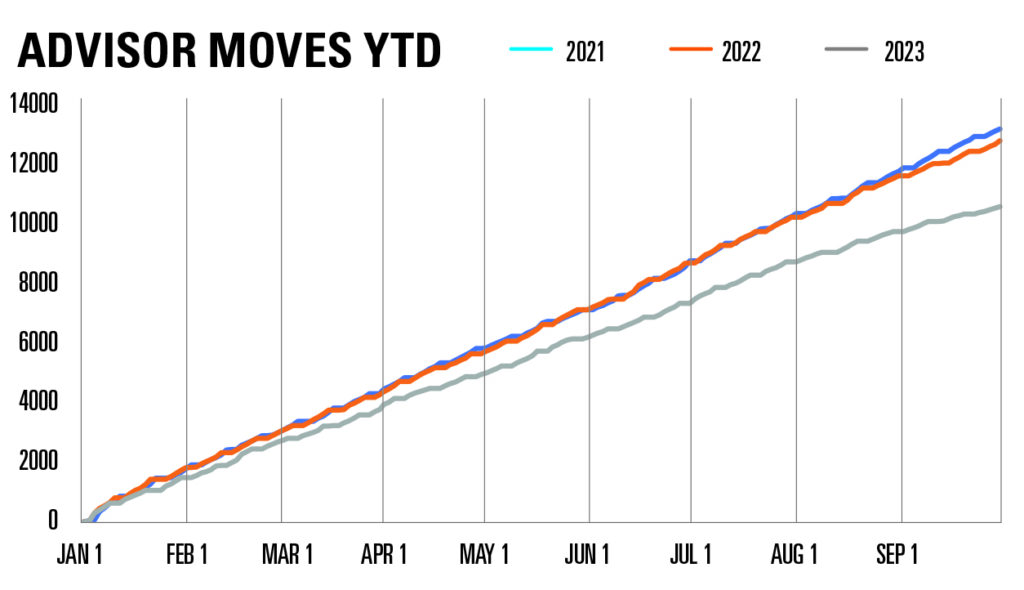

Advisory industry recruiting activity continued to decline over the third quarter, according to the latest analysis of the Advisors on the Move database.

In the third quarter, total recruiting activity, which consists of movements of experienced reps between unrelated firms, excluding those resulting from a merger or acquisition, was down 9.6% from the second quarter and 18.9% year over year.

Recruiting activity was at the lowest of any comparable period in the past five years, down 13.7% even from 2020.

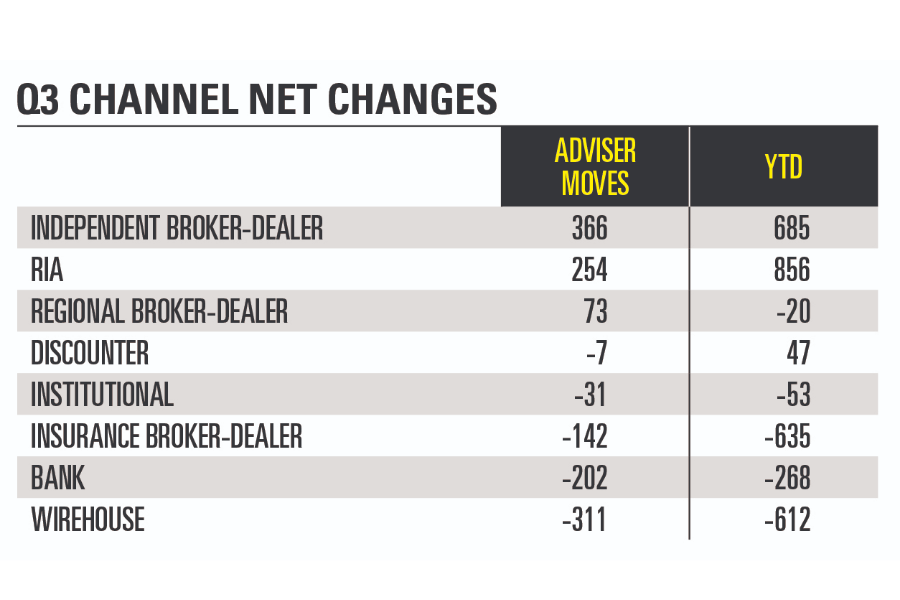

As in other recent years, the topline number belies two divergent trends. Independent broker-dealers and registered investment advisors recruited 366 and 254 advisors away from other firms, respectively, while 311 advisors left wirehouses for other channels, and 202 departed banks.

It’s well-documented that advisors overall have a preference for operating under independent models, where, as independent contractors rather than employees, they are able to make a wider range of decisions about their operations and take home a larger share of the revenue they produce. That preference has consistently shown up in the recruiting data, as well as in recent Fidelity research that found about one in six advisors had switched to an independent firm over the past five years and that 94% were happy with the move.

And while recruitment has been down significantly, plenty of advisors have moved by other means in 2023.

Increasingly, firms that historically have lost experienced advisors to independent channels have established their own independent arms. Over the first nine months of this year, 1,355 advisors moved between related firms, nearly triple the level seen in the comparable period of 2022. The vast majority – 85% – of these moves have been to the independent broker-dealer or RIA arms of the advisor’s existing firm.

