“If you can see her, you can be her.”

That is a guiding belief that Lindsey Lewis, managing director and chair at The American College Center for Women in Financial Services, has held throughout her career. But for Lewis and other women entering the financial advising industry, examples of high-achieving women advisors were often few and far between.

Some of the country’s leading women in the industry are teaching the tools they have acquired in hopes of breaking down some of the barriers they had to overcome.

Gloria Garcia Cisneros has racked up many “firsts” in her family. First to attend college, first to enter the corporate world, and first to obtain US citizenship. Growing up in a lower-income immigrant community, Garcia had to work tirelessly to build connections that others in the field found at their fingertips.

“I stumbled into the industry – I really didn't know about money and finances. It’s not something our community talks about when you’re living paycheck to paycheck,” said Garcia, wealth manager at LourdMurray in Los Angeles. “You come into the industry and there’s a playbook that you feel like you were left out of.”

Keeping true to her fundamental beliefs was not always easy for Garcia, but she believes this adherence to her values helped shaped the formidable career she has carved out for herself, and advises emerging female advisors to do the same.

“Stay true to yourself, because even though that might open less doors, it'll open more authentic ones that are real connections,” she said.

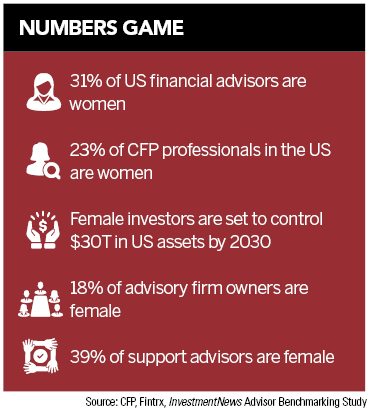

Garcia pointed to what is being dubbed “the greatest wealth transfer in history” as trillions of dollars are set to be inherited by millennials in the coming years. She said the demographics of those inheriting wealth will shift completely from those in previous generations, [CJ1] [2] an emerging trend she is excited see play out.

“The people we are trying to serve are going to look different and how we approach that is going to be different,” she said. “We have to expand our services to meet that demand; we can't just do investing and call it a day.”

For Michelle Clary, founder and CEO of Piton Wealth, the path to success was not straightforward. After trying her hand in auditing and trading in the semiconductor industry, she resolved to start Piton from the ground up, yearning for the interpersonal rewards that she earned from the financial advising sector. But building her new firm’s foundations was full of sacrifices, including a challenging sleeping situation.

“There was a year during that time where I couldn't afford a part-time assistant, an apartment, and an office, so I slept in the back room of my office on an air mattress for 12 months,” Clary said. “It was a lot of early sacrifice, but I often tell people that that period in my career was probably the most joyful period, simply because I knew that the sacrifices I was making were going to pay off in dividends, both for me and the people I was serving.”

While the industry has historically been dominated by men, Clary believes women often have the natural traits that make financial advisors successful.

While the industry has historically been dominated by men, Clary believes women often have the natural traits that make financial advisors successful.

“I think women are just very naturally gifted at this job,” she said. “Women are more detail oriented. By and large there is a very intrinsic, authentic care for people. I think the dedication that women have to care for clients is also very good.”

Like Garcia, Clary says staying true to her internal compass has always been a key component to her work. While every advisor’s reasons will vary, Clary says remembering why they got into the industry is an essential daily task.

“Find why you’re doing this and make sure you don’t forget that,” she said. “Because ultimately, whether it’s day one, 10 or 25 years, you always come back to that ‘why.’”

Breaking into a male-dominated industry like financial advice is a challenge for most women. But growing up with six brothers, holding her own in traditionally male-oriented spaces was all too familiar for Lindsey Lewis.

“I grew up in an environment where I felt like if any of my brothers could do it, I could do it too,” Lewis said.

In her new role at the American College, Lewis cherishes the ability to mentor young professionals in the industry, and has been able to fine-tune the mentorship process to better suit the needs of women stepping into the industry. She finds that often leading women in business who speak at events are too far removed from the experience of starting out in the finance industry.

“I’ve been to a lot of events where you have someone who’s a female CEO and it’s absolutely fabulous. However, maybe they are too many steps away from their current career trajectory,” Lewis said. She now hosts an event called Polished, which helps young financial advisors with everything from resume building to asking for a raise while connecting them with other women in the industry who have directly applicable advice to share.

After overcoming an array of obstacles, Garcia is excited to see the next generation of women in the industry pave their own path.

“I hope there are many more like me coming, because I know that we tend to doubt ourselves and are our harshest critics, but I think the impact that you have when you genuinely care and represent more than just yourself is pretty powerful.”

Summit Financial unveiled a suite of eight new tools, including AI lead gen and digital marketing software, while MassMutual forges a new partnership with Orion.

A new analysis shows the number of actions plummeting over a six-month period, potentially due to changing priorities and staffing reductions at the agency.

The strategic merger of equals with the $27 billion RIA firm in Los Angeles marks what could be the largest unification of the summer 2025 M&A season.

Report highlights lack of options for those faced with emergency expenses.

However, Raymond James has had success recruiting Commonwealth advisors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.