Stocks surged around the world and bonds tumbled after a large-scale coronavirus vaccine study delivered the most-promising results in the battle against the worst pandemic in a century.

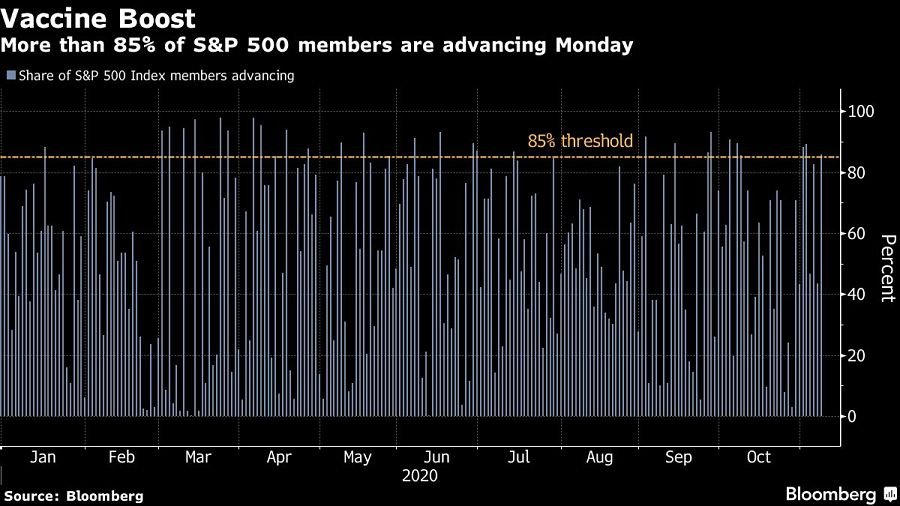

More than 85% of S&P 500 companies climbed Monday as the gauge jumped to a record on news that the COVID-19 shot being developed by Pfizer Inc. and BioNTech prevented more than 90% of infections. The enthusiasm also drove the Dow Jones Industrial Average to an all-time high and sparked a rally in small caps.

At 11:10 a.m. New York Time, the S&P 500 was up 2.57% at 3,599.53. The Dow Jones Industrial Average was up 3.76%, or 1,065.95 points, at 29,389.35.

Shares that have been hit hard by the economic toll of lockdowns such as travel stocks and movie theaters jumped, with Carnival Corp. and Cinemark Holdings Inc. surging more than 35%. Stay-at-home companies Zoom Video Communications Inc. and Peloton Interactive Inc. plunged at least 16% on hopes that a return to normal is on the horizon. Online giant Amazon.com Inc. retreated.

A credit derivatives index that measures the perceived risk of high yield dropped by the most in seven months, with junk-rated companies hitting the market in droves to take advantage of a plunge in borrowing costs. Oil soared, while gold, the Japanese yen and the Swiss franc slumped.

Investors pulled out of haven assets and poured cash into markets that are closely tied to economic growth, with a gauge of global stocks also hitting a record high. President-elect Joe Biden Monday announced a new coronavirus task force as his transition team seeks to fulfill a campaign promise to develop a dramatically different approach than President Donald Trump’s to contain the pandemic.

Anthony Fauci, the top infectious disease expert in the U.S., said the vaccine being developed by Pfizer will have a “major impact” on everything we do with regards to the coronavirus going forward.

“The bull market has a ton of ammunition to keep going,” said Chris Larkin, managing director of trading and investing product at ETrade Financial. “With more certainty around the election, a strong quarter of earnings across many sectors, and extremely positive news on the vaccine front, there is little to hold us back.”

Elsewhere, the Australian dollar-yen cross -- a commonly watched risk barometer -- surged by most since June. The Turkish lira soared after the weekend resignation of the country’s economy czar and the dismissal of the central bank chief.

Most firms place a limit on advisors’ sales of alternative investments to clients in the neighborhood of 10% a customer’s net worth.

Those jumping ship include women advisors and breakaways.

Firms in New York and Arizona are the latest additions to the mega-RIA.

The agent, Todd Bernstein, 67, has been charged with four counts of insurance fraud linked to allegedly switching clients from one set of annuities to another.

“While harm certainly occurred, it was not the cataclysmic harm that can justify a nearly half billion-dollar award to the State,” Justice Peter Moulton wrote, while Trump will face limits in his ability to do business in New York.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.