Over the past two weeks, InvestmentNews hosted its 14th annual (and first virtual) Retirement Income Summit. Having had the opportunity to moderate and host this collection of leading investment minds, I wanted to share my takeaways for advisers and their clients as we look at retirement planning now.

First, and foremost, communication must change. The consistent message over the four days, from a variety of voices, was that the key to success for clients planning for retirement and those living in retirement is a regular cadence that allows questions to be asked and new information to be shared.

Second, while I hate clichés and catchphrases, the current environment does provide the opportunity for a “retirement reset.” That phrase serves as an umbrella for a host of factors affecting retirement, including ultra-low interest rates hitting income planning. And the job market has moved up the decision on when to retire for those losing their jobs and retiring earlier than anticipated. Meanwhile, others with jobs but unanticipated financial insecurity are now looking at working longer.

Everyone — clients and advisers alike — needs to look at retirement with a fresh eye.

Finally, RIS reminded us all that the SECURE Act is still out there — that was a massive change that dominated the first months of 2020. Michael Kitces spent nearly 90 minutes breaking it down in his presentation and Q&A. Check out our coverage on pages 12 and 13. Enjoy!

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

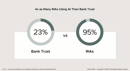

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.