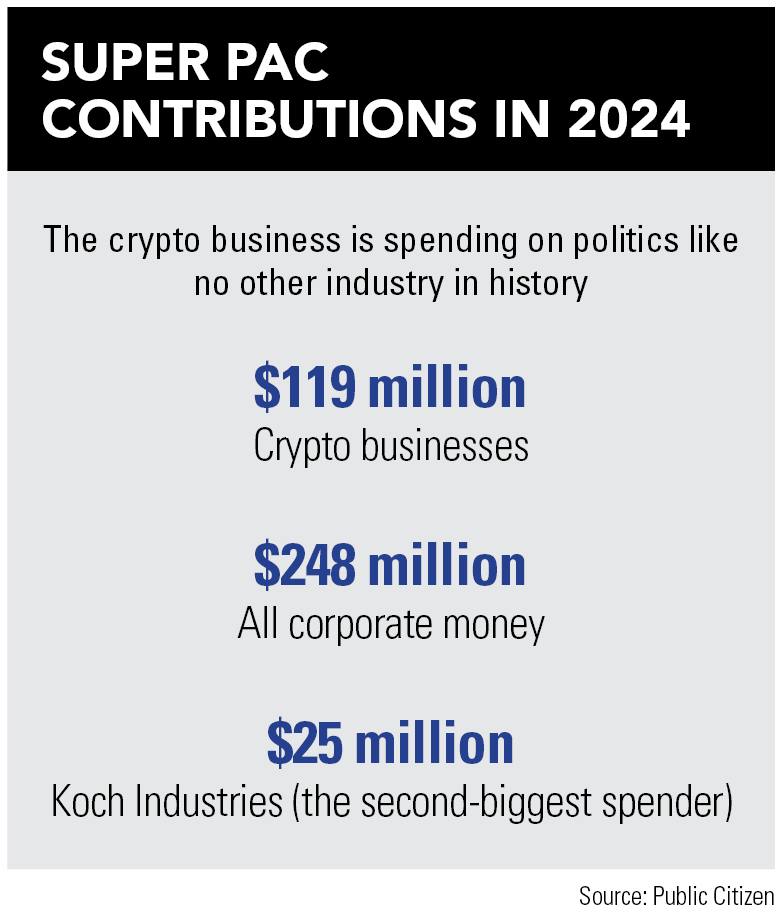

The cryptocurrency industry is making outlandishly large political contributions this year, accounting for nearly half of all corporate spending on federal elections.

That total, at least $119 million toward political action committees, is vastly more than the $5 million cryptocurrency backers spent on elections in both 2020 and 2022, according to a recent report by Public Citizen. Across the three election cycles, spending by crypto firms represents about 15 percent of all money given to super PACs since they started in 2010.

Those figures would be hard for any candidate to ignore, let alone Vice President Kamala Harris, the Democratic nominee who has a thin lead on former president Donald Trump in the polls.

Even as crypto firms have backed PACs supporting both Republicans and Democrats, it’s beyond clear that they have been unhappy with the Securities and Exchange Commission under the Biden administration – and especially chair Gary Gensler. That has been the case as the agency has cracked down on crypto-related fraud in the wake of the FTX collapse – Gensler has pointed to an industry he sees as being rife with fraud. Crypto supporters have decried the lack of operating rules and “regulation by enforcement,” even as Gensler has said that most crypto tokens could be considered securities.

It wasn’t until a court victory by Grayscale that the agency approved spot-price bitcoin ETFs, and only recently has it done the same for spot ether ETFs.

Gensler may be considered enemy No. 1 by the crypto world, and some of its big players have met recently with both the Biden administration and Trump about the future of the SEC, according to a report by CNBC.

“The SEC has always been a political agency,” said Howard Fischer, partner at Moses Singer, a former senior trial counsel at the SEC. Shortly after the 2008 financial crisis, when Fischer joined the SEC, there was much scrutiny by legislators regarding what the regulator could have done differently to help prevent it, he said.

“It’s always easier for Congress to point at the SEC than say, ‘We should have come up with rules and regulations on our own,’” he said. “That’s especially true with crypto.”

Until very recently, crypto was mostly apolitical, sitting outside of normal financial and regulatory structures, he noted.

“What we’re really seeing is the inclusion of an extremely well-financed industry that has reached the conclusion that you can ignore the regulators, but that doesn’t mean the regulators will ignore you,” he said.

Gensler is well aware of the industry’s feelings about him, and he doesn’t appear shy about being in the spotlight – although the SEC did not respond to a request for comment on this story.

“This SEC chairman is sort of like a lightning rod. He has no bones about being very public and talking to the press. He’s not a fly-under-the-radar type of chairman,” said Aaron Cutler, partner in the global regulatory practice at Hogan Lovells.

The chair of the SEC is a position appointed by the president, so under Trump, Gensler would no longer serve in that capacity, and he could even resign from the commission, even as his five-year term lasts through 2026. Trump has promised to remove Gensler, though it’s unclear if he can easily do so.

But if Harris wins the presidency, the question is: “Does Gensler stay on as chair?” Cutler said.

It wouldn’t help her campaign to be associated with him, observers have said. And if Gensler aspires to be Treasury secretary, it’s unclear if that would be mentioned before the election.

“It’s just not clear if Yellen is going to step down,” Cutler said. Gensler “would also have a tough time getting confirmed. How the Senate shakes out is going to really affect that.”

And even support among some progressives for the current SEC is a question, said James Angel, academic director of the Finra Certified Regulatory and Compliance Professional Program at Georgetown University.

“Gensler is definitely a liability. He has not made anyone happy at the SEC,” Angel said, pointing to the commission’s regulation by enforcement, unclear views on Ethereum as a security, and other issues, such as equity market structure reforms.

“Having this turf battle between the SEC and CFTC over who regulates what is really an embarrassment to our country,” he said, regarding the debate over digital tokens being securities or commodities.

For his part, Angel is planning to vote for Harris, adding that he hopes Gensler is not later appointed to the Treasury. Harris has an opportunity to distinguish herself from Biden and carries less baggage from his administration, he said.

“This election is so close that almost anything could be a deciding factor. Trump is a brilliant demagogue, and he understands that the crypto crowd has a lot of the same vibes as the MAGA crowd,” he said, pointing to a distrust of institutions. “It’s natural for him to pivot toward them, especially if they are going to give him money.”

Still, it’s worth noting that the Trump administration didn’t move to regulate crypto, he said.

“I doubt he would really do anything differently, given the poor job of administering the government he did the first time around,” he said. “I don’t think the Trump administration would be the savior that some of the crypto crowd would hope for.”

The fact that the agency has gotten so much heat about crypto recently could be a byproduct of an upswing in digital token values without a more recent meltdown of a crypto institution, Fischer said.

If the election had happened just after the FTX collapse, for example, the pressure on the SEC politically would almost certainly be lower or nonexistent, he said.

“That shows the extent to which these discussions are very, very time-centric,” he said. “If tomorrow we see the collapse of several major exchanges, for example, the question [would be] whether Gensler and his approach are a liability or an asset.”

It’s also interesting that the SEC does not appear to be facing as much criticism from the political right now as it did last year over its climate-disclosure rule, he said.

“That has receded as a concern for whatever reason,” he said. “What won’t change, however, is that the crypto industry will still have a lot of money and will still be using that money to influence the political process.”

But it shouldn’t be lost on Congress that it has the ability to establish rules for crypto, he said.

“The control of the House and Senate could be more important in terms of crypto legislation.”

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.