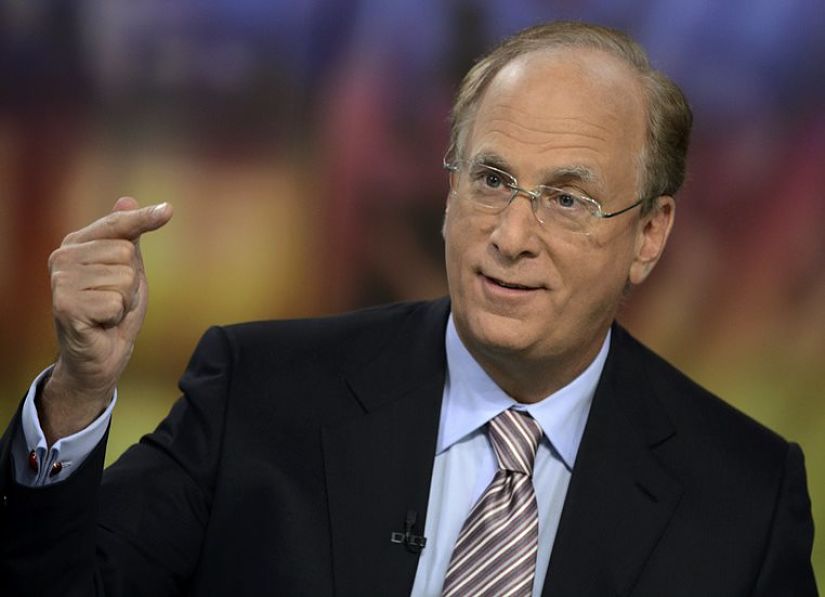

Russia’s invasion of Ukraine has the potential to accelerate the global shift to green energy and the use of digital currencies, according to BlackRock Inc. Chief Executive Officer Larry Fink.

In his annual letter to shareholders on March 24, Fink said while the war will “inevitably slow” the move to net zero in the immediate term, it will speed up the use of renewable energy sources in the longer term.

“We’ve already seen European policy makers promoting investment in renewables as an important component of energy security,” Fink, 69, said. “More than ever, countries that don’t have their own energy sources will need to fund and develop them — which for many will mean investing in wind and solar power.”

On digital currencies, Fink said the war will prompt countries to reconsider their reliance on traditional money and payment systems. “A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption,” Fink said.

In a sign of the growing importance of digital currencies, Fink said BlackRock is now studying how they and stablecoins can be used to help clients.

Other highlights from the letter:

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Raymond James also lured another ex-Edward Jones advisor in South Carolina, while LPL welcomed a mother-and-son team from Edward Jones and Thrivent.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.