Leave it to exchange-traded funds to give investors and advisers yet another way to overthink asset allocation.

The latest instrument for tweaking diversification and likely baiting speculation comes from ProShares in the form of four ETFs that enable investors to avoid entire sectors of the overall equity market.

The ETFs, which start trading on Thursday, strip out energy, financial, health care and technology sector stocks from the S&P 500 Index.

The concept is novel, and it is surprising that the asset management industry took this long to come up with it.

Imagine owning the ProShares S&P 500 Ex-Financial ETF (SPXN) in

2008 when the overall index fell by 36.8%, thanks in large part to a 54.7% decline in the financial sector.

Of course, you would have had to know enough to get out of financials just prior to 2008, and then hopefully been able to dash back in prior to 2012 when the financial sector started carrying its weight again in the larger index.

RECENT EXAMPLE

Another way to slice it, and a more recent example, would be to look at the floundering energy sector.

In the second quarter, companies in the S&P 500 combined generated just 0.1% earnings growth. But energy sector stocks in the index suffered a combined 55.8% drop in earnings in the period. Extracting that from the overall index results in second-quarter earnings growth of 7.9% for the S&P.

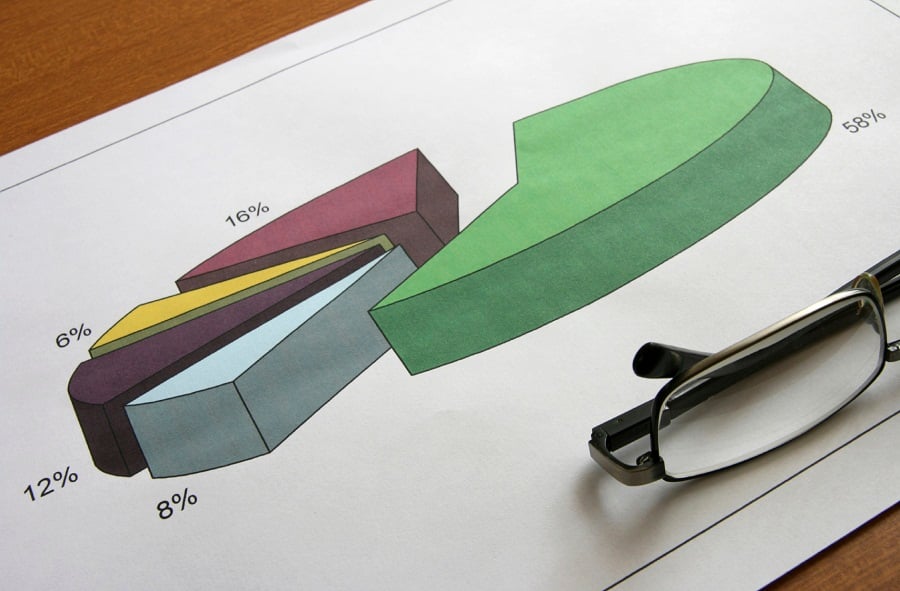

So despite its minor 8% weighting in the S&P, the energy sector's oversized earnings decline had a major impact from a fundamental perspective.

“We know that earnings and stock prices don't necessarily go hand in hand, but we also know that if we excluded energy, the fundamentals of the index would look a lot better,” said Todd Rosenbluth, director of mutual fund and ETF research at S&P Capital IQ.

In terms of investment performance, the S&P 500 declined by 20 basis points in the second quarter, compared with a 2.6% drop in the energy sector. So being invested in the S&P ex-energy theoretically would have resulted in better-than-market performance.

WHAT BIG INVESTORS HAVE BEEN DOING

In addition to the energy sector ETF (SPXE), and the financial sector ETF, which has a 16% weight in the S&P, ProShares is launching the Ex Health Care ETF (SPXV), representing 15.4% of the index, and the Ex-Technology ETF (SPXT), representing 19.61% of the overall index.

“This is what institutional investors have been doing for a long time,” said Michael Sapir, chief executive of ProShares, which manages $31 billion across more than 130 mutual funds and ETFs.

In some ways, excluding specific sectors is akin to shorting a sector, without all the hassle of having to actually sell anything short.

Mr. Sapir also believes the new ETFs will appeal to investors who might work in an industry like technology, for instance, and feel they already have enough tech-sector exposure through stock options.

It's more likely the ETFs will be used to make market calls on specific sectors, which is something that can already be done through a

bounty of individual sector ETFs. But until now, it wasn't easy to accomplish the specific weightings of the S&P minus a particular sector.

Even though the four sectors ProShares chose to exclude are not the largest weightings in the S&P, Mr. Sapir said they represent the sectors in which market participants and investors are most interested.

'DAUNTING AND KIND OF A PAIN'

“You certainly could just buy the sectors you are interested in,” he said. “But for most investors and financial professionals, that would be a little daunting and kind of a pain.”

In terms of timing, Mr. Rosenbluth said ProShares might be onto something, considering how various sectors have historically performed immediately following a

Federal Reserve interest-rate hike.

“Historically, back to 1971, if you looked at how the sectors performed six months after a rate hike, the worst performing sector has been financials, with an average decline of 80 basis points,” he said.

The technology sector, with an average gain of 6.5%, has been the best post-hike performer, and the S&P 500 has averaged a 2.4% gain six months after a rate hike.

“When the Fed starts raising rates, you're probably better off not having financial-sector exposure,” Mr. Rosenbluth added.

Because it takes two sides to make a market, the other side of this potential opportunity looks like another way to stumble, according to Paul Schatz, president of Heritage Capital.

“I think it's a novelty that won't get a lot of interest,” he said. “If they are going to launch an index fund that excludes energy, I would seriously start looking to buy energy shortly after that ETF launches.”

Looks like Mr. Schatz will be buying energy-sector stocks on Thursday.