“In contrast to that commotion over the [Department of Labor] rule, it’s been mostly crickets from the brokerage industry when it comes to firms announcing concrete changes they are making … in preparation for Reg BI.”

The above excerpt from this week’s cover story on Regulation Best Interest by Mark Schoeff Jr. underscores the industry’s reaction to the new rule. The similarities between the hue and cry that accompanied the DOL’s fiduciary rule and the pending judicial decision around Reg BI stand out to me.

The reaction is intriguing because this industry’s reputation does not include quietly abiding the intrusion of external forces. As one source in the article suggests, perhaps it’s semantics because “fiduciary” (the ‘F’ word) feels weightier than “Best Interest.” Plus, the implementation guidance of “good faith effort” and “reasonable progress” leave lots of gray area.

But the second issue may well be the reason for the crickets. A hearing Tuesday will determine if the Securities and Exchange Commission exceeded its authority and ignored Dodd-Frank, so perhaps the relative quiet indicates a delay is more likely than the scheduled June 30 implementation.

Ultimately, does strict regulation create a greater burden than best-efforts guidance? Watching the implementation across the industry will answer that intriguing question.

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

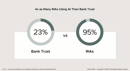

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.