On Wall Street, Jefferies Financial Group is expanding banking services for crypto clients, BlackRock Inc. is backing a stablecoin firm while Goldman Sachs Group Inc. is ramping up crypto trading. There’s even a former bank executive who switched his LinkedIn profile — to an avatar.

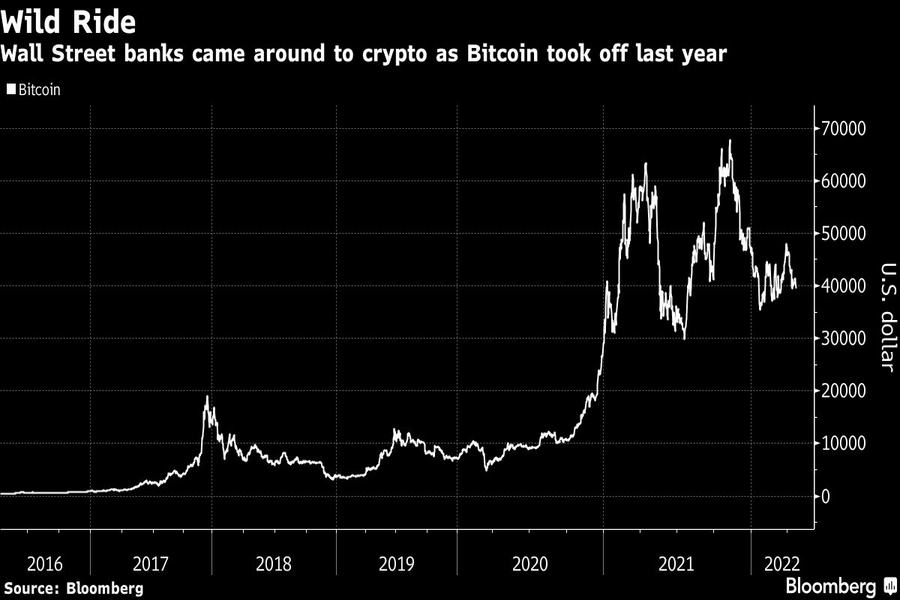

The moves by financial heavyweights — and one banker’s profile reinvention — underscore how far Wall Street firms have come in accepting cryptocurrencies. For years, executives at banks and money managers were some of the industry’s most vociferous dissenters, until soaring prices and a flood of investor money drove home the point that staying on the sidelines meant missing out.

But as demand rises, that earlier resistance could impede Wall Street’s latest efforts to stay competitive, just as regulatory uncertainty and internal compliance cloud expansion plans. Goldman’s Chief Executive Officer David Solomon said this month the bank was taking its cue from regulators, calling their guidance “very restrictive and very, very small.”

“Banks are forever going to be trying to play catchup,” said Michael Moro, CEO of digital currency prime brokerage Genesis. “Crypto is going to move way faster than banks can. We have every bank in the world pretty much having some sort of crypto, blockchain working group.”

Institutional investors traded $1.14 trillion of cryptocurrencies last year on the largest U.S. crypto exchange Coinbase Global Inc., a ninefold increase from 2020. Main Street’s deepening uptake has intensified scrutiny: Treasury Secretary Janet Yellen cautioned this month about potential excesses or systemic risks stemming from a market where financial transactions use crypto and blockchain, while President Joe Biden in March issued the first executive order targeted at digital tokens to help address possible hazards.

On Wall Street, efforts made over the past year or so are coming to fruition. Jefferies, which already provides leverage finance, equity capital markets and convertible bond issuance services for crypto clients, plans to expand in the next couple of months as demand rises, said Alexander Yavorsky, the firm’s global joint head of financial institutions.

Yavorsky and two other senior bankers are on a quasi-crypto team set up to beef up the bank’s effort. Jefferies is also exploring offering crypto services in trading, prime brokerage and wealth management, he said.

This month, BlackRock joined a $400 million funding round in stablecoin firm Circle and struck a partnership with the company to explore capital-markets use of USD Coin, a stablecoin pegged to the U.S. dollar. Earlier this year, trading powerhouse Citadel Securities won its first outside investment from two Silicon Valley investors with crypto expertise.

And Goldman, which traded its first over-the-counter Bitcoin options in March, has a digital assets team working on trading, the tokenization of traditional asset classes and strategic investments among other initiatives, according to a webinar with clients this month.

These measures follow an uncomfortable relationship between Wall Street and cryptocurrencies, which were created after the 2008 financial crisis as an attempt to bypass the regulated banking system. Lenders largely stayed away as Bitcoin prices whipsawed between huge gains and steep crashes.

JPMorgan Chase & Co. CEO Jamie Dimon deemed Bitcoin a fraud in 2017, comments he later said he regretted. In October, he said it was worthless but that he’d follow clients and recently acknowledged that decentralized finance — where banks are replaced by algorithms — is “real.”

As some dive into the industry, they’re facing mounting competition. Large banks are still not yet trading Bitcoin itself, unlike many crypto firms, though some have ventured into its derivatives.

Goldman last year began offering trading in non-deliverable forwards, contracts which pay out in cash and cater to clients not yet comfortable with buying cryptocurrencies. By the time it launched, a number of hedge funds had enough confidence to just buy the crypto directly, according to a person familiar with the matter, who asked not to be identified discussing private information.

“It’s possible that you will see banks starting something, and then realize that by the time they got ready to launch, their clients’ interests have gone elsewhere in crypto,” Moro said.

Given the layers of legal, compliance, trading and technology work required, expanding into crypto was a “Herculean effort” for boutique investment bank Cowen Inc., which started its digital assets unit in March after a year of preparation, according to Drew Forman, who runs the division.

Besides wealth management, trading and advisory, a next step for banks could be wholesale lending to crypto firms, according to Damien Vanderwilt, co-president of Galaxy Digital Holdings, who sees this change coming by year-end. It would entail lending to crypto companies that provide the virtual currencies as collateral.

Whatever their moves, banks are being watched closely. A banking trade group said recent Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency requirements could make it harder for banks to develop offerings, handing crypto firms an advantage.

Biden’s recent executive order was seen as encouraging, but more guidance is needed before banks can move forward “in any significant manner,” said Nicholas Losurdo, a partner at law firm Goodwin Procter.

Wall Street is also trying to retain talent that’s leaving for the crypto industry, lured by potentially richer rewards, flexible work and front-row seats to innovation. Citigroup Inc. lost at least a dozen executives across the firm in the past year, including its recently appointed co-heads of the digital-assets group within its wealth-management division. They started their own crypto hedge funds this year.

The bank plans to hire 100 people in digital assets within its institutional business. A spokeswoman for the bank said it’s expanding its digital-asset capabilities and has made strategic investments to meet client demand.

One former Goldman vice president who made the leap to web3, the catchall term for crypto startups, decentralized finance and more, switched out his LinkedIn profile for a Bored Ape picture -- a famous nonfungible token. Ajit Tripathi is now an angel investor in crypto.

“It’s a way to signal you are a web3 native person,” he said. “You are one of the cool kids.”

US wealth advisory business will get international footprint boost with new tie-ups.

New research shows physicians start their careers at least $200K in debt.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.