identified more than 250 expense initiatives that will take three to four years. He also said the company has a “clear line of sight” to a 10% return on tangible common equity, a key measure of profitability, and expects to get to 15% over the longer term. The bank had a 1.3% return in 2020.

Morgan Stanley boosted CEO James Gorman’s pay 22% to $33 million after a third consecutive year of record earnings, making him the highest-paid CEO of a prominent U.S. bank.

JPMorgan Chase & Co. CEO Jamie Dimon’s pay package held steady at $31.5 million, while Goldman Sachs Group Inc. cut David Solomon’s pay to $17.5 million after a penalty for the bank’s 1MDB scandal.

[Video: FPA alters course amid pandemic]

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.