Hedge fund manager Vivek Ramaswamy has been climbing the presidential polls, thanks in part to his corporate successes.

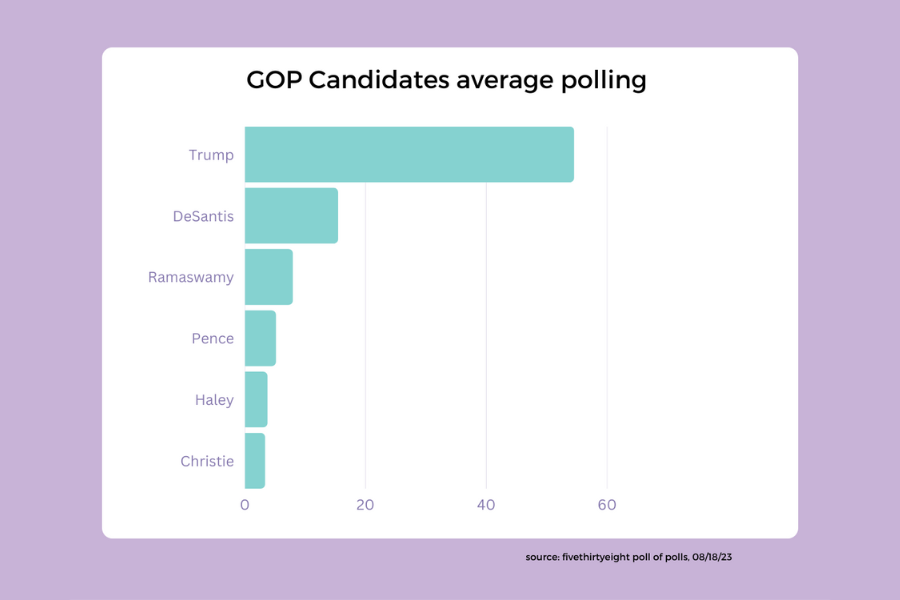

Before his bid for the Republican nomination, where he's now ranked third after Donald Trump and Ron DeSantis, Ramaswamy established and led a pharmaceutical venture, Roivant, which went public in 2021. He then launched Ohio-based Strive Asset Management, a financial firm positioned as a right-leaning alternative to the ESG movement's emphasis on investments with environmental, social, and governance consequences. Its slogan, setting it apart from ESG, is “invest in excellence.”

However, recent legal actions from two ex-employees against the financial firm and its founders, including Ramaswamy and Anson Frericks, hint at potential issues within it. These suits allege that both founders aggressively prompted staff to break securities laws. Additionally, the company may not have achieved the desired results for its "anti-ESG" ventures.

Christopher Lenzo, representing ex-EVP Joyce Rosely, told Bloomberg that Strive might've been more of a publicity move to advance Ramaswamy's political aspirations rather than a genuine investment venture.

“[Strive]was founded, in retrospect, largely as a PR mechanism for the presidential campaign of Ramaswamy,” he said. “Not a lot of thought was given to running it as an investment firm.”

The lawsuits have yet to make mainstream headlines. But with an upcoming presidential debate, Ramaswamy’s history will be under the microscope. Allies of second-placed DeSantis' are bound to focus their criticisms on third-place Ramaswamy.

Strive responded by stating its commitment to robustly defend its position, and refraining from further comments due to ongoing litigation. Tricia McLaughlin, Ramaswamy's PR head, clarified the distinction between Strive and his campaign.

In one case, from Kansas, John Phillips accuses Ramaswamy of portraying an overly optimistic financial situation at Strive to stakeholders and staff, leading Phillips to resign from a lucrative position at JPMorgan based on these assertions. Philips was Executive Director and Client Manager at JP Morgan from 2014-2022. Before that he had roles as an SVP and Wholesaler at Fidelity Investments, where he started in 2000.

Another case from New Jersey's Union County cites Rosely's dismissal after she highlighted instances of sexual misconduct and potential securities law breaches at the firm. Rosely alleges her concerns were dismissed by Frericks, the then top executive at Strive. Like Phillips, she claims both founders encouraged illicit practices, with concerns about misleading sales materials and unlicensed securities salespeople.

Both were let go in March, with Rosely claiming age discrimination in the layoffs, as all those dismissed were over 40. She also believes it was retaliation against raising concerns about workplace issues.

After their exit in April, Matt Cole became Strive's CEO. By June, he recognized that the company, managing ETFs of approximately $1 billion, would pivot from political discourse to emphasizing "shareholder capitalism." A memo seen by Bloomberg indicated growth had slowed due to the firm's overly political stance but expected it to pick up pace by 2025.

Strive Asset Management fast facts;

Launched: May 2022

ETFs on US Markets: 10

AUM: $951m

Av. Expense ration: 0.28%

Largest ETF: Strive US Energy $355m

Smallest ETF: Strive 1000 value $18m

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.