LPL has once again extended its reach in New York state with the addition of a three-decade veteran advisor from Osaic.

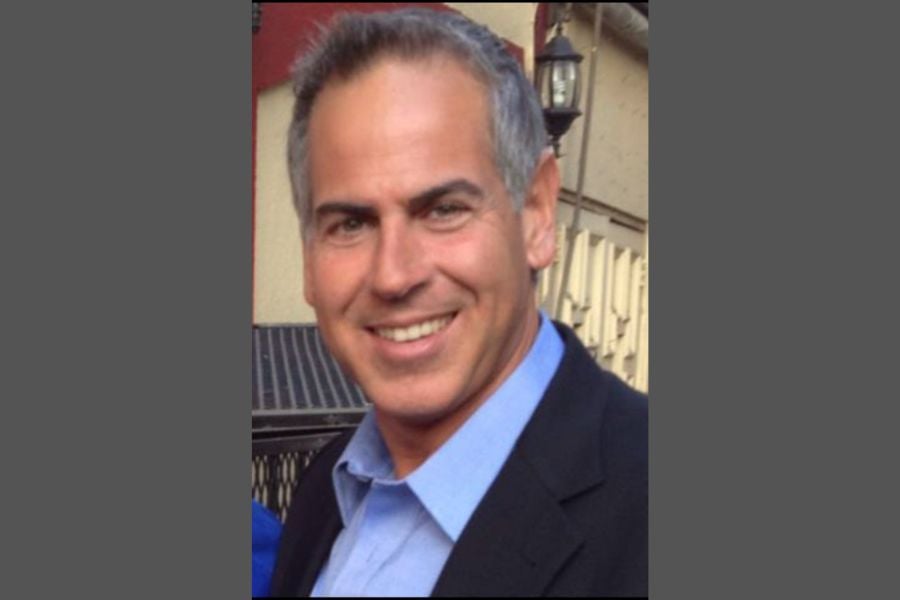

On Monday, the firm announced that financial advisor Jerry Rizza has joined its broker-dealer, RIA, and custodial platforms. Rizza previously worked with Osaic, where he reportedly oversaw approximately $250 million in advisory, brokerage, and retirement plan assets.

With a diverse background spanning 31 years in financial services, Rizza’s career includes a stint in the Oakland A’s minor league baseball system and over three years as an accountant in New York City.

He shared his passion for financial planning, stating, “As I learned more about the financial services industry, I fell in love with the idea of helping families plan for a more secure financial future,” the veteran advisor said in a statement Monday.

Based in Melville, New York, Rizza leads Rizza Financial Services with the support of two experienced assistants, Rachel Beneventano and Jessica Weich. His practice focuses on retirement planning and behavioral investment counseling, aimed at helping clients build and manage wealth for retirement.

His decision to affiliate with LPL was motivated by a desire for improved service, efficiency, and advanced technology, with an “advisor-centric model [that] offers the support we need to serve our clients more efficiently and effectively.”

Beyond day-to-day operations, Rizza believes the transition will benefit his practice in the long term.

“This move has been years in the making, and I believe it’s a strategic investment in our future,” he said.

The news of Rizza’s transition to LPL comes shortly after the firm welcomed another veteran-led team from Osaic, Investment Advisors Financial Group. That team, headquartered in New Jersey, reportedly managed $1 billion in assets.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Analysis of four-year data shows average account balances nearly doubling among steady savers, with younger workers seeing the largest percentage growth.

Survey research shows just over half of Gen Xers satisfied with advice as retirement and economic anxieties take a toll.

Two reports reveal investor behavior including earlier participation of young Americans.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.