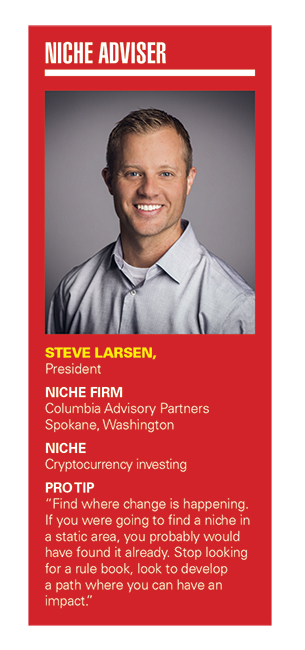

As with so many financial advisory niches, Steve Larsen found his focus right under his nose.

Six years after purchasing a single Bitcoin for $235 and then essentially ignoring it, Larsen said a “light bulb went off” a year ago when he stumbled on an article about cryptocurrencies.

“I had always wanted to find a niche, but never really found one that fit for me,” he said. “Then, finally, I found the intersection where people needed a lot of advice, and since March I’ve been managing crypto portfolios for clients.”

Larsen, president of Columbia Advisory Partners in Spokane, Washington, recalls being hungry for cryptocurrency knowledge back in 2015 when he made his initial investment. But he had difficulty finding information on areas related to blockchain and digital currencies, so he moved on.

“In late 2020, I clicked on an ad about some things going on with Ethereum, and suddenly it all came flooding back, as well as some new information,” he said. “It took me about an hour to completely fall down the rabbit hole.”

Larsen believes his education in information systems and background as a web developer make him uniquely suited to focus on cryptocurrency investing.

He recalls getting his first job out of college following the collapse of the 2000 tech bubble based on a fantasy football program he developed while in college. And he was initially interested in Bitcoin back in 2015 because he wanted to learn more about the world of decentralized betting pools.

After leaving the web developer gig, Larsen spent two years cutting his teeth in financial services at Edward Jones before launching his own advisory firm in 2004. Until last year, he was running a garden variety advisory practice that had grown to $200 million by serving the broad spectrum of financial planning needs.

While Larsen has quickly become fluent in cryptocurrency investing, he respects that fact that it is still a foreign concept to many of his clients, which is why his initial move into the niche was with “clients we had really good relationships with.”

The next stage of his niche development included friends and family, and now he's starting to expand it to the rest of his clients.

Larsen estimates that about 1% of his total advisory assets are allocated to crypto, and that about 15% of his clients own crypto, with a maximum portfolio allocation of around 5%.

“My first goal is for everybody interested in crypto to have an opportunity to invest,” he said. “And my secondary goal is to provide education about what’s going on with cryptocurrencies so more people will want to go into it.”

When adding crypto to client portfolios, Larsen builds diversified allocations of between six to 10 different cryptocurrencies that he “monitors and rebalances just like a traditional portfolio.”

The digital currencies are purchased on the Gemini custodial platform, where investors are charged commissions of around 2%, and he usually allocates crypto into taxable accounts for the sake of simplicity.

“Right now, crypto has to be considered the aggressive part of the portfolio, so we take it out of stocks,” he said. “But we’re also reducing exposure to cash and bonds to make room for crypto.”

Even as crypto has become easier to purchase and custody, Larsen said it needs to find a place in a diversified portfolio, and the current uncertainty surrounding inflation is an open door of opportunity.

“I think a lot of our client base is nervous about the economy, inflation and the labor market, and they are very open to systems that might help hedge that risk,” he said. “Traditionally, that meant gold, real estate or starting your own business, but now I believe crypto is the hedge.”

In terms of challenges related to his niche, Larsen is frustrated over the lack of regulatory clarity and the inability of regulators to draw a hard line.

“Most planners would like to see the SEC come in and add clarity, because the uncertainty is not helpful to anybody,” he said.

Another challenge is getting clients comfortable with the extreme price volatility of an “asset class that can go up or down 12% to 15% a day, and up 300% or down 80% in a year,” he said.

And when it comes to advising clients to buy something like Bitcoin at more than $66,000, when he paid $235 just six years ago, Larsen said the focus on today’s price misses the point.

“Right now, the global financial system is built on global currencies, particularly the U.S. dollar, and that’s what crypto will replace,” he said. “This means the dollar gets some well-needed competition to keep it in check. If the dollar had a competitor now, we wouldn’t have the monetary policy the Fed is pursuing.”

Asked whether he's worried about clients buying at the top, Larsen responded, “Anybody who buys Bitcoin under $100,000 will have a good story for their grandkids. We haven’t even begun to see what’s going to happen with this.”

Wealth management unit sees inflows of $23 billion.

Deal will give US investment bank a foothold in lucrative European market.

New report examines the impact that the initiative has had on philanthropy.

Few feel confident that they will meet their retirement goals.

Catch-up contributions, required minimum distributions, and 529 plans are just some of the areas the Biden-ratified legislation touches.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.