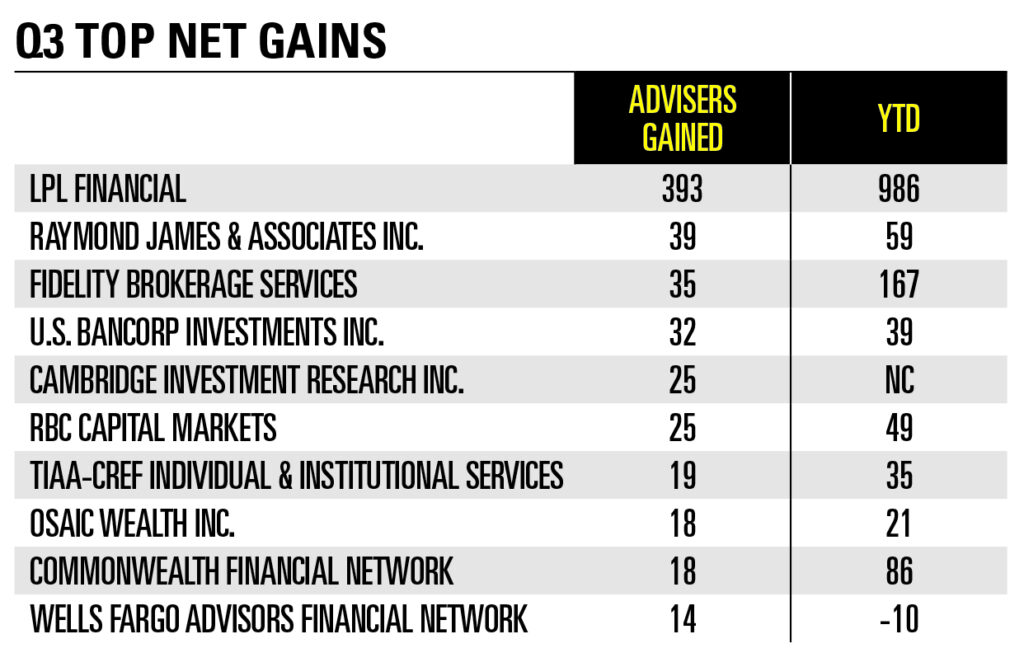

A case in point is Wells Fargo. Hundreds of its wirehouse advisors have moved to Wells Fargo Advisors Financial Network, its independent arm, over the past two years, stemming the head count losses at the company and establishing FiNet as a recruiter in its own right. This quarter, it attracted 14 advisors from unrelated firms.

Then there are mergers and acquisitions, also excluded from the recruiting data but a potent source of new advisors for firms large enough to pursue deals. More than 700 advisors moved to Cetera after its acquisition of Securian closed in August, for example.

According to Echelon Partners, the third quarter saw a rebound in deal announcements from the past 12 months, and though total M&A activity is expected to remain relatively flat from 2022, the number of $1 billion-plus transactions is anticipated to rise 10.2% year over year. That likely means more bulk movements of advisors over the coming months.

LPL Financial once again led recruiting in the third quarter, onboarding 393 advisors from other firms for a year-to-date total of 986. The firm was followed by Raymond James & Associates, Fidelity Brokerage Services, and U.S. Bancorp Investments.

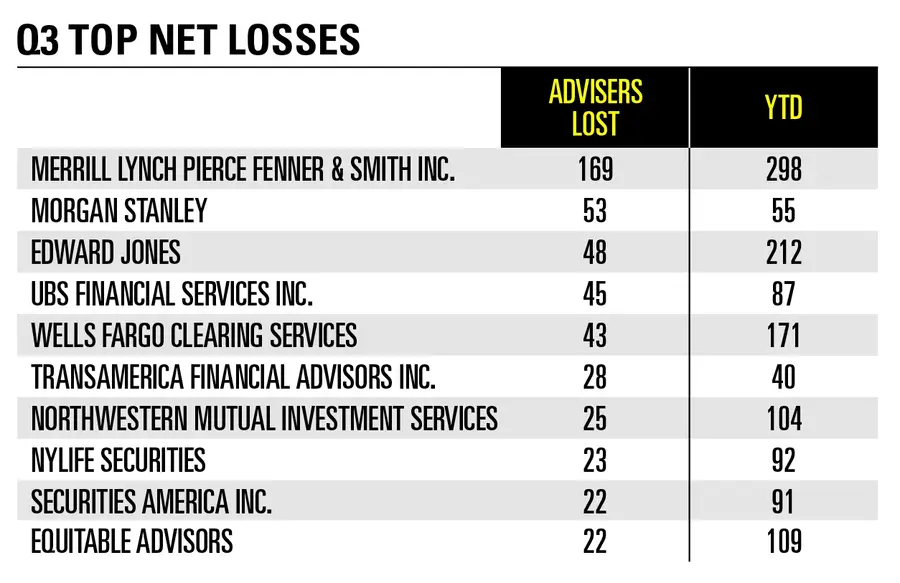

On the other side of the ledger, Merrill Lynch lost the most advisors to other firms — 169 during the quarter and 298 so far this year. That was followed by Morgan Stanley, Edward Jones, UBS Financial Services, and Wells Fargo Clearing Services.

DISCLAIMER AND METHODOLOGY: The InvestmentNews Advisors on the Move database is designed to capture all recruiting activity of retail financial advisors/teams of advisors as they move from one firm to another. The activity recorded within the database comes from a number of sources, including InvestmentNews and other media reports, press releases, direct submissions that have been reviewed by InvestmentNews, and regulatory filings. To qualify as a move, no more than 60 days can have elapsed between the date an advisor/team leaves one firm and the date they join another. Any advisor registration changes that came as a result of merger and acquisition activity are not recorded as moves in the database.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.